Managing personal finances has become commonplace, and finance apps’ popularity reflects this trend. In fact, 75% of smartphone users have turned to at least one such application to handle their money matters. With this significant demand, now is the best time to discover how to make a budget app that stands out.

Get ready to learn about the features that make a budgeting app effective. Besides the key functionalities, we’ll outline core design considerations, the required tech stack, and monetization strategies that nurture the finance application’s growth.

WeSoftYou, a leading software development company, will guide you through all the intricacies of making a budget app. With our expertise in FinTech application development services, we’ll help you explore the why and how behind building a personal finance tool that puts the power of financial control right at your fingertips.

Key Features of a Budget App

Let’s start our guide on budget app development with the features to include in such applications. Here are the ones you absolutely don’t want to miss.

Registration and Onboarding

Provide seamless signup that requires the user to enter a few details: email, password, personal info, and bank account credentials. Your application must also deliver smooth onboarding that ensures users understand how to make the most of it right from the start.

User Profile

A user profile is essential for personalizing your budget app experience. Allow your customers to enter and edit their profile info, including their name, profile picture, and preferred currency.

Authentication

Your budgeting app must include a secure passcode or biometric authentication feature to protect sensitive financial data. It ensures that only authorized individuals access the app and keeps user information confidential.

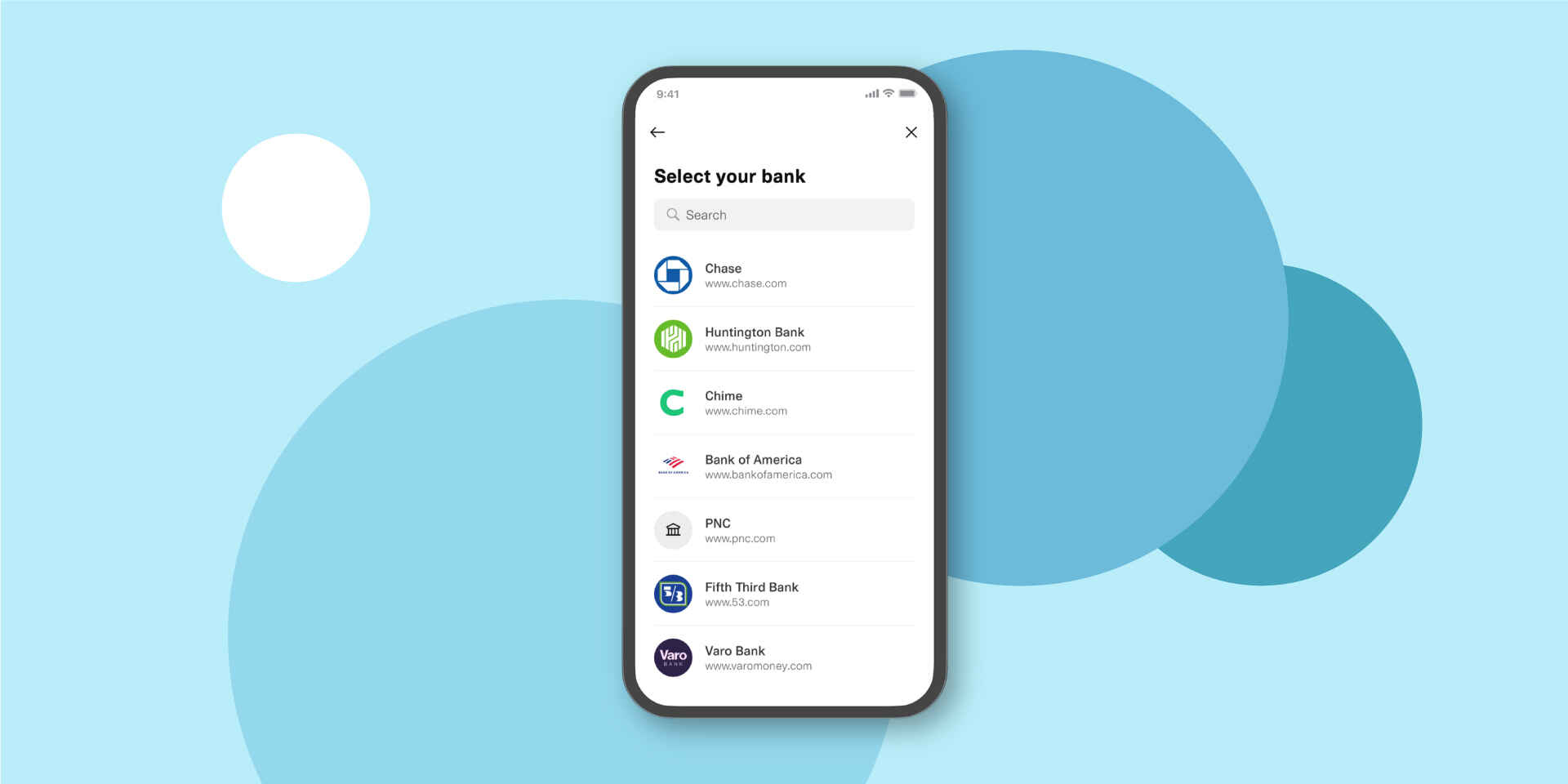

Bank Account and Credit Card Connection

Another critical feature of your budget app involves connecting with users’ bank accounts and credit cards. It automates transaction tracking, freeing your customers from entering financial details manually.

History and Transaction Tracking

Your budgeting app should allow users to track their transactions conveniently. Detailed transaction histories enable them to monitor their spending and improve their financial habits.

