Money lending apps have revolutionized how people access loans, offering convenience and accessibility like never before. They allow borrowers to access funds simpler and speed up application processes. At the same time, creditors expand their customer base, automate loan management, and minimize risks through advanced credit scoring and verification systems.

This article delves into money lending app development. We will explore its definition, operational principles, essential features, and crucial considerations before software creation. As an expert in fintech app building, WeSoftYou shares its rich expertise, helping you navigate the intricate landscape of developing a successful money lending app.

So, let’s embark on this enlightening journey to unlock the potential of your loan solution.

What Is a Money Lending App?

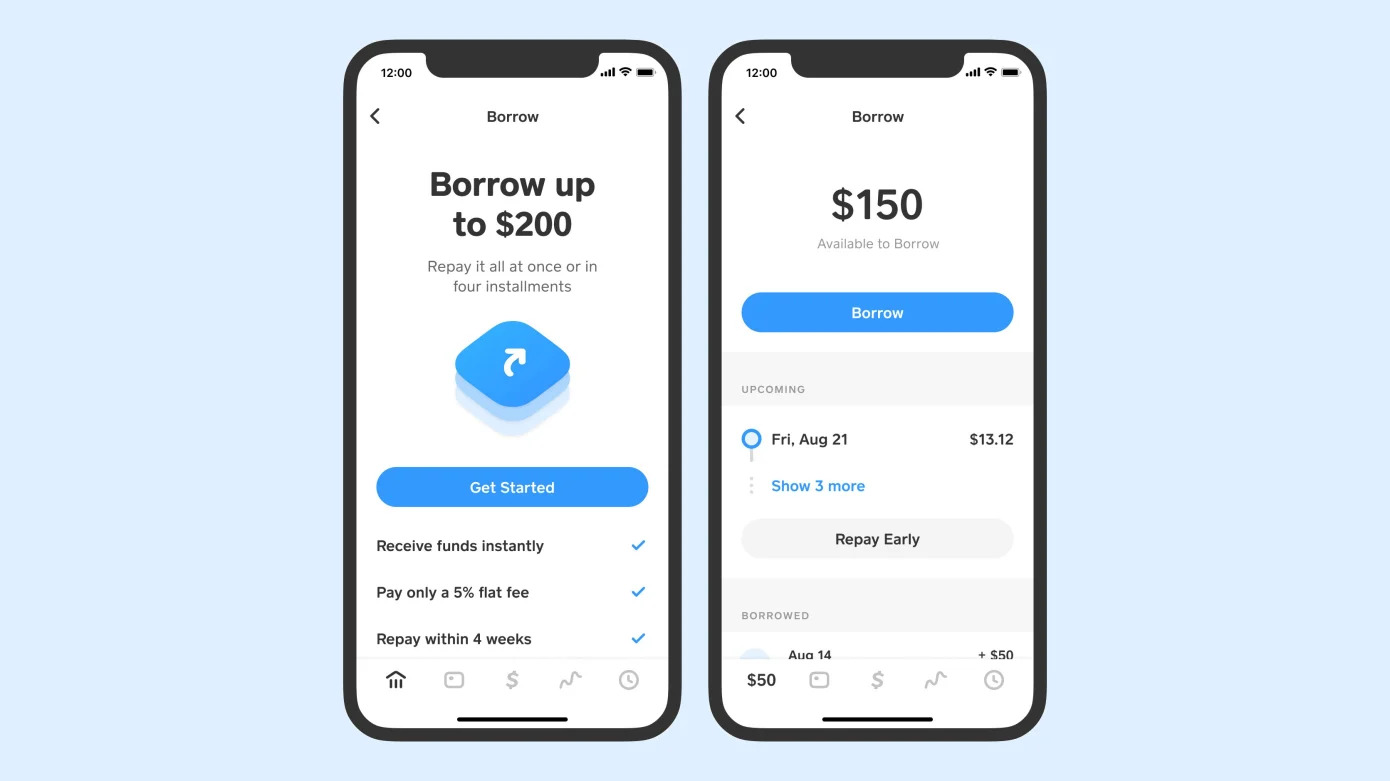

A money lending app is a mobile application that allows individuals to borrow money from a creditor or lending platform through smartphones or other digital devices. It’s an alternative to traditional financial institutions like banks or credit unions for obtaining loans.

