Manual loan processing, endless paperwork, and high error rates is a competitive risk. The loan management software market is forecasted to surge from USD 5.9 billion in 2021 to USD 29.9 billion by 2031, growing at a CAGR of 17.8%, while digital lending platforms are expected to hit an astonishing USD 114.72 billion by 2034. This rapid growth shows one thing clearly: lenders who still rely on outdated processes are falling behind.

Customers today expect faster approvals, accurate servicing, and seamless digital experiences. Without the right system in place, inefficiencies can eat into profits and frustrate clients—leaving your institution exposed while competitors embrace automation.

If you face similar challenges, maybe it’s time to consider developing a custom Loan Management System (LMS). In this article, we’ll break down what an LMS is, its core benefits, key features, and what you can expect when investing in oneBacked by years of experience delivering fintech solutions, we at WeSoftYou has helped lenders worldwide streamline their processes with custom-built systems that match their unique needs.

What Is a Loan Management System?

A Loan Management System (LMS) is a software that handles the entire loan lifecycle: application, approval, disbursement, repayment, and ongoing monitoring.

Its primary purpose is to streamline operations, minimize manual errors, strengthen risk management, and deliver a smoother borrower experience. By centralizing processes into a single system, lenders can better oversee their loan portfolios, cut down on administrative costs, and reduce the risks that often come with manual or fragmented lending operations.

Loan Management System Workflow

For lenders, Loan Management System is a business lever. The way you manage your LMS workflow defines how efficiently you operate, how well you control risk, and how customers perceive your brand. In a market growing at double-digit CAGRs, the stakes couldn’t be higher.

Application

First impressions matter. A smooth loan processing system cuts onboarding time, reduces paperwork errors, and sets the tone for a borrower’s trust. Speed here is a competitive edge.

Credit Scoring

Accurate credit scoring is risk management and profitability. Automated evaluation ensures reliable lending decisions, protecting margins while enabling scale.

Approval

Approval speed is directly tied to customer satisfaction. By streamlining this step, lenders reduce churn, accelerate disbursements, and strengthen compliance without additional overhead.

Loan Servicing

A loan servicing system is the engine room of lending. By automating repayments, schedules, and interest tracking, businesses safeguard revenue, improve cash flow visibility, and cut back-office costs.

Debt Collection

Collections are where many lenders lose efficiency and profit. Automated reminders and structured workflows protect recovery rates while preserving customer relationships.

Closure and Tracking

Proper loan tracking systems ensure every repayment is accounted for and loans are closed cleanly. Beyond compliance, this transparency builds long-term trust and provides data insights for smarter future lending strategies.

| Stage | What Happens | Strategic Business Value | Risk if Ignored |

| Application | Borrower submits data and documents through a loan processing system. | Faster onboarding reduces friction, drives customer acquisition, and sets a trust baseline. | Manual errors, slow approvals, and poor UX cause drop-offs and higher CAC. |

| Credit Scoring | Automated evaluation of borrower’s creditworthiness and risk profile. | Scalable, consistent decisions protect margins and enable rapid growth across portfolios. | Subjective or outdated scoring increases default rates and shrinks profitability. |

| Approval | Validation and regulatory compliance checks before issuing loan approval. | Compliance assurance, faster disbursement, and improved customer satisfaction. | Bottlenecks lead to regulatory fines, operational delays, and churn. |

| Loan Servicing | Managed via a loan servicing system: repayment schedules, interest tracking. | Strong cash flow visibility, lower servicing costs, and higher repayment reliability. | Revenue leakage, miscalculations, and inefficiencies drain resources. |

| Debt Collection | Reminders and structured recovery workflows for overdue loans. | Higher recovery rates, reduced NPLs, and better customer relationship management. | Rising delinquency rates, operational strain, and reputation damage. |

| Closure and Tracking | Loan tracking system monitors repayment until closure and archives records. | Full compliance, transparent records, and data insights for smarter future lending. | Compliance breaches, lost customer trust, and weak portfolio analytics. |

