We at WeSoftYou understand that the development of Decentralized Finance (DeFi) applications can be a complex and costly endeavor. CEOs, CTOs, and founders are often intrigued by the potential benefits of DeFi apps but are hesitant due to the uncertainty surrounding the costs involved. In this article, we will outline the various factors that influence the cost of DeFi app development and provide a breakdown of the expenses you can expect. From our experience as a software development company with a proven track record, we aim to guide you in making informed decisions about developing a DeFi app.

What is a DeFi App?

Before diving into the costs, it is crucial to comprehend what DeFi apps are and why they have gained so much attention in recent years. DeFi, short for Decentralized Finance, refers to the use of blockchain and smart contracts to provide financial services in a decentralized manner. These apps aim to democratize financial services by eliminating intermediaries and allowing users to have full control over their funds.

DeFi apps have revolutionized the traditional financial landscape by leveraging the power of blockchain technology. They enable users to access financial services without relying on centralized institutions, such as banks or brokerage firms. This decentralization brings numerous benefits, including increased transparency, lower fees, and enhanced security.

The definition of a DeFi App

A DeFi app is a decentralized application that provides a range of financial services such as lending, borrowing, asset management, and more, through smart contracts. These apps operate on blockchain networks like Ethereum and leverage the immutability and security provided by distributed ledger technology.

One of the key advantages of DeFi apps is their ability to automate financial processes through smart contracts. These self-executing contracts eliminate the need for intermediaries, reducing costs and increasing efficiency. For example, in a lending scenario, a DeFi app can automatically match lenders with borrowers based on predefined criteria, streamlining the borrowing process.

