DeFi Yield Farming Development Services

An ideal yield farming platform has secure smart contracts, provides transparent operations and fees, and is fully decentralized. Let the WeSoftYou blockchain-passionate team help you with such a DeFi yield farming platform development. What we’ll bring to your door? A highly performative, customizable, interoperable, and transparent solution that will contribute to your businesses’ decentralization.

Get project estimationDeFi Yield Farming Development Services We Provide

Smart contract development

The WeSoftYou team creates customized yield farming smart contracts that are secure, efficient, and tailored to meet the specific requirements of your platform — both now and in the future.

Integration with third-party DeFi protocols

Yield farming platforms may need to integrate with other DeFi protocols to enable liquidity and reward transfers between different platforms. We can provide integration services, helping connect yield farming platforms with other protocols.

Token creation

The development of unique coins to reflect users' shares of rewards and liquidity is frequently necessary for yield farming systems. Let us provide token creation services to help design, create, and distribute these tokens.

Yield farming value propositions

Our team can help you design additional mechanics that will incentivize the users to hold the token and give benefits both for them and for your company.

Governance tokens

Give your users governance tokens as a thank-you for joining the liquidity pool. These tokens allow the holders to decide how the core protocol is run, enabling more voting power for them proportionally to how many tokens they hold.

Liquidity tokens

Provide your users with liquidity tokens as rewards for supplying liquidity. In return for extra tokens, these tokens can be staked or put into another smart contract. This gives your users a low-risk way to increase their holdings.

Exchange fee

To attract more users in less time, consider offering rewards such as a share of the exchange pool's fees or incentives for swapping tokens between pools. Providing these rewards at both fixed and flexible intervals can help increase user engagement and participation.

Testimonials

Client feedback is a big factor in the awards process. Clutch.co’s leading companies have been vetted for quality and performance, and we are happy that WeSoftYou made the list.

Technologies We Use

Our engineering team speaks the language of Web3, providing precise and scalable DeFi yield farming platform development. See what’s in our vocabulary.

Blockchain

WeSoftYou works with Tezos, EVM-based blockchains, and Ethereum. What we’ll go with will depend solely on your choice of a blockchain.

Frameworks

Our team utilizes various frameworks, including Truffle, Brownie, React.js, Node.js, Django, and Serverless, to develop Web3 solutions for our clients.

Programming languages

By carefully selecting the appropriate tech stack, WeSoftYou ensures the optimal efficiency of various Web3 products. Our technical solutions are provided in Python, Javascript/Typescript, or Solidity, depending on your specific needs.

Our DeFi Yield Farming Development Process

DeFi yield farming development services are born in several steps.

Advisory and ideation

Determining your needs and objectives for the yield farming platform. Our development team will list the platform's essential features and capabilities with you.

Prototyping

The next step is to create a design for the platform, including the user interface, user experience, and technical architecture. The WeSoftYou designers work with user stories, UX research results, and other documentation from the advisory stage.

Technical stage

In this step, we develop the smart contracts that power the platform: they manage the liquidity pools, distribute rewards, and ensure security. The smart contracts are then integrated with the platform's UI/UX, backend systems, and other components.

Testing and deployment

The platform gets tested to ensure it is secure and functions as intended. The QA process includes both manual and automated testing. Once we’ve tested and verified the platform, it is deployed and can be run by the first users.

Support and maintenance

After the platform is launched, our tech team will provide ongoing upkeep and support to make sure the platform functions properly and accommodates users' changing needs.

Why Choose Us?

WeSoftYou offers much more than only expertise. Thus, there are many more reasons why we should work on your next DeFi yield farming platform development.

Democratic price

WeSoftYou offers fully scalable DeFi app development services at a reasonable price, allowing you to obtain a high-quality product without breaking the bank. Our pricing will not leave your budget high and dry; at the same time, you’ll get a fully viable product that can be scaled anytime.

Web3 as a super-ego

At WeSoftYou, we offer comprehensive knowledge and unique professional insights gained from years of experience in the industry. Our team members are passionate about their work, and this is reflected in the numerous unique examples in our portfolio that we are proud to showcase.

Flexible engagement models

At WeSoftYou, we provide various options for interacting with our team. You can choose to work with us on a fixed-fee basis, opt for a time-and-materials approach (based on the resources we used to develop your product), or hire a dedicated team to work with you exclusively.