Benefits Of Online Loan Management Systems

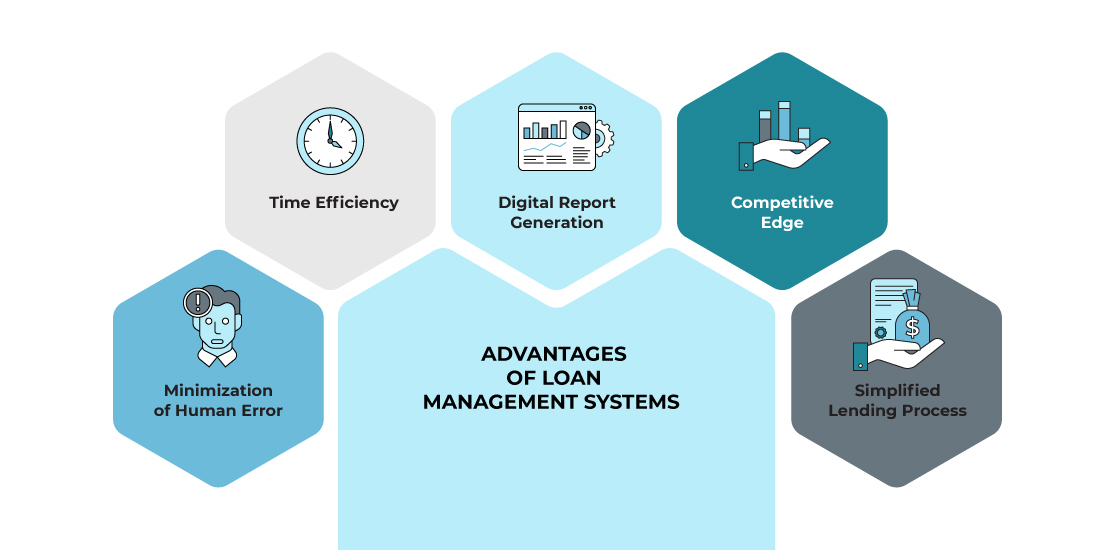

Loan management systems offer numerous benefits to financial institutions and lending organizations.

Minimization of Human Error

Manual data entry, calculations, and document verification are prone to mistakes, leading to incorrect decisions, payment discrepancies, or legal issues. By automating these tasks, the system ensures accuracy, consistency, and compliance with lending regulations.

Time Efficiency

LMS significantly reduces the time required to process loan applications, evaluate creditworthiness, and disburse funds. This enables lenders to serve borrowers more quickly, enhancing customer satisfaction and increasing operational efficiency.

Digital Report Generation

Digital reports include metrics such as loan disbursement and repayment trends, delinquency rates, profitability analysis, and risk exposure. Access to real-time and accurate data allows lenders to make data-driven decisions, identify areas for improvement, and monitor the health of their loan portfolio.

Competitive Edge

Lenders differentiate themselves from competitors by streamlining workflow, reducing turnaround time, and improving the customer experience. The ability to offer quick and efficient loan processing, accurate reporting, and analytics attracts borrowers and enhances the company’s reputation.

Simplified Lending Process

An LMS provides a user-friendly interface for borrowers to submit loan applications, upload required documents, and track their status. Lenders can easily access and evaluate borrower information, perform credit assessments, and make informed lending decisions.

Loan Management System vs. Manual Loan Processing

The debate is no longer about whether to digitize; it’s about survival in a market where lending volumes are increasing, compliance rules are tightening, and customers expect instant decisions. Manual loan processing might keep the lights on, but it creates bottlenecks that directly slow growth and erode trust. A modern Loan Management System improves workflows as well as positions lenders to scale profitably, manage risk with precision, and deliver the digital experience borrowers demand.

| Dimension | Manual Loan Processing | Loan Management System (LMS) |

| Speed to Market | Weeks to process and approve loans; borrowers drop off during lengthy cycles. | Automated workflows cut processing from weeks to hours, enabling lenders to compete in a fast-moving market. |

| Risk and Compliance | Human checks create blind spots; audits are reactive, slow, and error-prone. | Real-time compliance monitoring, automated audit trails, and proactive risk controls protect the business. |

| Scalability | Growth requires hiring more staff, increasing operational costs exponentially. | Scales seamlessly with loan volume; one platform supports exponential growth without proportional overhead. |

| Profitability Impact | Operational inefficiencies eat into margins; revenue leaks from errors and missed payments. | Predictable cash flow, lower servicing costs, and higher recovery rates directly boost profitability. |

| Customer Experience | Delays, lack of transparency, and inconsistent communication damage loyalty. | Borrowers enjoy self-service portals, instant approvals, and clear loan tracking, improving retention and NPS. |

| Strategic Insight | Data is fragmented, making it difficult to forecast trends or design new lending products. | Centralized analytics provide actionable insights for product innovation, pricing strategies, and risk modeling. |

| Competitive Position | Manual operations lock the business in reactive mode; competitors with LMS gain speed and trust advantage. | LMS adoption future-proofs the business, allowing faster innovation and stronger positioning in a $100B+ market. |