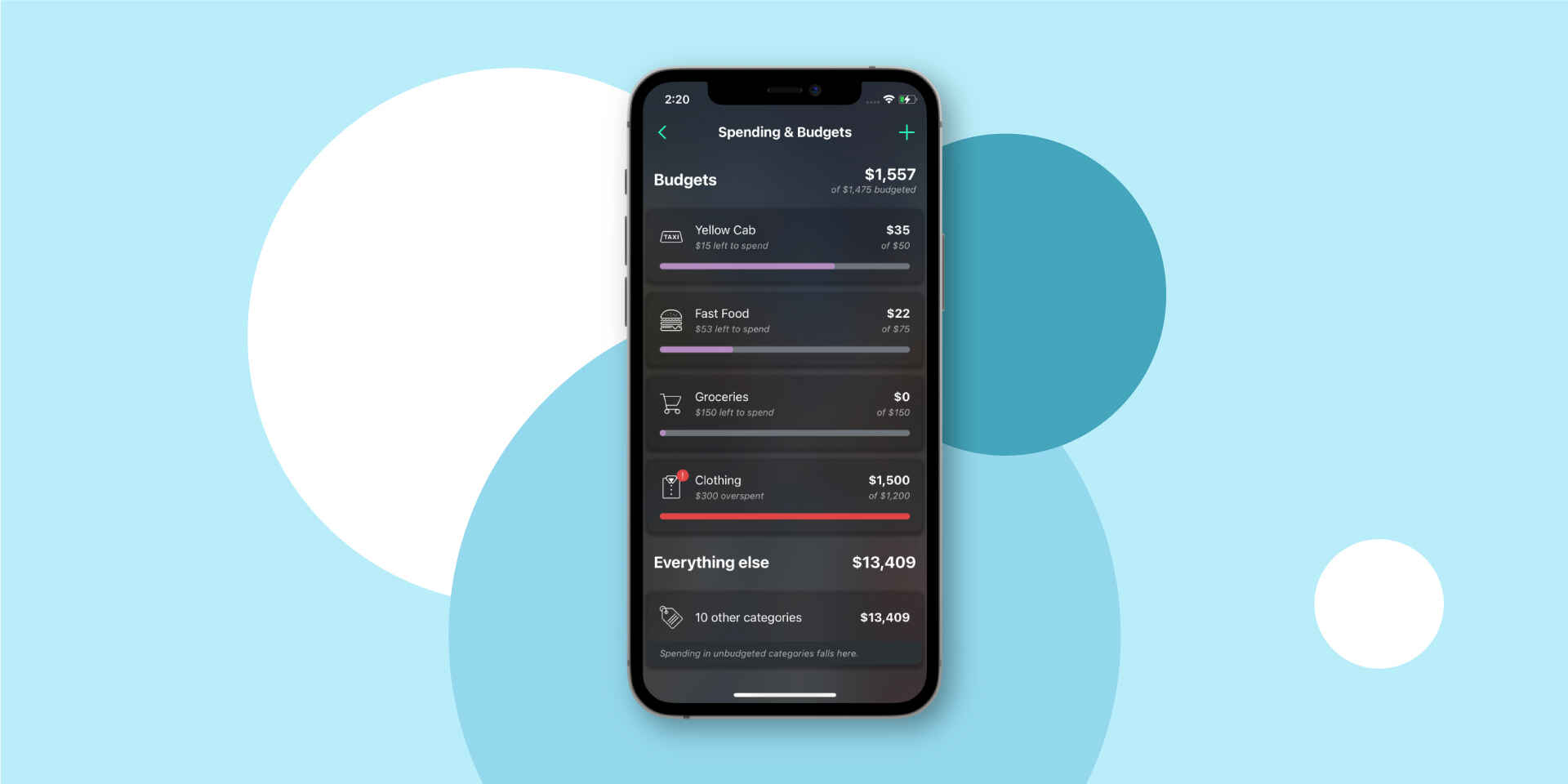

Expenses Categorization

Let users sort their expenses. Provide pre-defined categories like groceries, travel, entertainment, etc., and custom ones to match their needs. You may also want to feature search and filter by category.

Budgeting

Budgeting tools are the heart of a budget app. They allow for setting spending limits, allocating money to various categories, and tracking real-time financial progress. Visualizing users’ budgets with charts or graphs is also a nice touch.

Receipts and Bills Scanning

You can simplify expense tracking for your users by featuring the ability to scan and store receipts and bills. It eliminates the hassle of manually entering transaction details and ensures every expense is noticed and stored.

Goals Setting

Setting financial goals is vital for long-term planning. Your budget app should enable users to define and track their goals, whether paying off debt or planning a vacation. You can also provide progress indicators and reminders to keep users focused on their objectives.

Forecasting and Analytics

Your budget app should provide forecasting tools and analytics to help users understand their future financial trajectories. Offer insights by analyzing spending patterns and income trends, enabling customers to make informed financial decisions.

Reporting

Reporting features allow users to generate detailed financial reports, such as income statements, expense summaries, and savings breakdowns. It’s another must-have functionality you don’t want to omit.