Money lending apps offer a streamlined and convenient process for loan applications. They often come with minimal documentation requirements and quick approval times. Such solutions utilize various money lending aspects. They include credit scores, income verification, employment details, and even alternative data points like social media activity or transaction history, to evaluate borrowers.

Note that lending solutions have different models and terms. Also, the regulations surrounding them vary across jurisdictions. Therefore, users should carefully review the terms, fees, and associated interest rates and consider their financial situation before borrowing money.

Benefits of Money Lending Apps

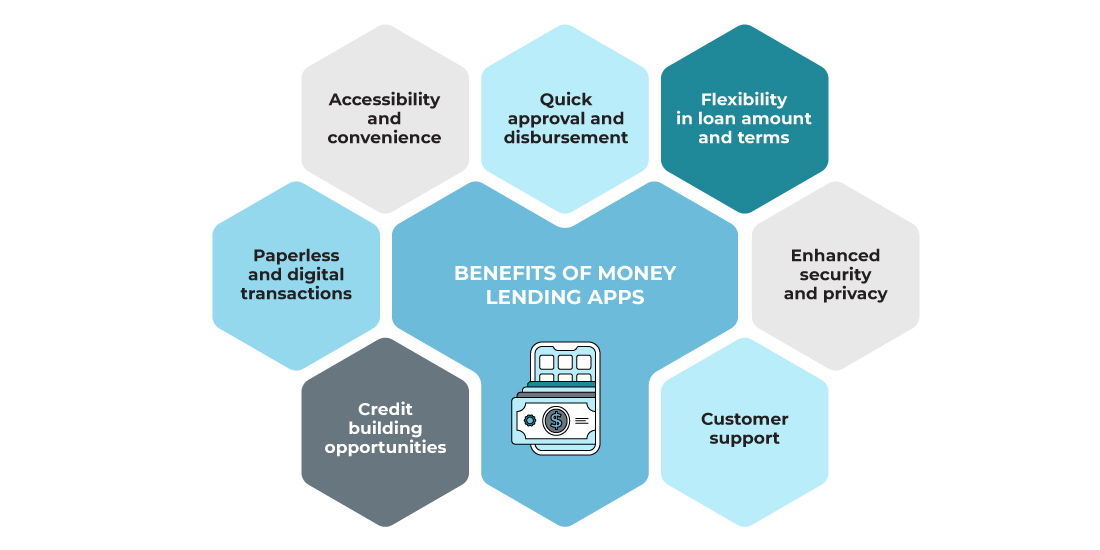

Loan apps offer several benefits, making them a popular choice for borrowers to get quick and convenient access to financial services. Let’s look at the most compelling advantages in more detail.

- Accessibility and convenience. Money lending apps provide instant access to loans anytime and anywhere, directly from users’ smartphones. It eliminates the need for physical visits to banks or financial institutions.

- Quick approval and disbursement. These apps use data analysis, credit scoring models, and machine learning. This way, they assess borrowers’ creditworthiness swiftly and provide instant approval decisions.

- Flexibility in loan amount and terms. Borrowers select the amount that suits their needs, whether a small emergency loan or a larger sum for a significant expense. Additionally, they customize their repayment schedule based on financial capabilities.

- Paperless and digital transactions. With money lending apps, borrowers submit their personal information, income details, and other necessary documents through the app.

- Enhanced security and privacy. Loan apps prioritize the security and privacy of borrowers’ personal and financial information. Also, they follow regulatory guidelines to safeguard data and maintain transparency.

- Credit building opportunities. Timely loan repayment positively impacts borrowers’ credit scores. They can build a strong credit history and improve their future borrowing prospects.

- Customer support. Money lending apps provide responsive customer support channels. Borrowers may seek assistance, resolve queries, and receive guidance throughout the loan process.

How Do P2P Money Lending Mobile Apps Work?