The Most Necessary Features of a Loan Processing Solution

A Loan Management System features collectively contribute to the efficiency of loan management operations, enabling lenders to make informed lending decisions, minimize risks, and optimize their loan portfolios. Let’s overview the most crucial functionalities:

Loan Origination

The feature of loan origination allows borrowers to submit loan applications digitally and facilitates automated credit evaluation and document management processes.

- Online Application: Allow borrowers to enter personal information, financial details, and employment history and upload necessary documents to submit loan applications.

- Application Workflow: Guide users through the loan application process, providing step-by-step instructions and validation checks to ensure all required fields are completed accurately.

- Credit Evaluation: Evaluate the creditworthiness of borrowers based on credit history, income, debt-to-income ratio, and other relevant criteria.

- Document Management: Store and organize loan-related documents securely, such as identification proofs, income statements, bank statements, and collateral details.

- Approval Process: Automate the loan approval process, allowing lenders to review applications, assess risk, and make informed decisions. It may involve workflow routing, verification checks, and decision-making based on predefined criteria.

- E-Signature: Enable electronic signatures for loan agreements, reducing the need for physical paperwork and expediting the loan origination process.

Loan Servicing

The loan servicing feature provides efficient tracking, processing, and administration of repayments.

- Payment Management: Track and manage loan repayments, including regular installments, interest payments, and additional fees. Calculate amortization schedules and provide payment reminders to borrowers.

- Account Management: Maintain loan account details, including balances, interest rates, payment history, and borrower information. Allow users to update contact information, loan terms, and other relevant data.

- Escrow Management: Handle escrow accounts for loans that require funds to be held for taxes, insurance, or other purposes. Track disbursements, reconcile balances, and generate reports.

- Customer Support: Manage borrower inquiries, address payment issues, and facilitate communication between borrowers and loan servicing personnel.

Debt Collection

This feature automates the collection process to manage overdue loans effectively.

- Delinquency Tracking: Monitor loan accounts for missed or late payments, identify delinquent accounts, and initiate appropriate collection actions.

- Collections Workflow: Automate the collections process, including generating payment reminders, escalation notices, and follow-up actions.

- Payment Arrangements: Offer the ability to negotiate and set up payment plans with borrowers to resolve delinquency and avoid default.

- Collections Reporting: Generate reports on delinquent accounts, collections efforts, recovery rates, and the effectiveness of strategies used.

- Compliance: Ensure compliance with debt collection laws and regulations, including Fair Debt Collection Practices Act (FDCPA) guidelines.

Reporting

You should empower lenders with real-time data and analytics for informed decision-making and regulatory compliance.

- Customizable Reports: Provide a range of predefined reports and the ability to create custom ones to analyze loan portfolio performance, delinquency rates, profitability, and other vital metrics.

