Integrated Financial Management Platform for NFS

WeSoftYou delivered an end-to-end FinTech platform for NFS, enabling small and medium businesses to centralize financial operations, automate billing, and make data-driven decisions.

Industry

FinTech, Small & Medium Business Solutions, Financial Services

Project duration

Q2 2023 – Ongoing

Country state

USA

Team

10

Technology

🏃

NFS is a FinTech service provider that specializes in solutions for small and medium-sized businesses (SMBs). Before partnering with WeSoftYou, NFS identified a critical need: SMBs often struggle with fragmented financial data spread across bank accounts, payment gateways, and legacy accounting software. Manual workflows and inconsistent data reconciliation led to inefficiencies and high operational costs.

WeSoftYou built an integrated financial management platform that centralizes payment, invoicing, and accounting functionalities. The solution automates tasks such as invoice generation, cash flow forecasting, and tax calculations. Equipped with advanced dashboards and analytics, SMB owners can now make data-driven decisions to optimize cash flow, reduce errors, and focus on strategic growth.

Results ✨

Up to 40% Lower Operational Costs

Automated invoicing, accounting, and reconciliation reduced reliance on manual labor, cutting overhead significantly.

Centralized Financial Data

Unified view of all financial transactions from multiple sources—bank feeds, payment gateways, and e-commerce platforms.

Improved Cash Flow Forecasting

Real-time dashboards and analytics enable proactive financial planning, helping SMBs avoid liquidity crunches.

Scalable Across Industries

Flexible architecture accommodates retailers, service providers, and online businesses, each with unique financial workflows.

Project goals ⚡️

Consolidate financial processes into a single, user-friendly platform.

Automate routine tasks (billing, tax calculations, invoice scheduling).

Provide real-time analytics for improved forecasting and budgeting.

Ensure secure data handling compliant with financial regulations.

Challenges ⛰

01.

Multiple Data Sources: Bank accounts, online payment systems, and e-commerce platforms all needed to be integrated.

02.

Complex Regulatory Landscape: Different states and countries impose varying taxation and reporting requirements.

03.

High Uptime Requirements: Financial transactions demand near 100% system availability.

04.

User Diversity: The platform must serve SMB owners with varying tech literacy, as well as financial professionals.

The process 🚧

To transform SMB financial management, we applied a methodical development approach paired with a robust technology stack. Each phase — from auditing existing processes to implementing automation and AI — was aimed at maximizing efficiency, reducing manual work, and supporting business growth.

Stages 🎢

01.

Discovery & Process Audit: Mapped out typical SMB financial workflows (invoicing, reconciliation, budgeting). Identified major pain points: manual data entry, duplication of records, delayed insights.

02.

Unified Architecture Design Employed Java Spring Boot for a stable, enterprise-grade back end. Set up a mixed database approach (MongoDB for transaction logs, MySQL for relational data). Built an integration layer for third-party APIs (banks, e-commerce platforms) using REST services.

03.

Incremental Feature Development Focused on core modules first: invoicing, payments, and basic reporting. Conducted usability tests to refine the UI for SMB owners and finance teams. Released new features (budgeting tools, tax automation, advanced dashboards) in iterative sprints.

04.

Automation & Machine Learning Integrated AI-based forecasting models to predict seasonal cash flow changes. Deployed automated alerts for unpaid invoices and anomalies in transaction patterns.

05.

Deployment & Continuous Support Hosted on AWS with CI/CD pipelines via Jenkins for rapid, reliable deployments. Provided ongoing maintenance, security patches, and new feature rollouts. Scaled infrastructure to accommodate user growth without service interruptions.

Team composition 👨💻

1 Project Manager

3 Back-end Developers

3 Front-end Developers

2 QA Engineers

1 DevOps Engineer

Technology stack ⚙️

Back-end: Java Spring Boot, MongoDB, MySQL, Jenkins, AWS (EC2, RDS, S3).

Front-end: Angular, Chart.js.

Core features 💻

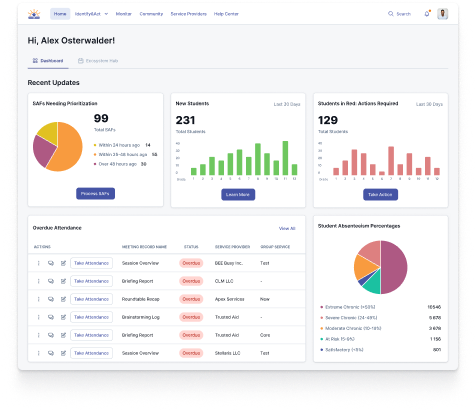

Financial Dashboard

- At-a-glance view of income, expenses, and cash flow trends.

- Customizable widgets for different SMB sectors.

Automated Billing & Invoicing

- Recurring invoice setup, payment reminders, and invoice tracking.

- Automatic tax calculations and compliance checks based on user’s region.

Transaction Reconciliation

- Links bank statement data and platform-generated records to ensure accuracy.

- Flags discrepancies for manual review.

Cash Flow Forecasting

- AI-driven projections for seasonal revenue fluctuations and expense patterns.

- Alerts for upcoming shortfalls or spikes in operating costs.

Security & Compliance

- Role-based permissions ensuring different staff levels see only relevant data.

- Data encryption and adherence to financial data protection standards.

Do you want to start a project?

Meet us across the globe

United States

66 W Flagler st Unit 900 Miami, FL, 3313016 E 34th St, New York, NY 10016

Europe

109 Borough High St, London SE1 1NL, UKProsta 20/00-850, 00-850 Warszawa, Poland

Vasyl Tyutyunnik St, 5A, Kyiv, Ukraine

Av. da Liberdade 10, 1250-147 Lisboa, Portugal