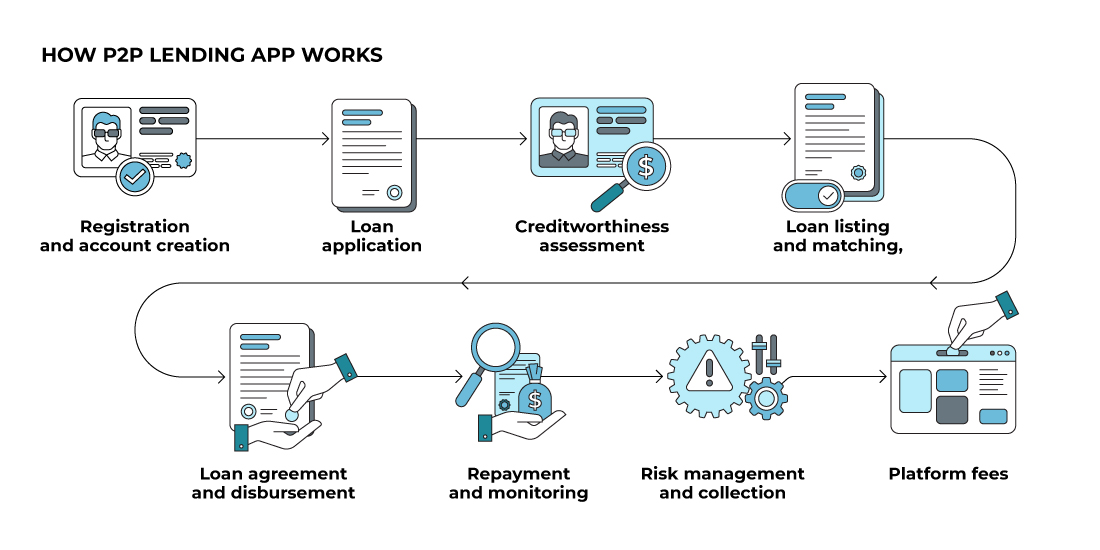

Peer-to-Peer (P2P) money lending mobile apps use the principle of connecting individual lenders directly with borrowers through a digital platform. They offer access to loans with potentially lower interest rates and fees. At the same time, such apps empower creditors to earn interest on their investments.

Here’s a brief overview of how such solutions usually work.

- Registration and account creation. Borrowers and lenders register on a P2P lending app by providing personal information. They may also need extra verification to prove their identity and credibility.

- Loan application. Borrowers submit applications specifying the desired loan amount, purpose, and repayment terms. Also, they provide additional details like income verification, employment information, and credit history.

- Creditworthiness assessment. The platform evaluates the borrowers’ creditworthiness. For that, it uses credit scores, income verification, employment stability, and other relevant criteria. The solution employs data analysis and algorithms to assess potential risks.

- Loan listing and matching. After determining the borrower’s creditworthiness, the application appears on the platform. Creditors can browse the listings and select the ones they want to fund depending on their preferences, risks, and interest rates.

- Loan agreement and disbursement. When a lender decides to fund a loan, the app facilitates loan agreement creation. It outlines the terms, interest rates, repayment schedule, and associated fees. Once both parties agree, the funds appear on the borrower’s account.

- Repayment and monitoring. Borrowers repay the loan according to the agreed-upon schedule, including principal and interest. The app allows for electronic repayments. Thus, lenders track the progress of their investments.

- Risk management and collection. P2P money lending apps may utilize collection agencies or implement mechanisms to recover overdue payments on behalf of creditors.

- Platform fees. The platforms charge origination, serving, or transaction fees for facilitating the lending process.