Key Features of DeFi Apps

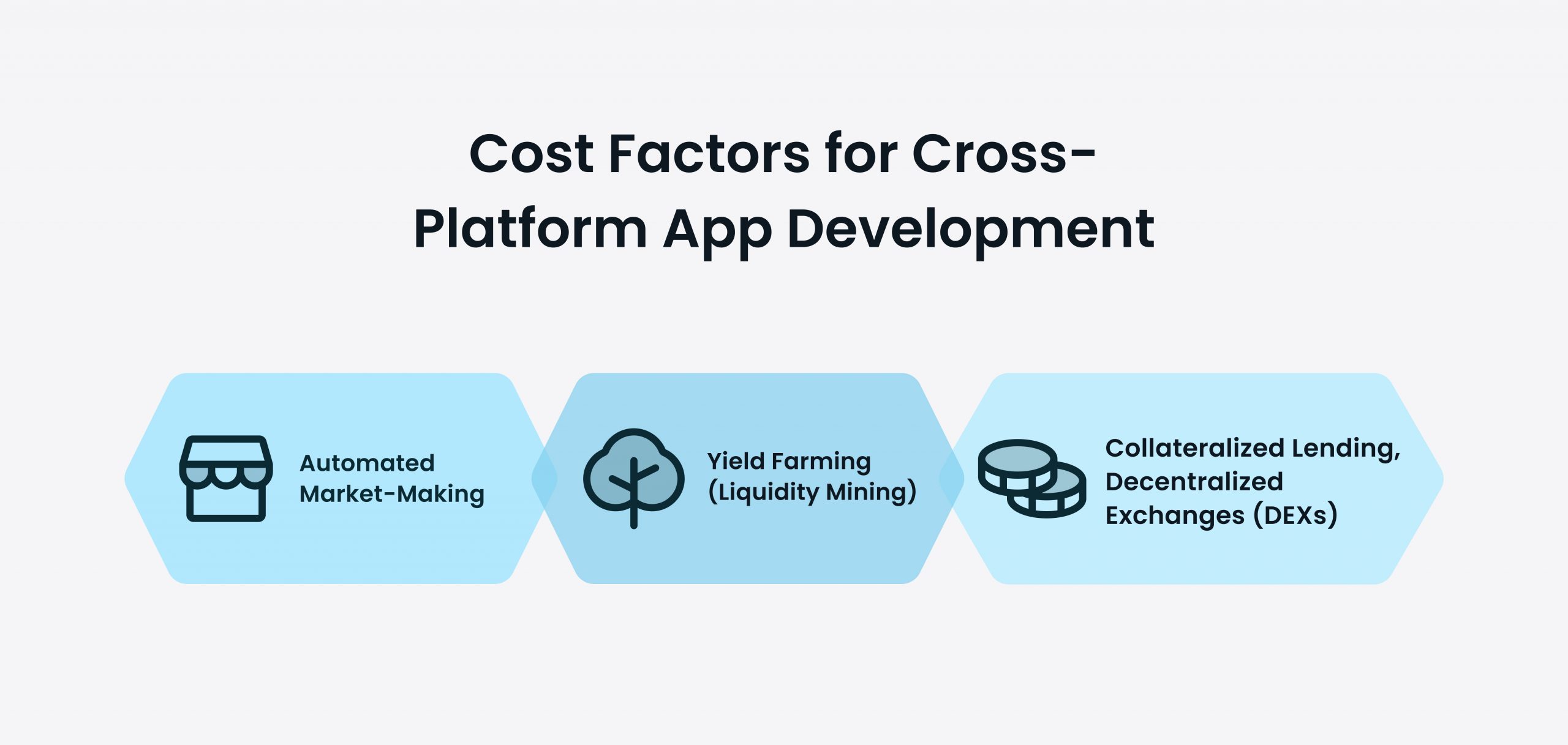

DeFi apps typically offer features like automated market-making, yield farming, collateralized lending, and decentralized exchanges. These features provide users with opportunities for passive income, asset diversification, and increased control over their financial activities.

Automated market-making is a popular feature in DeFi apps that enables users to trade assets without relying on traditional order books. Instead, liquidity pools are used to automatically determine asset prices based on supply and demand. This mechanism ensures continuous liquidity and reduces the risk of market manipulation.

Yield farming, also known as liquidity mining, is another exciting feature offered by DeFi apps. It allows users to earn additional tokens by providing liquidity to specific pools. By staking their assets in these pools, users contribute to the overall liquidity of the platform and are rewarded with additional tokens as an incentive.

Collateralized lending is a fundamental service provided by DeFi apps. It allows users to borrow funds by locking their digital assets as collateral. This mechanism eliminates the need for credit checks or traditional loan approval processes, making borrowing more accessible to a wider range of individuals.

Decentralized exchanges (DEXs) are an essential component of DeFi apps, providing users with a platform to trade digital assets directly with each other. Unlike centralized exchanges, DEXs do not require users to deposit their funds into a centralized wallet, reducing the risk of hacking or theft.

In conclusion, DeFi apps have revolutionized the financial industry by offering a decentralized alternative to traditional financial services. With their key features like automated market-making, yield farming, collateralized lending, and decentralized exchanges, these apps provide users with increased control, transparency, and opportunities for financial growth.

What Influences the Cost of DeFi App Development?

The cost of developing a DeFi app is influenced by several factors that need careful consideration. By understanding these factors, you can make informed decisions and manage your budget effectively.

Complexity of the App

The complexity of your DeFi app will directly impact its development cost. The more intricate the app’s features and functionality, the more time and effort it will require from the development team. Advanced features like decentralized trading algorithms and complex smart contracts may significantly increase the development cost.

For example, if your DeFi app aims to provide users with advanced trading options such as limit orders, stop-loss orders, and margin trading, the development team will need to implement sophisticated algorithms and integrate with various external exchanges. This level of complexity requires extensive coding and testing, which can drive up the development cost.

In addition, if your app requires complex smart contracts to facilitate lending and borrowing activities, the development team will need to ensure the security and efficiency of these contracts. This may involve auditing the smart contracts for potential vulnerabilities and optimizing their performance, which can add to the development cost.

The Development Team

Choosing the right development team is crucial for the success and cost efficiency of your DeFi app. Experienced developers with a deep understanding of blockchain technology and smart contract development are essential. The number of developers and their hourly rates will also impact the overall cost of development.