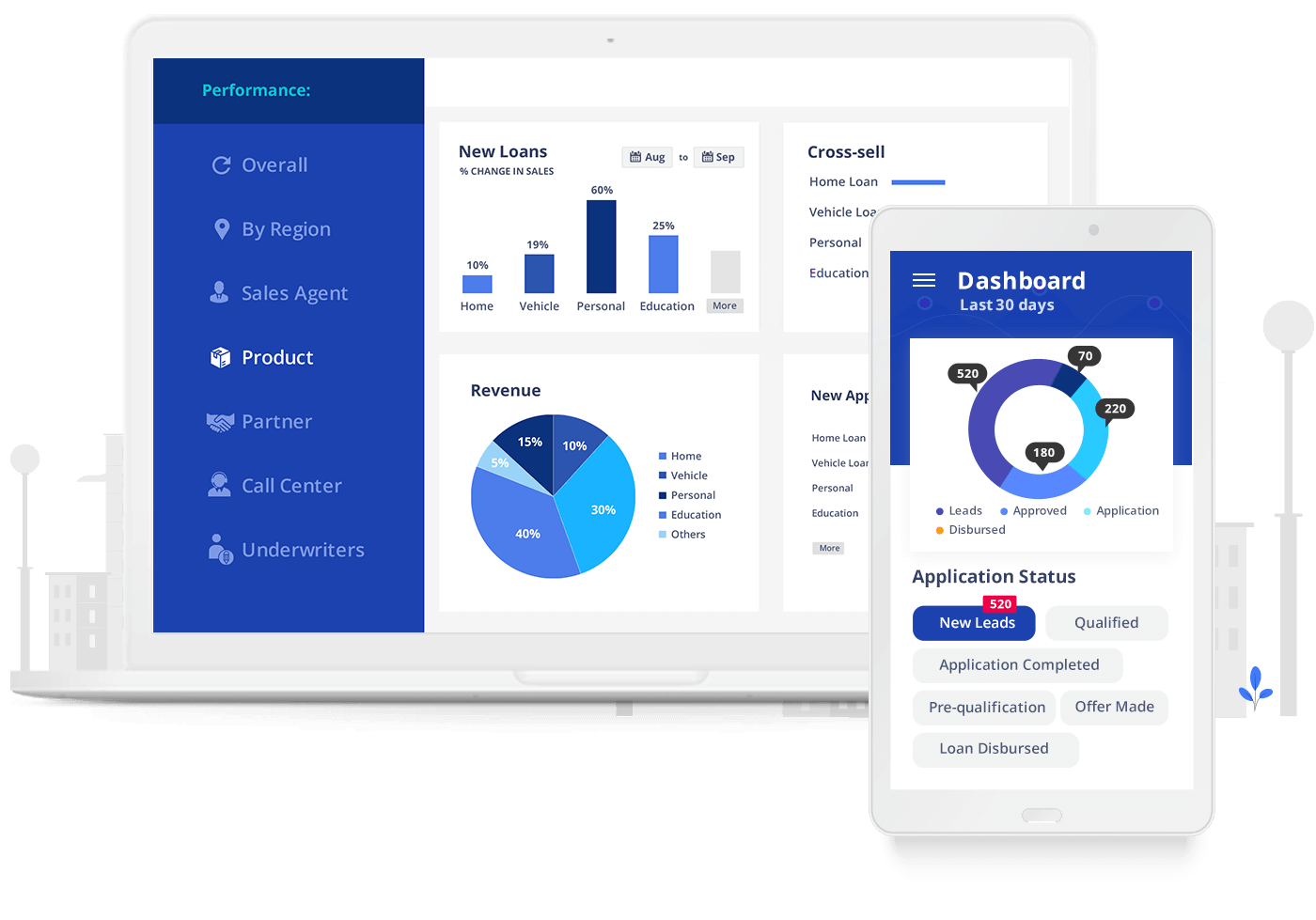

- Dashboard and Analytics: Offer interactive dashboards and visualization tools to present real-time data, KPIs, and trends for monitoring and decision-making.

- Regulatory Reporting: Generate reports for financial authorities, credit bureaus, and other regulatory bodies.

- Audit Trail: Maintain a detailed audit trail of application history, approval processes, account changes, and collection activities for transparency and regulatory purposes.

| Functionality | Key Features | Business Value |

| Loan Origination | Online Application: Borrowers submit personal/financial info and upload documents.Application Workflow: Step-by-step guidance with validations.Credit Evaluation: Automated checks on credit history, income, debt-to-income ratio.Document Management: Secure storage of IDs, bank statements, collateral docs.Approval Process: Automated workflows with verification and risk assessment.E-Signature: Digital agreements for faster processing. | Streamlines onboarding, reduces paperwork, shortens approval cycles, and lowers risk of errors or fraud. |

| Loan Servicing | Payment Management: Tracks repayments, interest, fees, and schedules reminders.Account Management: Centralized borrower accounts with balances, history, and updates.Escrow Management: Handles funds for taxes, insurance, or other obligations.Customer Support: Manages inquiries, disputes, and borrower communication. | Protects recurring revenue, ensures repayment discipline, improves cash flow visibility, and enhances customer satisfaction. |

| Debt Collection | Delinquency Tracking: Identifies late or missed payments.Collections Workflow: Automates reminders, escalations, and follow-ups.Payment Arrangements: Negotiated repayment plans to reduce defaults.Collections Reporting: Insights into delinquency rates and recovery performance.Compliance: Ensures adherence to FDCPA and other regulations. | Boosts recovery rates, lowers delinquency losses, and protects brand reputation through compliant practices. |

| Reporting and Analytics | Customizable Reports: Portfolio performance, profitability, delinquency analysis.Dashboards & Analytics: Real-time KPIs, trends, and visualizations.Regulatory Reporting: Automated reports for authorities and credit bureaus.Audit Trail: Complete history of applications, approvals, and account changes. | Enables data-driven decisions, simplifies regulatory compliance, and provides transparency for audits. |