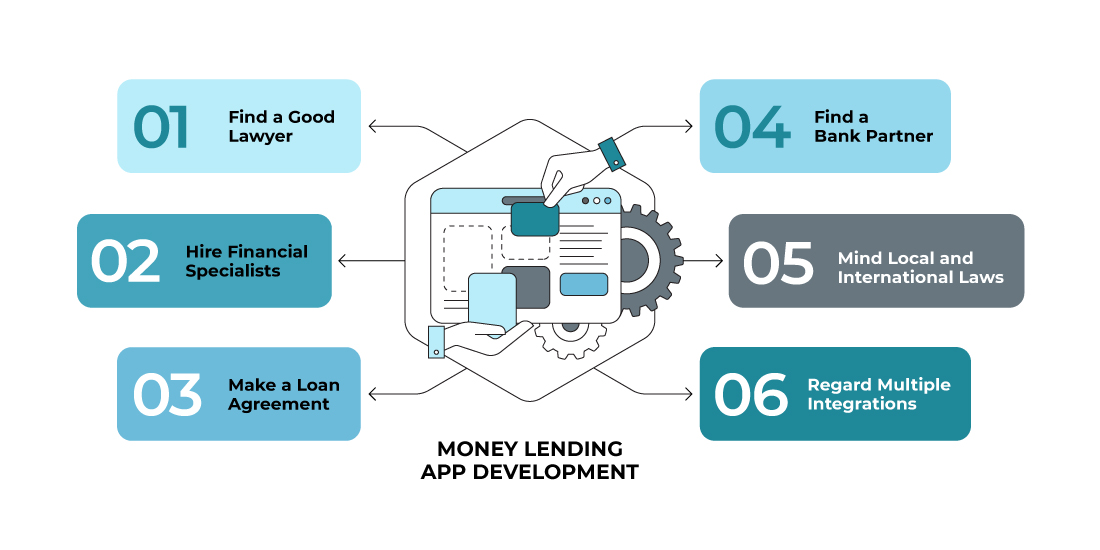

Things to Consider Before Loan Lending App Development

To create a loan app, consider the following aspects. They ensure legal compliance, operational efficiency, and a smooth user experience.

Find a Good Lawyer

Engage the services of a competent lawyer with expertise in finance and technology to navigate the legal and regulatory landscape. They can guide compliance, assist in drafting necessary agreements and contracts, and explain relevant local and international laws.

Hire Financial Specialists

Build a team of financial specialists who understand lending practices, risk assessment, and underwriting. They will design the loan processes and evaluate borrowers’ creditworthiness. Moreover, such professionals will ensure the team follows reliable practices throughout the platform development and operation.

Make a Loan Agreement

Create a comprehensive and legally binding loan agreement that outlines the terms and conditions of the loans facilitated through your app. This agreement should cover interest rates, repayment schedules, penalties for late payments, and any fees or charges associated with the loan.

Find a Bank Partner

Establish a partnership with a reputable bank or financial institution to handle loan disbursements, funds management, and secure transactions. Such collaboration adds credibility to your loan app and enhances customer trust.

Mind Local and International Laws

Prioritize the legal and regulatory requirements specific to your target market. Study the local and international laws governing money lending, consumer protection, data privacy, and financial transactions. Thus you will operate legally and protect all involved parties’ interests.

Regard Multiple Integrations

Consider integrating your loan app with third-party services and platforms to enhance functionality. These may include payment gateways, credit scoring systems, identity verification solutions, and reporting agencies.

How to Create a Loan App: What to Start With?