When selecting a development team, it is important to consider their expertise in DeFi app development specifically. DeFi apps have unique requirements and challenges compared to traditional applications, so working with developers who have prior experience in this field can help ensure a smoother development process and reduce the likelihood of costly mistakes.

The size of the development team can also affect the cost. A larger team may be able to complete the development faster, but it will also increase the overall cost. On the other hand, a smaller team may take longer to develop the app, but it may be more cost-effective in terms of hourly rates.

Technology Stack Used

The technology stack you choose for your DeFi app will have cost implications. Popular blockchain networks like Ethereum are widely used in the DeFi space, but alternative networks may offer cost advantages. The choice of programming languages, frameworks, and libraries will also affect development costs.

For example, developing a DeFi app on Ethereum may involve higher development costs due to the network’s popularity and the need for gas fees to execute smart contracts. However, Ethereum’s extensive developer community and well-established infrastructure can provide advantages in terms of support and security.

Alternatively, building a DeFi app on a less popular blockchain network may offer cost advantages, as the gas fees may be lower and the competition among developers may be less intense. However, it is important to consider the network’s scalability, security, and community support when making this decision.

The choice of programming languages, frameworks, and libraries can also impact the development cost. Some languages and frameworks may have a steeper learning curve, requiring more time and effort from the development team. Additionally, the availability of libraries and development tools for a particular technology stack can affect the speed and efficiency of development, which in turn can influence the overall cost.

DeFi App Development Cost Factors

Now that we have covered the factors influencing the cost of DeFi app development, let’s dive into the specific expenditure areas.

Design and User Interface

A well-designed and intuitive user interface is crucial for attracting and retaining users. The cost of designing the user interface and user experience (UI/UX) will depend on the complexity of your app and the level of customization required.

When it comes to design, you need to consider various factors. For instance, the color scheme and typography play a significant role in creating a visually appealing interface. The choice of colors can evoke certain emotions in users, while the right typography can enhance readability and overall user experience.

Furthermore, the layout and navigation of your app should be carefully planned to ensure ease of use. A well-organized layout allows users to find the information they need quickly and effortlessly. Additionally, intuitive navigation ensures that users can easily move between different sections of the app without feeling lost or confused.

Backend Development

The development of the backend infrastructure, including smart contracts, blockchain integration, and decentralized data storage, constitutes a significant portion of the costs. The complexity of the app’s features and the number of integrations needed will impact the backend development costs.

When developing the backend of a DeFi app, it is essential to consider scalability and security. Scalability ensures that your app can handle a growing user base and increasing transaction volume without compromising performance. On the other hand, security measures, such as encryption and authentication protocols, are crucial to protect user data and prevent unauthorized access.

In addition to smart contracts and blockchain integration, you may also need to implement various APIs (Application Programming Interfaces) to connect your app with external services or data sources. These integrations can add complexity to the development process and increase costs.

Testing and Quality Assurance

Thorough testing and quality assurance are vital to ensure the smooth operation and security of your DeFi app. The cost of testing will depend on the complexity of the app and the rigor of the testing process.

Testing a DeFi app involves various types of testing, including functional testing, performance testing, and security testing. Functional testing ensures that all features and functionalities of the app work as intended. Performance testing assesses the app’s performance under different load conditions to identify any bottlenecks or performance issues. Security testing focuses on identifying vulnerabilities and weaknesses in the app’s code and infrastructure to prevent potential security breaches.

To ensure comprehensive testing, it is recommended to engage a team of experienced testers who can create test cases, execute tests, and provide detailed reports on any issues found. This level of quality assurance helps to minimize the risk of bugs, glitches, and security vulnerabilities in your DeFi app.

Maintenance and Updates

Regular maintenance and updates are necessary to keep your DeFi app secure and up to date with the rapidly evolving blockchain ecosystem. This includes fixing bugs, improving user experience, and adding new features to stay ahead of the competition. The cost of maintenance will depend on the frequency and complexity of updates required. It’s crucial to have a dedicated team of developers who can handle these tasks efficiently and effectively.