What Else to Know About Building Successful LMS

Transforming your financial operations with a custom LMS requires building an infrastructure for growth, risk control, and customer trust. Nonetheless, it’s not solely about assembling a set of features. To truly transform lending operations, you need to design with scalability, compliance, customer experience, and data intelligence in mind. Below are the aspects that define whether your LMS becomes a growth driver or just another software tool.

Scalability and Future-Proofing

The lending market is growing fast. At the same time, AI in lending is set to expand from $11.63B in 2025 to $29.58B in 2029 (20.4% CAGR), showing how technology is becoming central to scaling operations. An LMS must be designed for growth, which means handling higher loan volumes without proportional increases in cost or staff. Cloud-native architecture, modular design, and API-driven integrations ensure your system adapts to demand and keeps pace with innovation.

Compliance as a Built-In Feature

Regulatory expectations are intensifying. In 2025 alone, the CFPB extended the Section 1071 small business lending rule compliance deadline by one year, while the FDIC recorded 470 TILA/Regulation Z violations through July. Besides, 75% of non-bank lenders report fair lending risks tied to AI bias, underscoring the need for proactive monitoring. Modern LMS platforms embed compliance, using ML-powered tools that now automate 85% of regulatory checks. This compliance-first design reduces the risk of fines, protects your reputation, and strengthens trust with stakeholders.

Seamless Integrations With the Financial Ecosystem

An LMS rarely stands alone. Integrating with CRMs, payment gateways, credit bureaus, and accounting systems eliminates silos and enables real-time data sharing. Increasingly, blockchain is being highly adopted in digital transformation efforts, providing immutable ledgers for loan transparency.

Customer-Centric Design

Borrowers demand speed and transparency. Features like digital applications, e-signatures, and real-time loan tracking have moved from “nice-to-have” to expected. AI-driven underwriting has reduced approval times by 40–60% in 2025 systems, helping lenders deliver near-instant decisions. This speed translates into higher satisfaction, stronger loyalty, and improved Net Promoter Scores (NPS), which are critical differentiators.

Data Intelligence and Strategic Insights

The true advantage of an LMS lies in its ability to turn data into strategy. Predictive analytics on delinquency, profitability dashboards, and risk modeling give executives proactive control over lending operations. With machine learning models in loan processing now achieving 95% accuracy in fraud detection, data-driven systems not only enhance security but also unlock new opportunities for growth and innovation.

How to Build a Loan Management System the Right Way: Our Experience

Building a Loan Management System can be a strategic move that determines whether a lender can scale, stay compliant, and deliver the kind of borrower experience that wins. From our work building fintech platforms, we’ve seen the difference between companies that treat LMS development as a software rollout and those that approach it as a business transformation initiative.

Start With Business Outcomes

Every lender has a list of “must-have features.” But building an LMS around features alone leads to bloated systems that don’t solve core problems. Instead, start with business goals: faster approvals, reduced delinquency, lower servicing costs, or improved retention.

- Define KPIs that matter, like approval turnaround time, NPL ratio, borrower satisfaction.

- Map technology requirements directly to those KPIs.

- Avoid feature creep by focusing only on what drives measurable impact.

In client workshops, we reframe the question from “what features do you want?” to “what bottlenecks are holding your business back?” That’s where real ROI comes from.

Build Compliance Into the Core

Compliance is often underestimated until it becomes a crisis. Retrofitting audit trails, regulatory reporting, or security standards after launch is expensive and risky.

- Design compliance workflows at the architecture stage, not post-launch.

- Embed automated audit logs, document versioning, and reporting modules.

- Include explainable AI in underwriting to avoid bias and meet regulator scrutiny.

We design what we call “compliance-first architecture.” It prevents last-minute scrambles when laws change and protects lenders from both fines and reputational damage.

Architect for Scale, Not Just Today

An LMS that handles today’s portfolio but collapses under growth is a liability. Scalability should be baked into design decisions from day one.

- Choose cloud-native infrastructure to handle loan volume spikes.

