Fintech is an industry that has undergone significant transformation in recent years. With advancements in technology, particularly in the field of artificial intelligence (AI), fintech businesses have the potential to revolutionize the way financial services are delivered. We at Wesoftyou have witnessed the power of AI in transforming various industries, and in this article, we explore how AI can specifically revolutionize fintech businesses.

The Intersection of AI and Fintech

As a seasoned software development company deeply engaged in the fintech sector, we recognize the pivotal intersection of AI and fintech, where artificial intelligence (AI) simulates human intelligence in machines, transforming financial services through innovative technologies. Our experience highlights the integration of AI into fintech, elevating customer experiences, optimizing operations, and fortifying risk management. The convergence of AI and fintech involves:

- AI and Fintech Definition: AI encompasses technologies like machine learning, natural language processing, and computer vision, enabling machines to analyze vast datasets and perform tasks traditionally requiring human intelligence. Fintech utilizes technology to enhance financial services, encompassing banking, lending, investment, and payment services.

- AI in Fintech Possibilities: Machine learning algorithms in fintech analyze financial data for pattern detection, aiding accurate predictions and informed decisions. Natural language processing facilitates AI-powered chatbots for efficient customer service, while computer vision enhances security through facial recognition and fraud detection.

- Automation and Efficiency: The combination of AI and fintech allows businesses to automate processes, reduce costs, and enhance efficiency. Robo-advisory platforms, powered by AI, provide personalized investment advice, making investment services more accessible and cost-effective.

- Current State of AI in Fintech: AI is already prevalent in fintech, with applications like robo-advisory platforms and AI-powered chatbots. Leveraging AI technologies enables real-time processing and analysis of financial data, empowering businesses to offer personalized services and make informed decisions.

- Future Innovations: While AI’s deployment in fintech is well underway, there is room for growth and innovation. Anticipated advancements include AI algorithms detecting fraudulent activities, AI-powered virtual assistants managing customer finances, and improved risk management through analyzing historical data and market trends.

In conclusion, the synergy between AI and fintech is a catalyst for transforming the financial services industry. Our firm belief is that by embracing AI technologies, fintech businesses can evolve customer experiences, streamline operations, and bolster risk management. The continuous advancement of AI promises even more innovative applications, revolutionizing the landscape of financial services.

The Role of AI in Fintech Transformation

Artificial Intelligence (AI) has emerged as a game-changer in the world of financial technology (fintech). It has the potential to revolutionize the way fintech businesses operate and interact with their customers. In this article, we will explore the specific ways in which AI can transform fintech businesses.

Customer Experience

One of the most significant impacts of AI in fintech is its potential to enhance the customer experience. AI-powered chatbots, for example, can provide personalized recommendations and assistance to customers, 24/7, without the need for human intervention. These chatbots are equipped with natural language processing capabilities, allowing them to understand and respond to customer queries in a human-like manner. Additionally, AI algorithms can analyze customer data to identify patterns and preferences, enabling fintech businesses to offer tailored products and services that cater to individual needs. This level of personalization can significantly improve customer satisfaction and loyalty.

Imagine a scenario where a customer is looking for investment advice. With AI, fintech businesses can develop intelligent algorithms that consider the customer’s financial goals, risk tolerance, and investment preferences to provide personalized investment recommendations. This not only saves time for the customer but also ensures that they receive advice that aligns with their unique circumstances.

Streamlining Operations

AI can also streamline operations within fintech businesses by automating repetitive and time-consuming tasks. With AI, processes such as customer onboarding, document verification, and risk assessment can be handled more efficiently, reducing manual errors and increasing operational efficiency. For instance, AI-powered document verification systems can quickly analyze and authenticate identification documents, eliminating the need for manual verification by employees. This not only speeds up the onboarding process but also enhances security by reducing the risk of fraudulent activities.