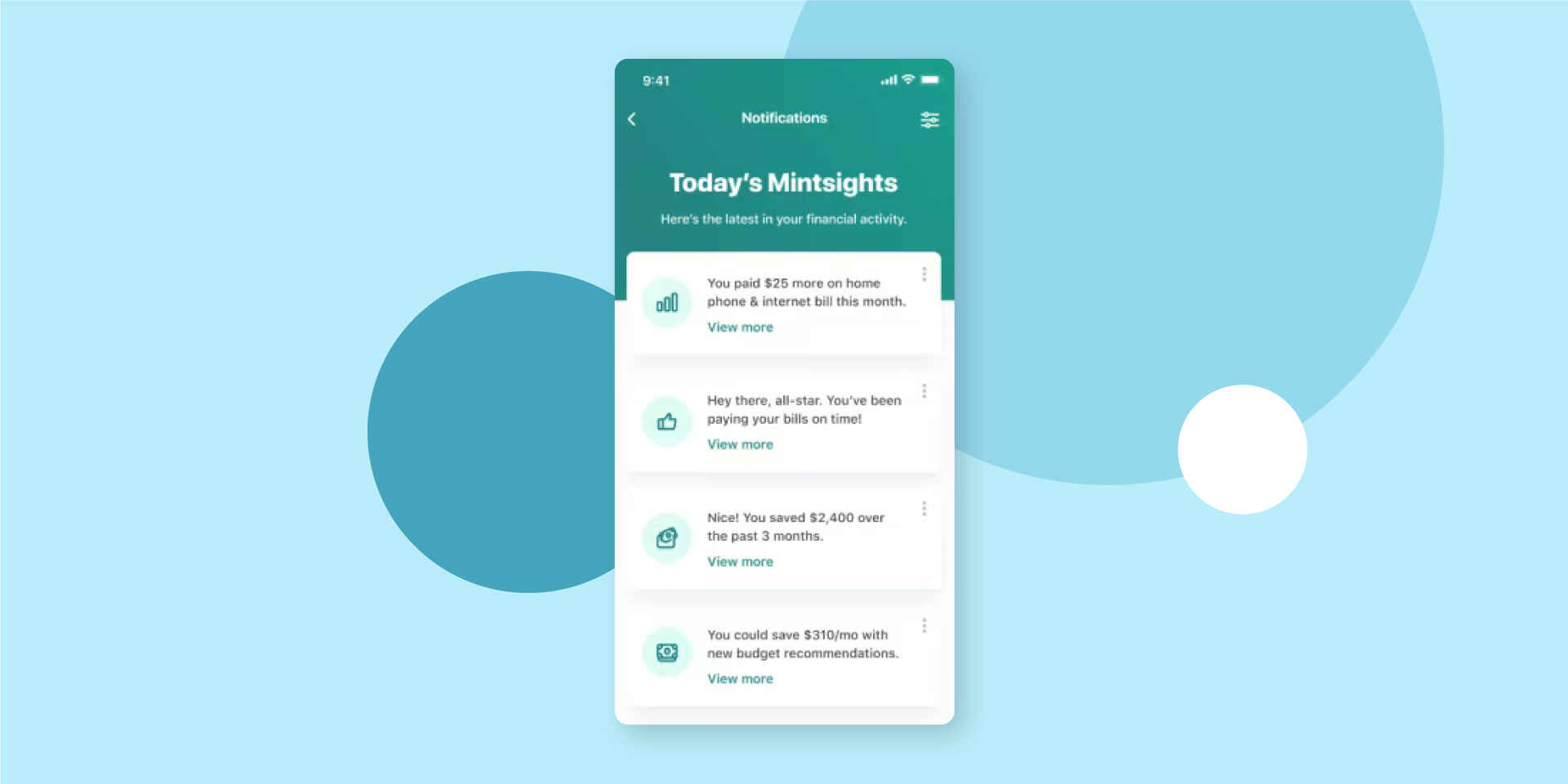

Notifications

Your personal finance app should notify your users about various matters. Some critical alerts may include upcoming bill payments, exceeding budget limits, or progress toward financial goals.

We’re done with the most critical budget app features. But there are other options you can offer your users. Look at these add-on functionalities:

Multiple Bank Accounts Tracking

For users with multiple bank accounts or credit cards, your budget app should support tracking and managing all accounts in one place.

Investment Recommendations

You can enhance your goal-setting feature with investment advice. Suggest optimal savings rates, investment strategies, and asset allocations tailored to users’ objectives by analyzing their income and expenses.

Crypto Wallet Integration

With the rise of cryptocurrencies, integrating your budget app with crypto wallets can be a valuable add-on. It allows users to track their crypto holdings, view real-time market values, and analyze their overall investment portfolio.

Gamification

Gamification elements make budgeting more engaging. Consider incorporating challenges, achievements, and rewards to make financial management an exciting experience.

You may also be wondering about your competitors. Which existing budget apps offer the above functionalities, or at least some of them? Consider these popular finance solutions:

Mint

Mint allows users to connect their bank accounts, credit cards, investments, and bills in one place. This app offers convenient cash flow monitoring with budgeting, goal setting, and expense categorization tools.

YNAB

YNAB leverages a zero-based budgeting approach. It helps users improve their credit score, offering different spending categories, transaction tracking, and real-time updates on available funds. Also, its goal-based savings feature enables users to set their financial objectives and track progress toward achieving them.