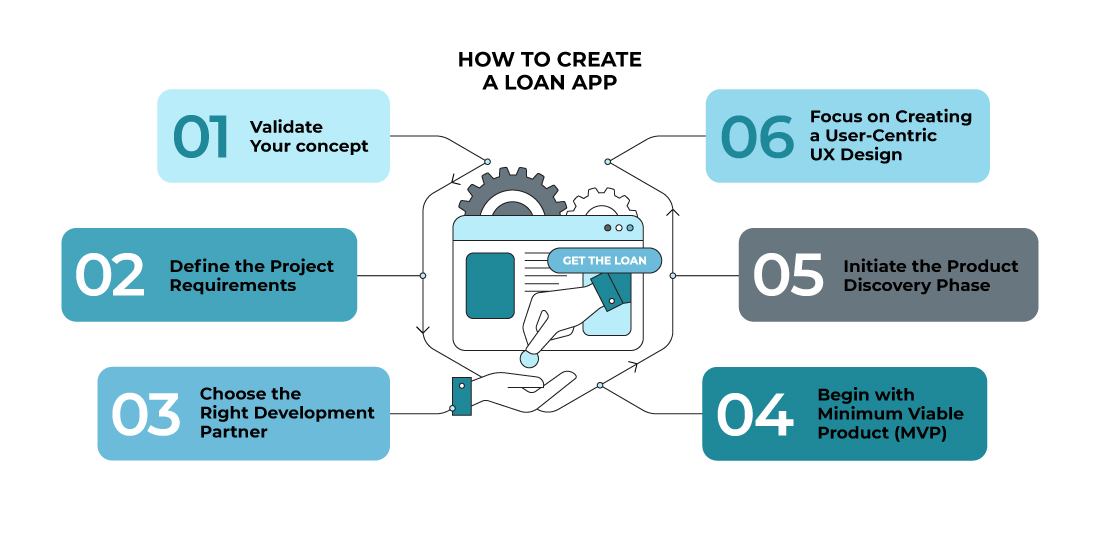

Creating a lending mobile app involves several essential considerations to guarantee a successful development process.

Step 1: Validate Your Concept

Initially, validate your concept. Conduct market research and analyze the demand for a lending app. Identify your target audience, assess the competition, and ensure the market is viable. Gather feedback from potential users and industry experts.

Step 2: Define the Project Requirements

Create a detailed project plan that outlines the development timeline, milestones, and resource allocation. Define the app requirements, including features, user flows, security measures, and integration needs. Clearly articulate your goals and objectives.

Step 3: Choose the Right Development Partner

Select a reliable and experienced development partner to bring your platform to life. Evaluate their expertise, portfolio, and track record. Consider their technical skills, understanding of the finance or lending industry, and ability to meet your project requirements.

Step 4: Begin with Minimum Viable Product (MVP)

Your MVP should include core features. With their help, users can apply for loans, complete the approval process, and make repayments. Focus on delivering essential functionality while keeping development costs and timelines manageable.

Step 5: Initiate the Product Discovery Phase

Сollaborate with your development team to refine the app’s features, user flows, and technical architecture. Conduct user research, gather feedback, and iterate on the MVP. This way, you will improve the app’s usability and address user needs. This phase helps you align with market demands and client expectations.

Step 6: Focus on Creating a User-Centric UX Design

Invest in designing a user-centric interface and experience for your platform. Create wireframes, prototypes, and visual designs prioritizing simplicity, ease of use, and intuitive navigation. Evaluate visual aesthetics and make sure it reflects your brand.

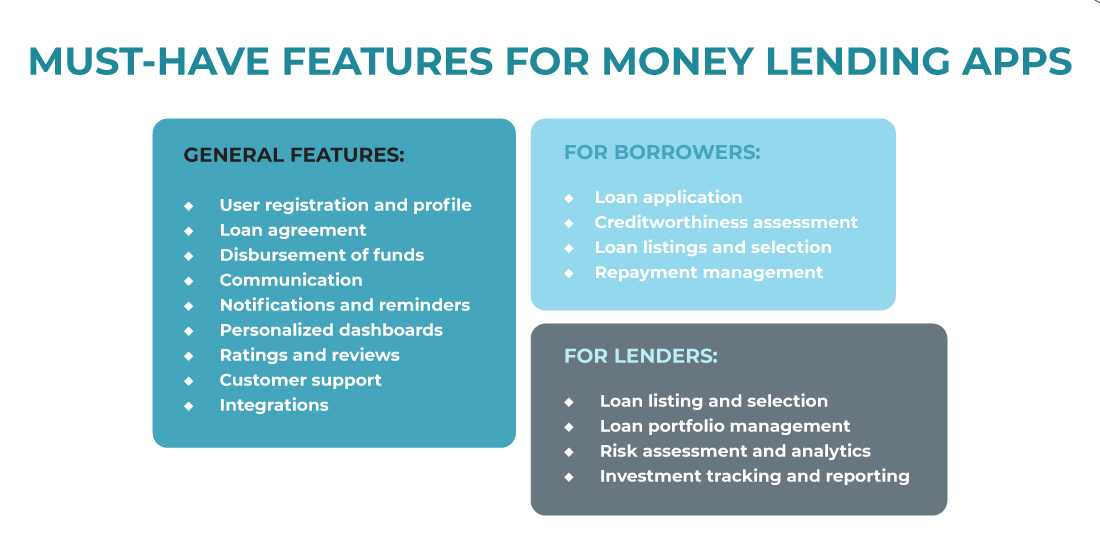

Money Lending Apps Features

Loan apps offer a range of features to facilitate the borrowing and lending process, enhance user experience, and ensure efficient operations. Let’s dive deeper into the essential and additional functionality of such solutions.