Moreover, AI algorithms can continuously analyze data and detect anomalies, enabling businesses to identify potential risks and fraud attempts in real-time. For example, AI-powered algorithms can monitor transactions for suspicious patterns or behaviors that indicate fraudulent activities. By leveraging AI in risk management, fintech businesses can proactively mitigate risks and protect their customers from financial fraud.

Risk Management and Fraud Detection

Fraud detection is a critical aspect of financial services. AI can play a significant role in identifying and preventing fraudulent activities by continuously monitoring transactions and detecting unusual patterns or behaviors. By analyzing vast amounts of data in real-time, AI algorithms can quickly identify potential fraud attempts and trigger alerts for further investigation. This proactive approach to fraud detection can save businesses and customers from significant financial losses.

Furthermore, AI can assist in risk management by analyzing historical data and market trends to predict potential risks and market fluctuations. This predictive capability allows fintech businesses to make informed decisions and develop risk mitigation strategies to protect their investments and assets.

In conclusion, AI has the potential to transform the fintech industry in numerous ways. From enhancing customer experience through personalized recommendations to streamlining operations and improving risk management, AI is revolutionizing the way fintech businesses operate. As AI continues to evolve and advance, we can expect even more innovative applications in fintech, driving further transformation and growth in the industry.

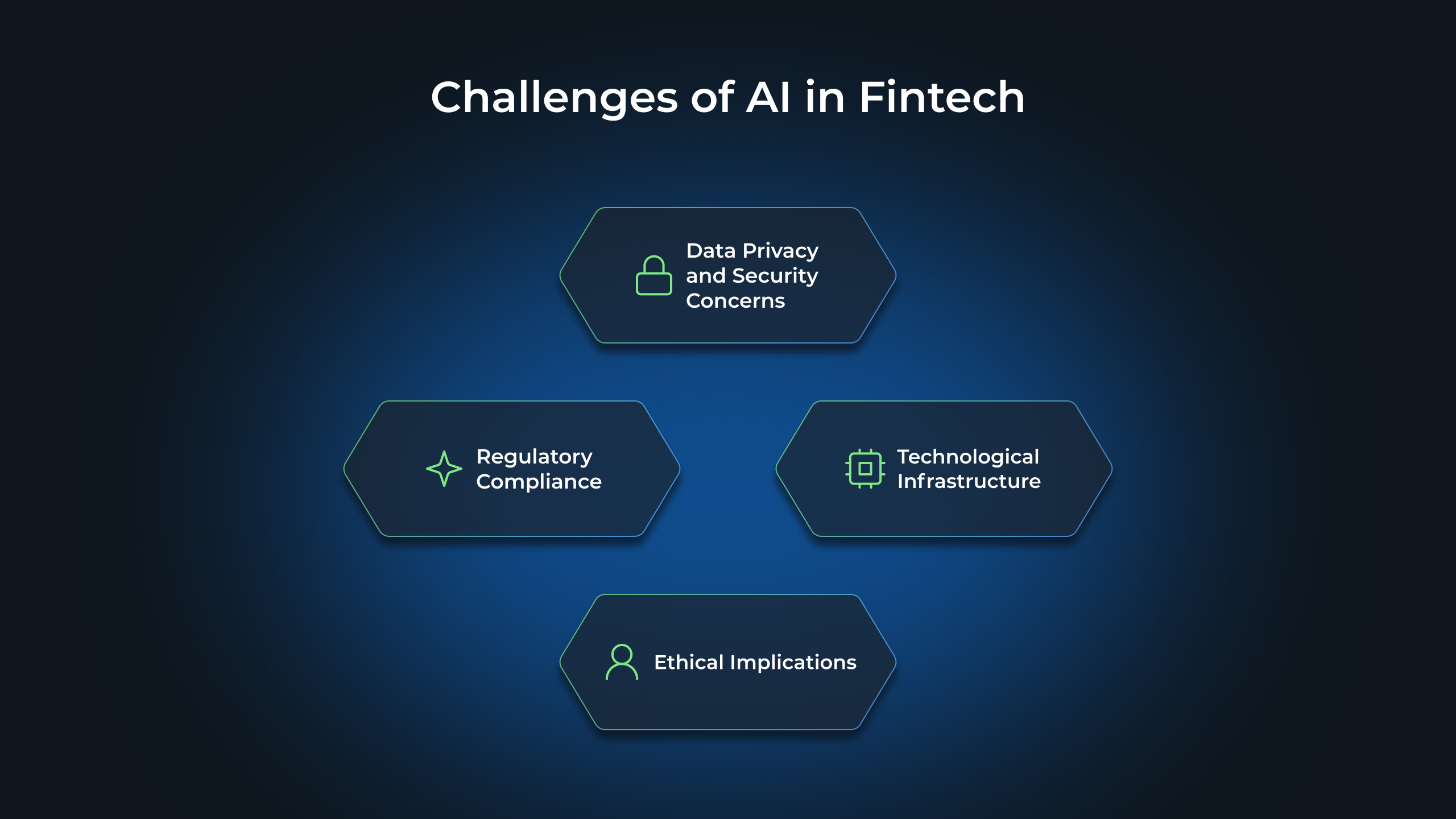

Challenges of AI in Fintech

While the benefits of AI in fintech are numerous, there are also several challenges that businesses must address.

Artificial Intelligence (AI) has revolutionized the financial technology (fintech) industry, offering innovative solutions to complex problems. However, the integration of AI in fintech comes with its own set of challenges that businesses must navigate to fully leverage its potential.

Data Privacy and Security Concerns

As AI relies heavily on data, ensuring the privacy and security of customer information becomes paramount. Fintech businesses must implement robust security measures and adhere to strict data protection regulations to build trust with their customers and maintain the confidentiality of sensitive financial data.

Data breaches and cyberattacks pose significant threats to the fintech industry. With the increasing sophistication of hackers, businesses must continuously update their security protocols to stay one step ahead. Additionally, they must educate their employees and customers about the importance of data privacy and implement encryption techniques to safeguard sensitive information.