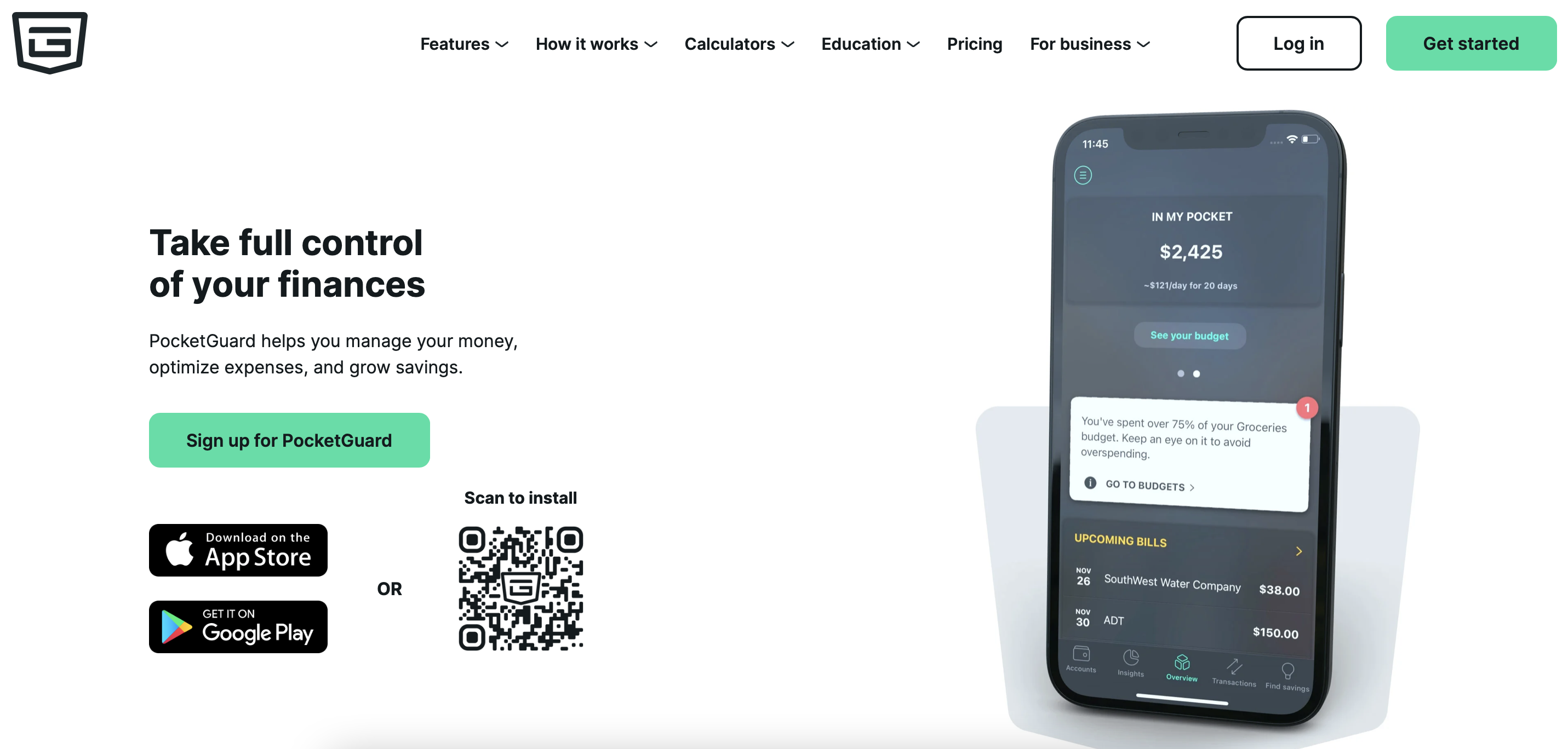

PocketGuard

PocketGuard simplifies expense tracking and budgeting. It connects to users’ bank accounts, credit cards, and loans to provide a real-time overview of their financial situation. PocketGuard automatically categorizes expenses, alerts users of bill due dates, and sets personalized spending limits based on income and financial goals.

Design Considerations for a Budget App

Moving on with our guide on how to make a budget app, let’s study the possible design solutions.

To begin with, we strongly recommend adopting a user-centered design. This approach ensures you meet your customers’ needs and tackle their pain points. It also enhances your budget app’s usability, ultimately increasing user satisfaction.

Let’s dwell on some design tips and considerations. Here are some suggestions for making your finance app intuitive and visually attractive:

- Keep the budgeting app’s interface clean and uncluttered, and use clear and concise language for labels, instructions, and notifications.

- Create a straightforward visual hierarchy through color, size, and typography to guide users’ attention and emphasize important elements.

