DeFi Lending Platform Development

Tired of DeFi solutions that overpromise and underdeliver? WeSoftYou understands the frustration of dealing with platforms that fall short on security, scalability, and user experience. That’s why we develop custom solutions that address these pain points directly. Imagine a DeFi platform that actually works for you—efficient, secure, and user-friendly. Let’s build it together.

Discuss your idea

DeFi Lending Platform Development Services We Provide

DeFi wallet

We develop secure and easy-to-use wallets that let your users manage their assets and transactions smoothly within your platform.

Smart contracts

We’ll create smart contracts that automate and safeguard your lending processes, ensuring every transaction runs smoothly and without intermediaries.

Liquidity pool

We design and manage liquidity pools to ensure your platform has the resources it needs to offer competitive returns and seamless operations.

Risk management

Our risk management tools help protect your platform and its users, making sure that you’re prepared for market changes and potential risks.

Fiat on-ramp

We make it simple for your users to convert their traditional currencies into digital assets, easing their entry into your DeFi platform.

Flash loans

Without using a go-between, traders can obtain unsecured loans from lenders while taking out flash loans. On Defi platforms, flash loans represent a new type of uncollateralized credit.

Testimonials

Client feedback is a big factor in the awards process. Clutch.co’s leading companies have been vetted for quality and performance, and we are happy that WeSoftYou made the list.

Technologies We Use

To build your DeFi lending platform, we rely on the latest blockchain technologies. Our tech stack is carefully selected to ensure your platform is secure, efficient, and scalable.

Our DeFi Lending Platform Development Process

Building your DeFi platform with us is a structured process that ensures we deliver exactly what you need. Here’s a glimpse of how we work:

Advisory

We start by having a conversation about your ideas and goals. This is where we help you choose the right blockchain, define your platform’s features, and set the stage for a smooth development process. Our team is with you every step of the way, providing guidance to make sure everything aligns with your vision.

Proof of Concept

Next, we create a proof-of-concept to demonstrate how your platform will work. This step helps us refine the idea, ensuring that the final product will meet your expectations and be practical in real-world use.

Technical stage

Our engineers then dive into the development phase, building the core components like smart contracts, the platform infrastructure, and any necessary tokens. This is where your platform starts to take shape, backed by the latest in blockchain technology.

Beta-testing

Before we launch, we put your platform through rigorous testing. Our team checks for bugs, reviews the code, and makes sure everything runs smoothly. If we spot any issues, we fix them to ensure your platform is reliable and ready for users.

Deployment and maintenance

Finally, we launch your platform and make it accessible to users. But our work doesn’t stop there—we continue to support you, fixing any issues, adding new features, and helping your platform evolve as needed.

Why Choose WeSoftYou?

Choosing the right partner for your DeFi platform is crucial. Here’s why WeSoftYou is the best choice.

WeSoftYou? Present!

You’ll see us at major blockchain events, either sharing our expertise on stage or staying current with industry trends. We’re deeply involved in the blockchain community, and we bring that knowledge and passion to every project we take on.

Impeccable Web3 expertise

With years of experience in Web3 and blockchain, our team knows what it takes to build successful DeFi platforms. We’re passionate about what we do, and we’re committed to delivering solutions that meet your needs and exceed your expectations.

Providing flexible engagement models

We understand that every project is different, so we offer flexible ways to work together. Whether you need a dedicated team, a fixed-price agreement, or a time-and-materials approach, we’re here to accommodate your needs and ensure a successful partnership.

Legal compliance and reliability

In the complex world of DeFi, staying compliant is essential. WeSoftYou ensures your platform meets all relevant regulations, from GDPR to local laws, so you can operate with confidence and peace of mind.