- Use modular architecture so new lending products or geographies can be added seamlessly.

- Build APIs for integrations with CRMs, payment gateways, and future fintech tools.

In our practice, a lot of lenders outgrow their LMS in less than two years because they didn’t design for scale. Future-proofing upfront is far cheaper than rebuilding later.

Put the Borrower at the Center

Lenders often optimize back-office efficiency but overlook borrower experience, which directly impacts conversions and loyalty.

- Simplify the loan application process with guided workflows.

- Offer e-signatures and digital uploads to eliminate paperwork.

- Provide real-time loan tracking and clear communication throughout the lifecycle.

Even small UX changes can lead to massive financial impact.

Turn Data Into a Growth Engine

Data is one of the most valuable assets in lending, but only if it’s structured and actionable. A modern LMS should be as much about intelligence as it is about processing.

- Use predictive analytics to spot delinquency risks early.

- Deploy fraud detection models to protect portfolios.

- Build profitability dashboards that guide capital allocation.

- Enable portfolio-level insights for designing new loan products.

Clients who invest in analytics modules see their LMS evolve into a strategy engine, helping leadership make proactive moves instead of reactive fixes.

Test Beyond the Happy Path

Most systems are tested under normal conditions. In lending, volatility is the rule, not the exception. Testing must reflect that.

- Run stress tests for mass delinquency, interest rate shocks, or regulatory changes.

- Validate compliance reporting under multiple scenarios.

- Test user flow with real borrowers, not just internal teams.

Our QA team often applies “black swan testing” — designing for the extreme. This ensures systems don’t just work when conditions are good, but when pressure is at its highest.

Treat Launch as the Very Beginning

Markets evolve, borrowers demand more, and regulators update rules. An LMS that stands still quickly becomes outdated.

- Plan for continuous updates and regulatory patches.

- Refine borrower experience based on feedback and behavior data.

- Add new technologies (AI underwriting, blockchain, alternative data) as they mature.

Our approach is to embed update cycles into every project roadmap. It keeps lenders ahead of compliance shifts and borrower expectations, not chasing them.

How Much Does It Cost to Build Loans Management System?

The cost of creating loan management systems can vary significantly depending on several factors, including the system’s complexity, desired features and functionalities, technology stack, and the development team’s rates and location. Additionally, customization requirements, integration with other systems, and ongoing maintenance and support should also be considered.

Keep in mind that the table below is a general approximation and should not be considered definitive pricing:

| Cost Component | What It Covers | Typical Range (USD) |

| Discovery & Planning | Business analysis, compliance requirements, workflow mapping, technical architecture. | $15,000 – $40,000 |

| UI/UX Design | Borrower-facing portals, lender dashboards, mobile-first design, user testing. | $20,000 – $60,000 |

| Core Development | Loan origination, servicing, debt collection, reporting modules. | $80,000 – $200,000+ |

| Integrations | APIs with CRMs, payment gateways, credit bureaus, accounting, KYC/AML tools. | $25,000 – $75,000 |

| AI & Data Intelligence | Predictive analytics, fraud detection, credit scoring, dashboards. | $40,000 – $120,000 |

| Compliance Features | Audit trails, regulatory reporting, role-based access control, explainable AI in underwriting. | $30,000 – $80,000 |

| Testing & QA | Functional, security, performance, stress tests, compliance simulations, user acceptance testing. | $20,000 – $60,000 |

| Deployment & Training | Cloud setup, user onboarding, staff training, change management. | $15,000 – $40,000 |

| Maintenance & Support | Continuous updates, bug fixes, compliance updates, scaling support. | $5,000 – $15,000 / month |

Total investments may look like this:

- MVP (basic features, small lender): $120,000 – $180,000

- Mid-size lender (scalable, multi-module system): $250,000 – $400,000

- Enterprise-grade (AI-driven, full compliance, global integrations): $500,000+

To get a realistic budget for your project, consult an experienced development partner. At WeSoftYou, we go beyond ballpark figures: our team analyzes your lending workflows, compliance requirements, and growth plans to create a cost estimate that reflects your specific needs. That way, you get a budget aligned with business goals, not just a price tag for code.

Why Choose WeSoftYou for Your Loan Management System Development

Building a Loan Management System blends technical exercise, fintech knowledge, compliance, customer trust, and growth. Our team has delivered fintech solutions that do more than process loans; they help lenders scale responsibly, minimize risk, and create borrower experiences that stand out in competitive markets.