- Maintain consistency in visual components like color schemes, typography, and icons.

- Design intuitive navigation that allows users to move between screens and access various features easily.

- Provide users immediate feedback through visual cues or progress indicators to users when they perform actions or complete tasks.

- Allow users to customize the mobile app by choosing color themes or font sizes.

- Make an effortless data entry process with auto-fill or scan-and-capture features.

- Use visual elements like charts, graphs, and progress bars to present financial information in an easily digestible format.

- Ensure that your budget app is accessible to users with disabilities by considering high-contrast options or screen readers.

How to Make a Budget App: Technical Considerations

Any finance software solution, whether a mobile bank app or a money management tool, requires a set of technical tools for proper operation. Review the following considerations to learn how to make a budget web app or mobile solution.

Platform Selection

Decide on the platform(s) you want to target for your budget app. Common options include the following:

- iOS

- Android

- Cross-platform

- Web

Consider your target audience and their device preferences when making this decision.

Programming Languages and Frameworks

Select a programming language and framework that align with your development goals and chosen platform. Here are the options:

- Swift for iOS

- Java or Kotlin for Android

- React Native or Flutter for cross-platform development

- Angular, React, or Vue for web

On top of that, cover the backend logic of your budget app. Leverage Ruby, C#, or C++ programming languages.

Your developers should also design robust data storage. They may use MySQL, PostgreSQL, or MongoDB databases or cloud services like AWS or Google Cloud.

Other Considerations

Besides selecting a platform and relevant programming tools, you may require other technologies to cover some of your budgeting app’s functionalities. Look at the following ones:

- OAuth or OpenID for user authentication

- Apple Push Notification Service or Firebase Cloud Messaging for push notifications

- Bank-specific APIs for real-time financial data syncing

Complying with data protection regulations like GDPR or PSD2 is also critical.

Marketing and Monetization Strategies for a Budget App

Having explored how to make a budget app development smooth, you probably wonder: how do I promote my application and start making money? We’re backing you up with relevant info, delving into marketing tips:

- Leverage Facebook, Instagram, Twitter, and other social media platforms to build a strong online presence.

- Develop a content marketing strategy to provide valuable and educational content related to personal finance and budgeting. You can do this through a blog or resource section in your app.

- Collaborate with personal finance and budgeting influencers to promote your app.

- Implement a referral program encouraging users to refer your budget app to friends and family.

Once you promote your personal finance management app, you can start generating profits by leveraging the following monetization strategies:

- Freemium model. It involves presenting a free basic app version with premium features offered at a specific cost.

- Subscription model. It involves introducing subscription-based pricing, where users pay a recurring fee to access premium features or services.

- In-app purchases. This approach implies offering purchases for additional features or content within the application, e.g., exclusive budgeting templates or advanced analytics.

- Advertisements. In this model, you display ads inside your budgeting app.

- Partnerships. You can also partner with financial institutions, fintech companies, etc., to offer integrated services, features, or products and generate revenue through commissions.

Conclusion

Budget app development can be a rewarding endeavor if approached comprehensively. Consider implementing basic and extra features, following user-centered design principles, choosing robust technologies, and monetizing your application to ensure success.

And if you need someone to handle your budget app’s design and development, WeSoftYou is a company to consider. With our FinTech industry expertise and numerous thriving projects like NDAX.io and Good Dollar, we can help you turn your finance app concept into reality.

WeSoftYou experts are recognized as the best developers and innovators by Payoneer, Clutch, Upwork, and Forbes. By working with us, you can be sure of your FinTech solution’s quality. So, if you’re ready to initiate your project, contact our reliable team.

FAQ

A budget app is a software solution designed to help users track and manage their finances. It allows them to set budgets, track expenses, categorize transactions, and gain insights into spending habits.

First, you should define the essential features you want to have in your app. Then, choose a platform and programming language, implement user authentication and data security measures, integrate with banking APIs, and develop functionalities like transaction tracking, budgeting tools, and notifications. Also, don’t forget about the UI/UX design and thorough testing.

Some top budgeting apps that have gained popularity include Mint, YNAB, and PocketGuard. They offer comprehensive budgeting tools, expense tracking, and financial goal-setting capabilities.