Our Case Studies

See more cases

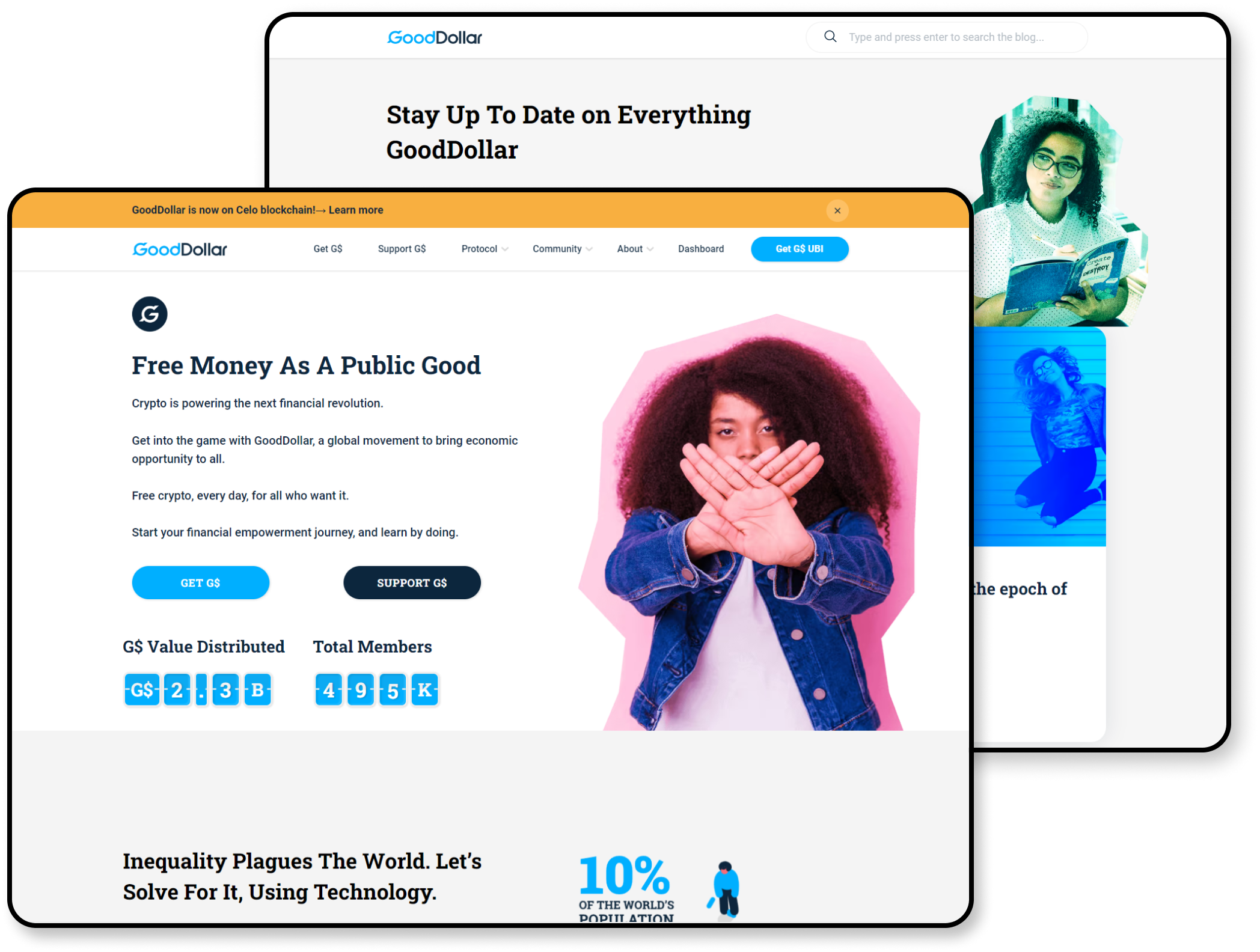

eToro (Good Dollar)

Blockchain revolutionizing global distribution & basic income

NDAX.io

Cryptocurrency exchange platform for secure trading

Knowledge Hub (Circle Economy)