General features:

- User registration and profile. Users should create accounts and set up profiles, providing personal information, contact details, and identification documents.

- Loan agreement. Facilitate the creation and signing of a loan agreement between the borrower and the lender. Outline the terms, interest rates, repayment schedule, and associated fees.

- Disbursement of funds. The app should support the secure fund transfer to the borrower’s designated bank account or digital wallet.

- Communication. Streamline communication between creditors and borrowers. Ensure they can exchange messages or seek clarifications regarding loan details or repayment status.

- Notifications and reminders. Apps send notifications and reminders to borrowers and creditors regarding loan status, repayment due dates, and other critical updates.

- Personalized dashboards. Provide access to loan-related information, transaction history, and account settings.

- Ratings and reviews. Users can provide ratings and reviews for lenders and borrowers. Therefore, others can assess their credibility and reputation.

- Customer support. Users seek assistance, ask questions, or address concerns about the lending process via helpful and flexible customer support.

- Integrations. Integrate your platform with payment systems to facilitate loan disbursements and repayments securely.

For borrowers:

- Loan application. Allow borrowers to submit loan applications, specifying the desired loan amount, purpose, and repayment terms. They may also provide additional details like income verification and employment information.

- Creditworthiness assessment. Use credit scores, income verification, employment stability, and other criteria to determine the borrower’s eligibility.

- Loan listings and selection. Show available loan listings. With their help, borrowers select the most suitable offers. They may compare interest rates, repayment terms, and other crucial details.

- Repayment management. Borrowers should view their repayment schedule, make payments, and track their payment history. Some apps offer reminders and automatic payment options.

For lenders:

- Loan listing and selection. Thanks to this feature, lenders browse available loan listings and select the desired option.

- Loan portfolio management: Creditors track their loan investments, view borrower details, repayment schedules, and portfolio performance. They should monitor their earnings and evaluate the overall health of lending activities.

- Risk assessment and analytics. Provide tools and analytics for lenders to assess the risk associated with potential borrowers. Include creditworthiness analysis, borrower profiles, and historical performance data.

- Investment tracking and reporting. Offer reports and analytics summarizing investment activities, earnings, and overall returns.