What makes us different?

- Deep Fintech Focus. We don’t approach LMS as just another software build. Our experience in lending, mortgage platforms, and AI/ML integrations means we understand the nuances of risk scoring, repayment flows, and regulatory pressure.

- Compliance Built In. From PCI standards to bank-level encryption and audit-ready reporting, our systems are designed to pass scrutiny. We know that in lending, compliance isn’t optional — it’s the foundation of trust.

- Smart Technology Choices. Whether it’s AI-powered underwriting, blockchain-backed transparency, or modular cloud-native design, we apply technologies that solve real business bottlenecks, not just look good on paper.

- Flexible Engagement for Real Timelines. Some lenders need quick wins; others need a platform that evolves over years. With models from fixed-fee builds to dedicated staff augmentation, we align with your roadmap — not force you into ours.

- Recognized Delivery. Our results speak for themselves: top ratings on Clutch, industry awards, and a reputation for shipping systems that combine reliability with innovation.

If you’re considering an LMS, the most valuable first step is understanding where your current lending process creates inefficiencies or compliance risks. We can help you assess those gaps and translate them into a clear development roadmap.

Conclusion

For many lenders we’ve worked with, the decision to build a Loan Management System started with a single frustration: approvals taking too long, compliance teams drowning in paperwork, or borrowers dropping out mid-application. Once they made the shift, the conversation quickly changed from “fixing problems” to “what can we do next?” That’s the real value of a well-built LMS: it doesn’t just solve today’s challenges, it creates space for growth, innovation, and stronger relationships with your customers.

At WeSoftYou, that’s the kind of transformation our team aims to deliver. We’d be glad to explore how it could look for your organization. If you’re considering building or modernizing your Loan Management System, feel free to reach out to our team for a conversation.

FAQ

Can a loan management system be customized to suit our specific business needs?

Yes. A well-designed LMS can be tailored to align with your processes, products, and brand identity. Customization can include adapting workflows to your underwriting policies, integrating with existing CRMs or accounting systems, and adding features like risk scoring models or automated compliance checks. The real value of customization is that it ensures the platform supports your way of doing business rather than forcing you into rigid templates.

Is data security ensured within a loan management system?

Absolutely. Security is one of the defining factors of a credible LMS. Modern systems implement encryption (both in transit and at rest), role-based access control, and multi-factor authentication. Beyond that, they undergo regular penetration testing, audits, and adhere to strict standards like GDPR and PCI DSS.

How user-friendly is a loan management system?

A robust LMS should simplify, not complicate, daily operations. User-centric design means intuitive dashboards for lenders, clear navigation for administrators, and seamless digital experiences for borrowers. In practice, this translates into less training time for staff, faster onboarding for clients, and fewer errors across the loan lifecycle. When done right, usability directly impacts both operational efficiency and customer satisfaction.

What is the best loan management software?

There isn’t a single “best” loan management software, as the right choice depends entirely on your business model, scale, and compliance environment. Off-the-shelf solutions can work for small lenders with simple processes, but larger institutions often require customized systems that integrate with existing CRMs, payment processors, and regulatory reporting tools. The “best” LMS is the one that supports your lending workflows, keeps you compliant, and delivers a seamless borrower experience without forcing you to change how you operate.

What are the five pillars of lending?

Traditionally, lenders evaluate borrowers using the five C’s of credit, often called the five pillars of lending:

- Character – the borrower’s credit history and reliability.

- Capacity – the ability to repay, based on income and existing debt.

- Capital – personal investment or stake in the loan, showing commitment.

- Collateral – assets pledged as security for the loan.

- Conditions – external factors like economic environment or loan purpose.

In practice, these pillars are not just used in underwriting but also shape how an LMS is configured, from automated credit scoring and collateral tracking to repayment capacity assessments and portfolio-level risk monitoring.

What is the difference between a Loan Management System and a Lending Management System?

While the terms are often used interchangeably, there is a subtle but important difference. A Loan Management System (LMS) focuses specifically on managing the entire lifecycle of individual loans (from application and approval to servicing, repayment, collections, and closure). A Lending Management System, on the other hand, has a broader scope: it manages multiple credit products (such as mortgages, credit lines, leasing, and microfinance) across different channels.

In short, an LMS is loan-focused, while a Lending Management System provides a portfolio-wide view for institutions managing diverse lending products.