E-Learning content management aggregator for Circle Economy

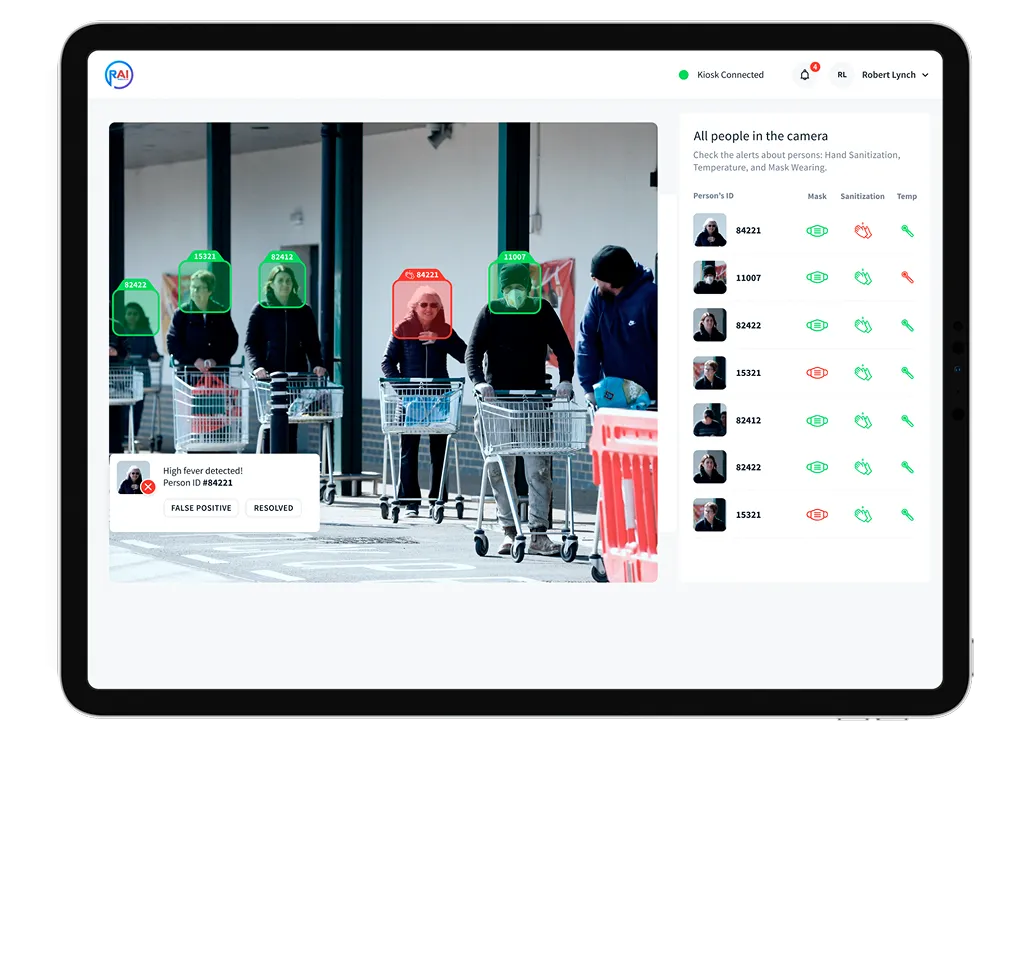

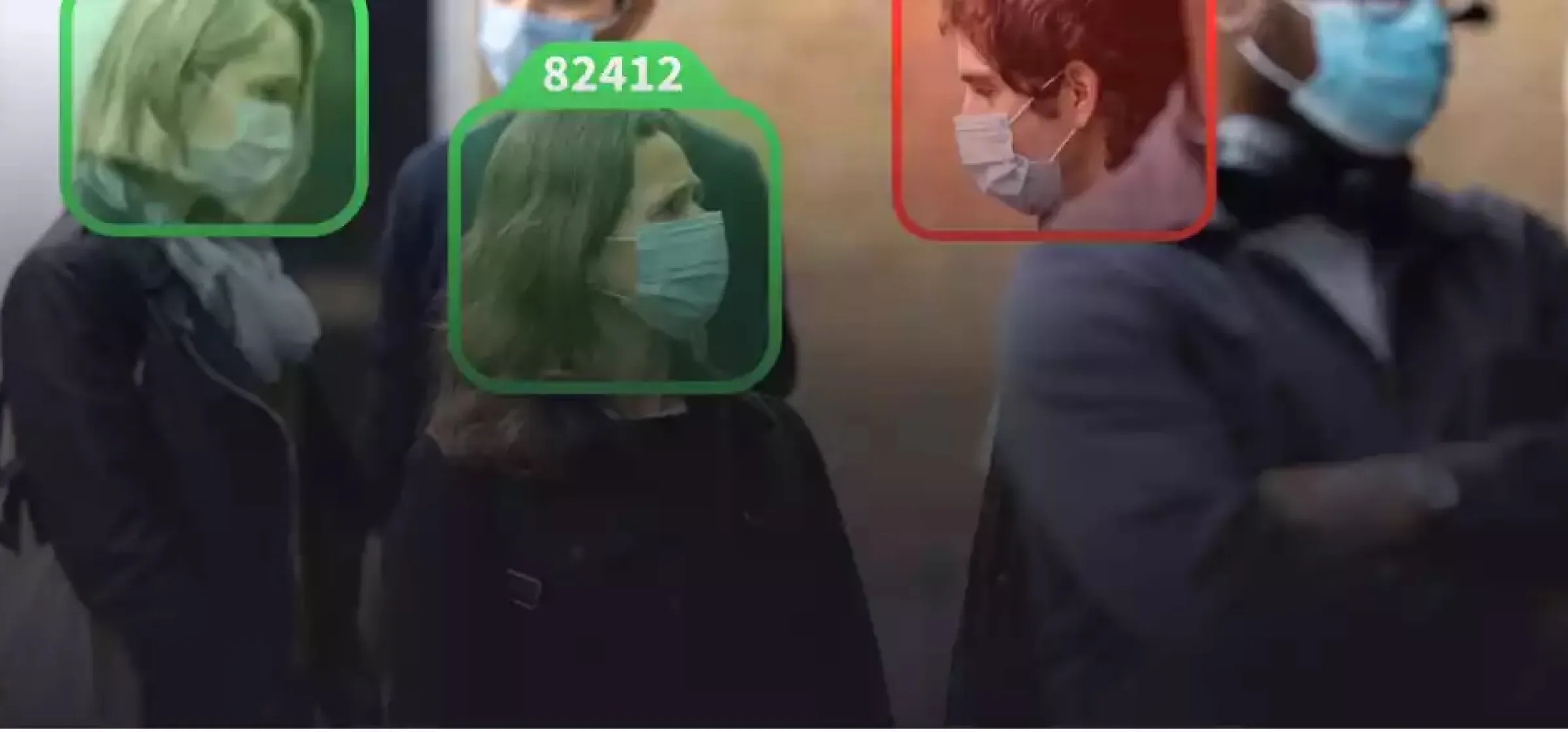

Radius.ai

AI driven platform to analyze shopper behavior

FAQ

A DeFi lending market is a decentralized platform that enables users to lend and borrow assets without relying on traditional financial intermediaries like banks or credit institutions. Instead of going through a centralized authority, transactions are facilitated through smart contracts—self-executing agreements written in code that automatically enforce the terms of the loan. These platforms typically offer various assets, including cryptocurrencies and stablecoins, which users can lend out in exchange for interest or borrow by providing collateral. The decentralized nature of these markets means they operate 24/7, often with lower fees and higher transparency compared to traditional lending systems, providing users with greater control over their financial activities.

It is subjective to determine the “best” DeFi lending platform as it depends on individual financial goals and risk tolerance. Some popular DeFi lending platforms that have gained significant traction include dYdX, NEXO, MakerDAO, Compound, and Aave.

These are just a few examples, and many other DeFi lending platforms are available. As with any financial investment, it’s essential to thoroughly research and compare different options before choosing a DeFi lending platform. It’s also important to keep in mind that DeFi lending markets are highly speculative and come with a high degree of risk. It’s crucial to understand the potential risks and benefits before participating.

The time required for DeFi lending platform development can vary depending on several factors, such as the platform’s complexity, the development team’s size, and the amount of resources allocated to the project. On average, a basic DeFi lending platform can take several months to a year to develop, while a more complex platform can take much longer.

It is important to note that building a successful DeFi lending platform requires a deep understanding of the underlying technology, regulatory compliance, and market demand. It is also important to perform thorough testing and security audits to ensure that the platform is reliable and secure for users.

Do you want to start a project?

Meet us across the globe

United States

66 W Flagler st Unit 900 Miami, FL, 3313016 E 34th St, New York, NY 10016

Europe

109 Borough High St, London SE1 1NL, UKProsta 20/00-850, 00-850 Warszawa, Poland

Vasyl Tyutyunnik St, 5A, Kyiv, Ukraine

Av. da Liberdade 10, 1250-147 Lisboa, Portugal