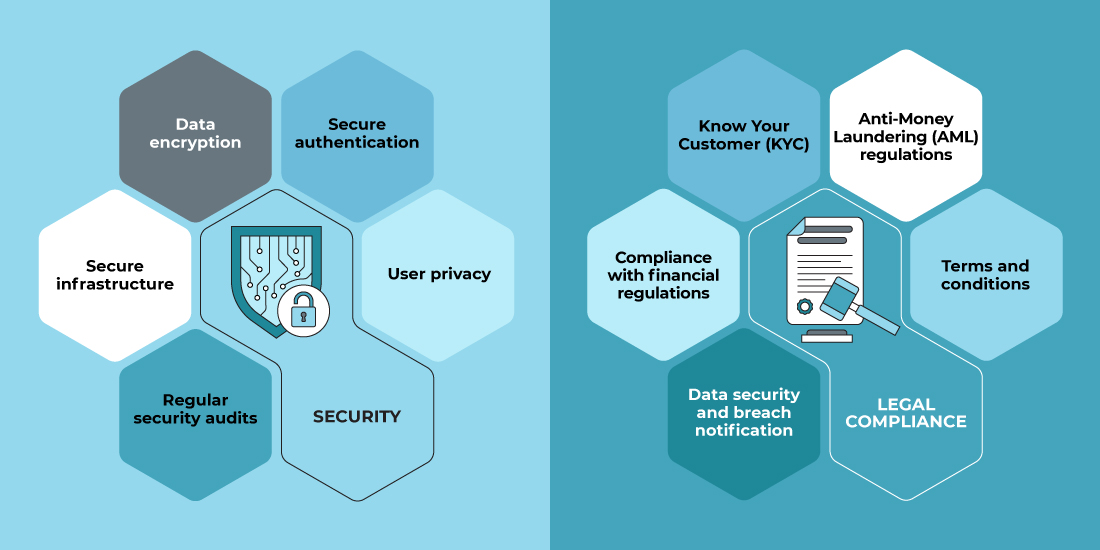

Security and Legal Compliance

Following security and legal compliance, you protect user data, financial transactions, and adherence to applicable laws and regulations.

Security:

- Data encryption. Implement strong encryption protocols to protect personal details, financial data, and transaction records.

- Secure authentication. Utilize two-factor (2FA) or biometric authentication to prevent unauthorized account access.

- Secure infrastructure. Host the app on servers with robust firewalls, intrusion detection systems, and regular security updates. These are efficient measures against potential breaches.

- Regular security audits. Conduct security audits and penetration testing to identify vulnerabilities and address potential weaknesses.

- User privacy. Develop a comprehensive privacy policy. It outlines how the platform collects, uses, and protects customer data. Ensure compliance with standards like General Data Protection Regulation (GDPR).

Legal compliance:

- Know Your Customer (KYC). Implement robust KYC procedures to check the user identity and mitigate the risk of fraud, money laundering, and other illicit activities. It involves verifying identification documents and conducting background checks.

- Anti-Money Laundering (AML) regulations. Implement AML procedures. Conduct due diligence on borrowers and report suspicious transactions to relevant authorities.

- Compliance with financial regulations. Study financial regulations specific to your target market, like banking regulations, lending regulations, and licensing requirements. Stick to those standards to operate legally and avoid potential penalties or legal issues.

- Data security and breach notification. Develop policies and procedures to safeguard user information, follow regulations, and establish protocols to notify users if a data breach occurs.

- Terms and conditions. Clearly define the terms and conditions of using the loan app. They should include loan agreements, repayment obligations, penalties for defaulting, and dispute resolution mechanisms.

Loan Lending App Development Cost

Following security and legal compliance, you protect user data, financial transactions, and adherence to applicable laws and regulations.

Security:

- Data encryption. Implement strong encryption protocols to protect personal details, financial data, and transaction records.

- Secure authentication. Utilize two-factor (2FA) or biometric authentication to prevent unauthorized account access.

- Secure infrastructure. Host the app on servers with robust firewalls, intrusion detection systems, and regular security updates. These are efficient measures against potential breaches.

- Regular security audits. Conduct security audits and penetration testing to identify vulnerabilities and address potential weaknesses.

- User privacy. Develop a comprehensive privacy policy. It outlines how the platform collects, uses, and protects customer data. Ensure compliance with standards like General Data Protection Regulation (GDPR).

Legal compliance:

- Know Your Customer (KYC). Implement robust KYC procedures to check the user identity and mitigate the risk of fraud, money laundering, and other illicit activities. It involves verifying identification documents and conducting background checks.

- Anti-Money Laundering (AML) regulations. Implement AML procedures. Conduct due diligence on borrowers and report suspicious transactions to relevant authorities.

- Compliance with financial regulations. Study financial regulations specific to your target market, like banking regulations, lending regulations, and licensing requirements. Stick to those standards to operate legally and avoid potential penalties or legal issues.

- Data security and breach notification. Develop policies and procedures to safeguard user information, follow regulations, and establish protocols to notify users if a data breach occurs.

- Terms and conditions. Clearly define the terms and conditions of using the loan app. They should include loan agreements, repayment obligations, penalties for defaulting, and dispute resolution mechanisms.