Additionally, as the blockchain technology and DeFi space continue to evolve, you may need to integrate with new protocols, upgrade your smart contracts, or adapt to changes in regulatory requirements. All these updates require time, resources, and expertise, which will impact your ongoing costs.

Marketing and Promotion

Building a great DeFi app is just the first step. To attract users and gain traction in the competitive DeFi landscape, you need to invest in marketing and promotional activities. Allocating a budget for marketing efforts is essential to create awareness and drive user adoption.

This can include various strategies such as social media campaigns, influencer collaborations, content marketing, and community engagement. By actively engaging with your target audience, you can build a strong community around your DeFi app, which can lead to increased user adoption and brand loyalty. However, it’s important to note that marketing costs can vary significantly depending on the scale and scope of your campaigns.

Security Measures and Updates

Ensuring the security of your DeFi app and its user funds is of paramount importance. With the increasing number of hacks and security breaches in the DeFi space, users are becoming more cautious about the platforms they trust with their assets. Therefore, investing in robust security measures is crucial to gain and maintain user trust.

Regular security audits and updates to address any vulnerabilities or emerging threats will require ongoing investment. This includes hiring security experts to conduct audits, implementing multi-factor authentication, and staying up to date with the latest security protocols. By prioritizing security, you can protect your users’ funds and reputation, which is essential for the long-term success of your DeFi app.

It’s worth mentioning that the ongoing costs for a DeFi app can vary depending on various factors such as the complexity of the app, the size of the user base, and the overall market conditions. Therefore, it’s crucial to regularly assess and adjust your budget to ensure you can meet these ongoing costs effectively.

Ways to Reduce DeFi App Development Costs

Developing a DeFi (Decentralized Finance) app can be an exciting venture, but it often comes with a hefty price tag. However, there are strategies you can employ to optimize costs without compromising on quality or functionality.

Let’s dive deeper into some of the key ways you can reduce DeFi app development costs:

Choosing the Right Development Team

One of the most critical decisions you’ll make during the development process is selecting the right development team. Opting for a reputable team with expertise in DeFi app development can save costs in the long run. A skilled team will be efficient in their work, reducing development time and minimizing unforeseen expenses. Additionally, experienced developers will have a deep understanding of the intricacies of DeFi, allowing them to navigate potential challenges more effectively.

When choosing a development team, it’s essential to assess their previous projects, client testimonials, and overall reputation within the industry. Investing time in finding the right team upfront can lead to significant cost savings down the line.

Prioritizing Essential Features

Identifying and prioritizing the essential features for the initial version of your DeFi app can help minimize costs. It’s tempting to include every possible feature right from the start, but this can quickly escalate expenses. By focusing on the core functionality, you can release a Minimum Viable Product (MVP) and gather user feedback before investing in further development.

Launching an MVP allows you to test the market demand, validate your concept, and gather valuable insights from real users. This feedback can guide your future development efforts, ensuring that you invest in features that truly add value and resonate with your target audience. By taking an iterative approach, you can control costs while continuously improving your DeFi app based on user feedback.

Opting for Open Source Technologies

Leveraging open-source technologies and existing libraries can significantly reduce development costs. The DeFi community is known for its collaborative nature, and many developers contribute to open-source projects that benefit the entire ecosystem.

By utilizing open-source frameworks and tools, developers can build on existing solutions and avoid reinventing the wheel. This not only saves time but also reduces costs associated with developing complex features from scratch. Additionally, open-source technologies often have a vibrant community of developers who can provide support and guidance, further streamlining the development process.

However, it’s crucial to consider the security and reliability of the open-source components you choose to incorporate into your DeFi app. Conduct thorough due diligence, review the community’s reputation, and ensure that the chosen technologies align with your project’s requirements.