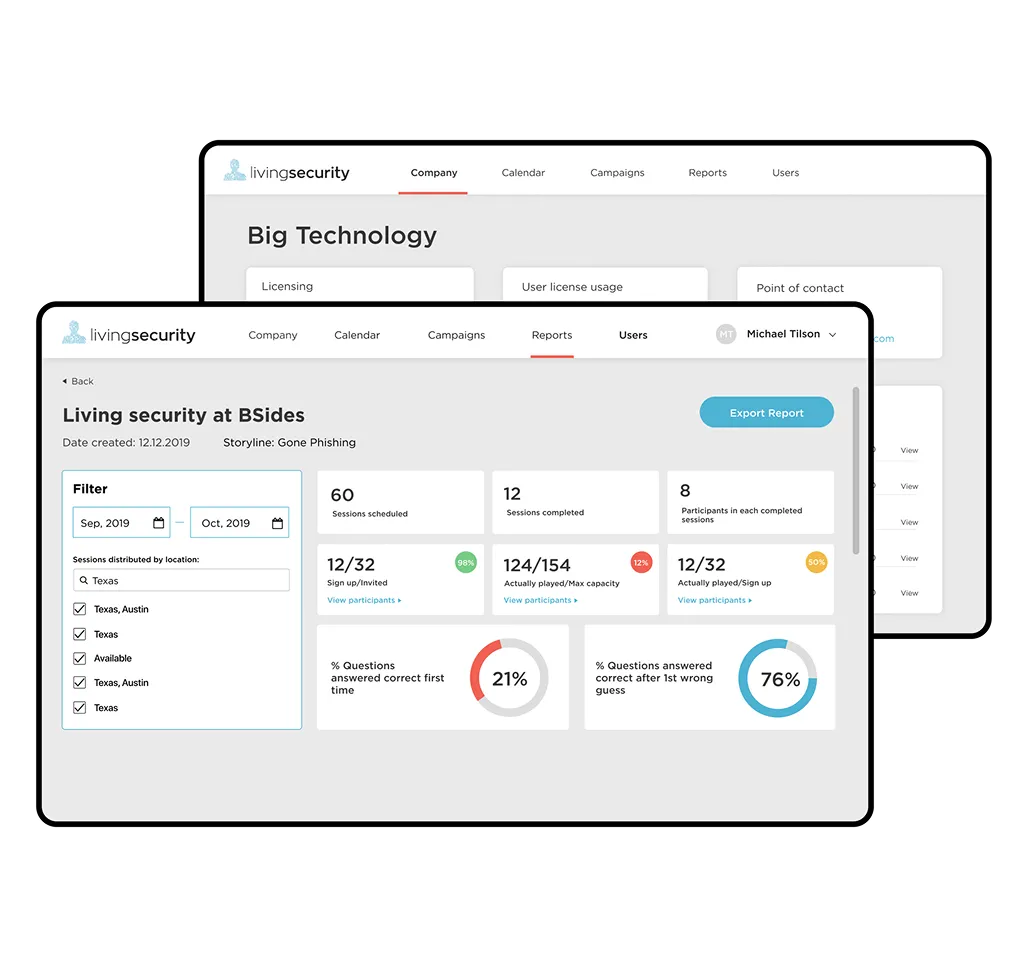

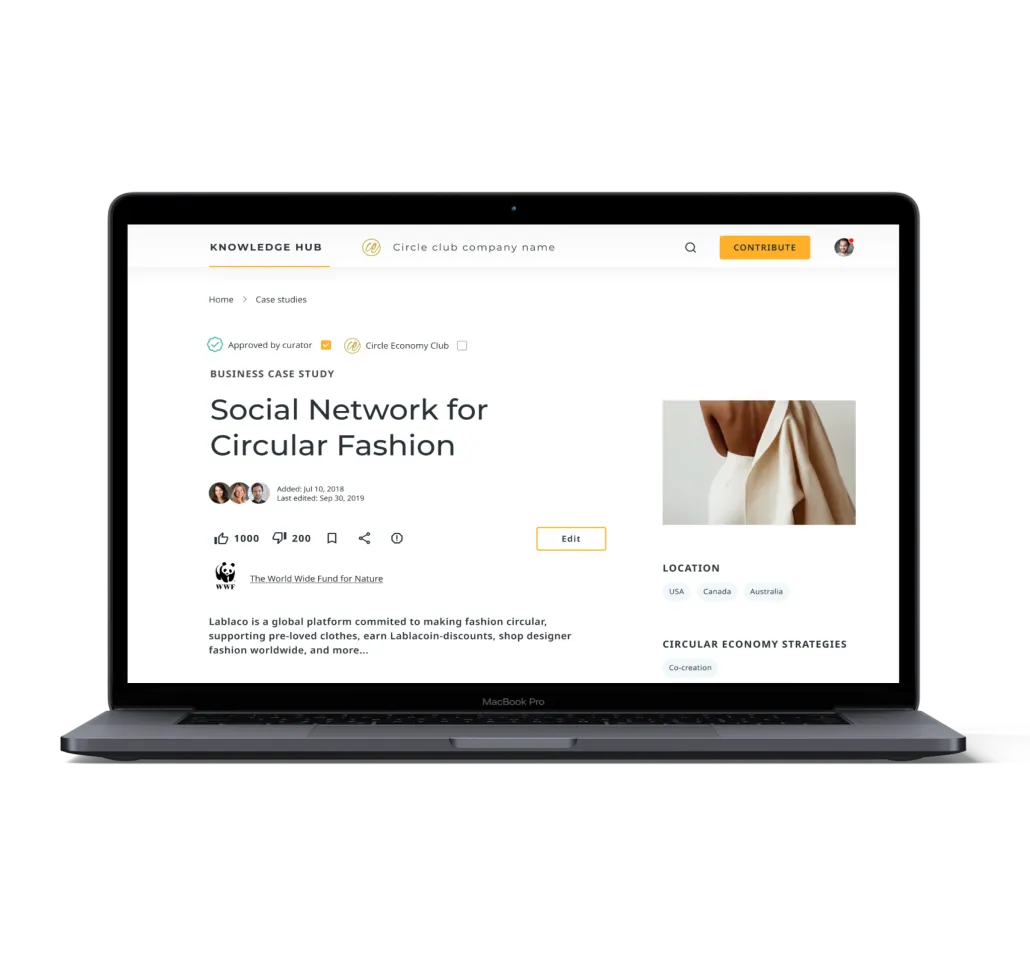

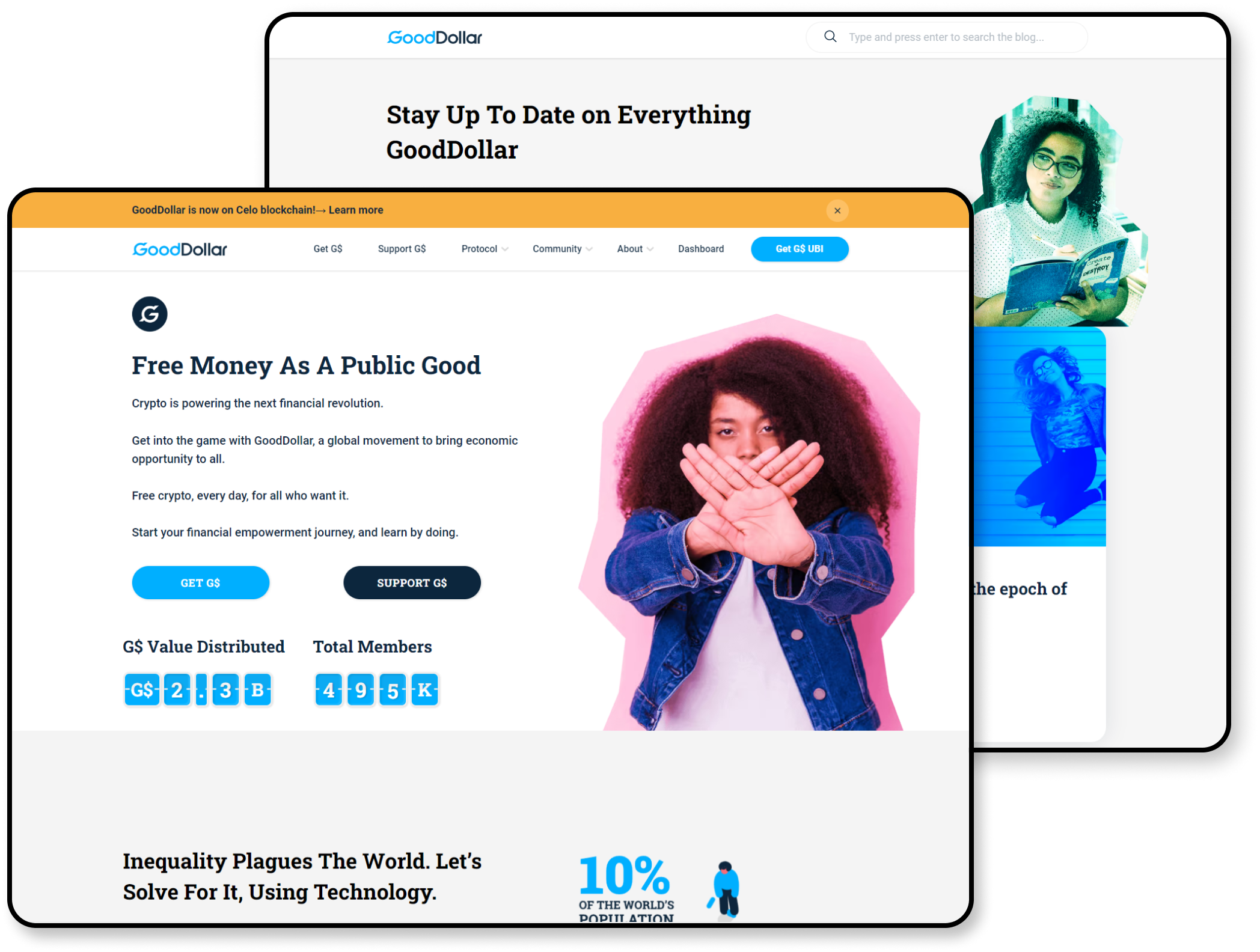

Our Case Studies

See more casesFAQ

Yield farming refers to the practice of earning a return or yield on cryptocurrency holdings by lending, borrowing, or staking cryptocurrencies in decentralized finance (DeFi) protocols. Yield farming involves providing liquidity to DeFi protocols in exchange for a reward or return, typically in the form of the protocol’s native tokens.

In yield farming, users lend their cryptocurrency to a DeFi protocol, which uses it to generate returns through various means, such as trading, lending, or other activities. In exchange for providing liquidity, users receive rewards in the form of tokens that represent their share of the generated returns. These rewards can be traded on cryptocurrency exchanges, held as a store of value, or used to provide liquidity to other DeFi protocols, earning even more rewards.