Loan Lending App Development Cost

The cost of money lending app development varies significantly depending on various factors. They include platform complexity, desired features, hired team rates, and location. Here’s an approximate cost breakdown for different stages of software creation:

| Development Stage | Approximate Cost Range |

| Concept and planning | $5,000 – $10,000 |

| UI/UX design | $8,000 – $15,000 |

| Front-end development | $10,000 – $20,000 per platform |

| Back-end development | $15,000 – $30,000 |

| API development | $5,000 – $15,000 |

| Testing and Quality Assurance (QA) | $5,000 – $10,000 |

| Deployment and launch | $2,000 – $5,000 |

| Post-launch maintenance | $1,000 – $5,000 per month (varies depending on requirements) |

What Development Model to Choose for Your Money Lending App?

For loan app development, you can choose between several models considering your specific requirements and preferences. The two most widespread options are product development outsourcing and the dedicated team. Here’s an overview of these models.

Outsourcing

This model involves collaborating with a software vendor or a team of professionals who handle end-to-end creation. This option is suitable when you have a well-defined project scope and clear requirements. Also, it allows for a fixed budget and timeline.

Advantages:

- An IT outsourcing agency handles the entire development process, from initial concept to final deployment.

- The hired team’s expertise includes UI/UX design, development, testing, and project management.

- This model involves a structured approach with milestones and deliverables. It ensures timely progress and accountability.

Considerations:

- Ensure clear communication and regular updates with the development agency. They should align with your vision and make any necessary adjustments.

- You may have limited flexibility to make changes during the workflow, as the scope and budget are usually fixed.

Dedicated Team

The dedicated team model involves assembling a group of developers, designers, and other specialists to work exclusively on your money-lending app. It’s suitable when you require more flexibility and ongoing collaboration throughout development.

Advantages:

- You have greater control over the project and can make changes and adaptations whenever necessary.

- The dedicated team becomes an extension of your in-house staff. They work closely with you on a long-term basis.

- Ongoing collaboration supports continuous improvement, quick adjustments, and agile development.

Considerations:

- You should invest time and effort in managing the dedicated team, coordinating tasks, and establishing productive communication.

When deciding between these development models, consider your budget, project complexity, and timeline. Also, keep in mind the level of control and involvement you desire. Consult with a reliable agency like WeSoftYou to discuss your requirements and choose the most suitable option.

WeSoftYou Expertise in Fintech App Development

WeSoftYou is a trusted expert in fintech app development, offering a comprehensive range of services. With a deep understanding of the financial industry, we specialize in creating innovative and secure lending and mortgage software. We have developed domain-centered solutions, including mortgage calculators, initial offering mechanisms, automated advice platforms, and legal maintenance tools.

Our company provides both product development outsourcing and dedicated team services. Whether you seek end-to-end solutions or prefer a team to work exclusively on your project, we have the flexibility to accommodate your requirements.

WeSoftYou prioritizes data security and compliance. We adhere to GDPR regulations and implement all the necessary measures to protect sensitive information. Our agency works with classic NDA patterns and legal documents like Comprehensive Agreements and Data & API Service Agreements to ensure confidentiality and trust in our partnerships.

Conclusion

Money lending apps have changed the industry, providing convenience, accessibility, and efficiency to borrowers and creditors. With the growing demand for such solutions, now is the perfect time to capitalize on their potential.

To seize these opportunities and ensure the success of your money-lending app, partner with a trusted and experienced development team like WeSoftYou. We possess the expertise and knowledge in fintech software development to bring your idea to life. Contact our team to create a customized loan platform that will satisfy your business needs.

FAQ

Yes. With customization, you can create a unique and visually appealing interface that aligns with your brand identity. Incorporating your brand colors, logo, and other visual elements, you provide a consistent and engaging user experience. It reflects your business’s identity and sets you apart from competitors.

Yes, you can leverage frameworks like React Native or Flutter to create a single codebase and build apps for iOS and Android platforms simultaneously. With this approach, your solution will reach a broader audience, providing a consistent user experience across different devices.

Our post-launch support and maintenance services include bug fixing, performance optimization, security updates, feature enhancements, and regular updates. They ensure your app runs smoothly, address any issues, and incorporate user feedback. All in all, these services are essential to improve the app’s functionality and user experience continuously.