By implementing these strategies, you can effectively reduce DeFi app development costs without compromising on quality or functionality. Remember, cost optimization is a continuous process, and it’s essential to stay agile and adapt to the evolving needs of your users and the DeFi ecosystem.

Conclusion

Developing a DeFi app can be a substantial investment, but the potential rewards and disruption in the financial industry make it a worthwhile endeavor for many businesses. As the DeFi space continues to evolve, it is crucial to partner with an experienced software development company like WeSoftYou to navigate the complexities and build a secure, scalable, and user-friendly DeFi app.

FAQ

The development timeline for a DeFi app can vary depending on the complexity of the app and the availability of resources. On average, it can take several months to develop a feature-rich DeFi app.

Developing a DeFi app involves various stages, including ideation, design, development, testing, and deployment. Each stage requires careful planning and execution to ensure a high-quality and secure app. During the ideation phase, the development team works closely with the client to understand their requirements and goals. This collaboration helps in creating a clear roadmap for the development process.

Once the initial planning is complete, the design phase begins. This phase involves creating wireframes, user interface designs, and user experience prototypes. The design team focuses on creating an intuitive and visually appealing interface that aligns with the client’s branding and target audience.

After the design is finalized, the development phase starts. This phase involves writing code, integrating APIs, and implementing smart contracts. The development team follows industry best practices and coding standards to ensure the app’s stability, scalability, and security.

Once the development is complete, rigorous testing is conducted to identify and fix any bugs or vulnerabilities. The testing phase includes unit testing, integration testing, and user acceptance testing. This ensures that the app functions as intended and meets the client’s expectations.

Finally, the app is deployed to the desired platform, and post-launch support and maintenance are provided to address any issues or updates that may arise.

Yes, it is possible to integrate multiple blockchains into a DeFi app. However, the complexity and cost of development will increase accordingly.

Integrating multiple blockchains into a DeFi app can provide various benefits, such as increased scalability, interoperability, and access to a wider range of assets and liquidity. However, it requires careful planning and implementation.

Each blockchain has its own unique features, consensus mechanisms, and smart contract languages. Integrating multiple blockchains requires developing custom bridges or utilizing existing interoperability solutions to enable seamless communication and transfer of assets between different chains.

The development team needs to have a deep understanding of the underlying technology and protocols of each blockchain to ensure smooth integration. They also need to consider the potential impact on the app’s performance, security, and user experience.

Additionally, integrating multiple blockchains may require additional development resources and expertise, which can increase the overall cost and development timeline of the app. It is essential to carefully evaluate the benefits and trade-offs before deciding to integrate multiple blockchains into a DeFi app.

To ensure the security of your DeFi app, it is essential to conduct regular security audits, implement robust smart contracts, and stay up to date with the latest security practices in the blockchain industry.

Security is a critical aspect of any DeFi app as it deals with sensitive user data and financial transactions. To enhance the security of your DeFi app, consider the following measures:

Regular Security Audits: Conduct regular security audits by independent third-party firms to identify and fix any vulnerabilities or weaknesses in your app’s codebase and infrastructure.

Robust Smart Contracts: Implement smart contracts with proper code reviews and testing to minimize the risk of bugs or vulnerabilities. Follow best practices, such as using secure libraries, avoiding unnecessary complexity, and conducting formal verification when possible.

Secure Infrastructure: Ensure that your app’s infrastructure, including servers, databases, and APIs, is properly secured. Implement strong access controls, encryption, and monitoring mechanisms to protect against unauthorized access and data breaches.

User Education: Educate your users about best security practices, such as using strong passwords, enabling two-factor authentication, and being cautious of phishing attempts. Provide clear instructions and resources to help them secure their accounts and assets.

Stay Updated: Stay informed about the latest security vulnerabilities, exploits, and best practices in the blockchain industry. Regularly update your app’s dependencies and libraries to incorporate security patches and improvements.

Ready to explore the possibilities of developing a DeFi app? Contact us at WeSoftYou for a free consultation or project estimation. Our expert team will guide you through the development process and help you turn your vision into reality.