Yield farming has become increasingly popular in cryptocurrency as a way to earn passive income on cryptocurrency holdings. It has created new opportunities for users to earn returns on their investments outside of traditional financial institutions. However, yield farming can also be risky, as the value of the cryptocurrency that provides liquidity can be volatile, and DeFi protocols may be subject to hacking or other security risks.

There are many DeFi yield farming tokens that have gained popularity in the cryptocurrency space. Some of the popular DeFi yield farming tokens include:

– AAVE, the native token of the Aave protocol, which is a decentralized lending and borrowing platform.

– UNI, Uniswap’s native token, which is a DEX that allows users to trade cryptocurrencies without a centralized intermediary.

– COMP, the native token of the Compound protocol, which is a decentralized lending and borrowing platform.

– SUSHI, the native token of SushiSwap, which is a decentralized exchange that operates similarly to Uniswap.

– Curve DAO Token (CRV), which is the native token of Curve, a decentralized exchange that specializes in stablecoin trading.

– YFI, the native token of the Yearn.finance protocol, which is a yield aggregator that automatically moves user funds between various DeFi protocols to optimize yield.

To start yield farming, the first thing to do is choose a suitable platform. The right DeFi yield farming platform has to align with your investment goals, risk tolerance, and budget.

Secondly, you should set up a crypto wallet, deposit crypto in there (or buy it directly in the wallet if its UX allows that), and eventually get it to your account on the yield farming platform.

Thirdly, decide on a farming strategy that aligns with your investment goals and risk tolerance. This may involve choosing which pool to join and how much to invest.

Then you should monitor your investment: keep an eye on it and adjust your strategy as necessary. DeFi yield farming can be a volatile market, so be prepared for fluctuations in the value of your assets.

Do you want to start a project?

Meet us across the globe

United States

66 W Flagler st Unit 900 Miami, FL, 3313016 E 34th St, New York, NY 10016

Europe

109 Borough High St, London SE1 1NL, UKProsta 20/00-850, 00-850 Warszawa, Poland

Vasyl Tyutyunnik St, 5A, Kyiv, Ukraine

Av. da Liberdade 10, 1250-147 Lisboa, Portugal