Regulatory Compliance

The integration of AI in fintech brings forward regulatory challenges as well. Fintech businesses need to navigate regulations that govern data usage, financial transactions, and consumer protection. Compliance with these regulations is essential to ensure the ethical and responsible use of AI in the financial industry.

Regulatory bodies are constantly updating their guidelines to keep up with the rapid advancements in AI technology. Fintech businesses must stay informed about these changes and adapt their practices accordingly. They must establish internal compliance teams and collaborate with legal experts to ensure that their AI systems adhere to the evolving regulatory landscape.

Technological Infrastructure

AI requires significant computational power and robust technological infrastructure to operate effectively. Fintech businesses must invest in the infrastructure necessary to support AI applications and ensure the scalability and reliability of their systems. Additionally, they must have access to high-quality data to train AI models accurately.

Building a reliable technological infrastructure involves procuring powerful hardware, such as high-performance servers and data storage systems. Fintech businesses must also invest in advanced software tools and algorithms that can process and analyze vast amounts of data in real-time. Furthermore, they need to establish partnerships with data providers and develop data management strategies to ensure the availability of accurate and relevant data for training their AI models.

Moreover, fintech businesses must consider the ethical implications of AI in their technological infrastructure. They must implement transparency and explainability mechanisms to ensure that their AI systems make fair and unbiased decisions. This involves developing algorithms that can be audited and providing clear explanations to customers about how AI is being used to make financial decisions.

The Future of AI in Fintech

Looking ahead, the future of AI in fintech holds immense potential for further transformation. With the ability to analyze vast amounts of financial data and identify patterns and trends, AI algorithms are revolutionizing the way businesses make investment decisions and offer valuable insights to their customers.

Market Trends

One of the most exciting applications of AI in fintech is its ability to predict market trends. By leveraging AI algorithms, fintech businesses can analyze massive amounts of financial data, including historical market data, news articles, and social media sentiment. This allows them to identify patterns and trends that may elude human analysts, enabling more accurate predictions about market movements.

Imagine a world where AI-powered algorithms can analyze thousands of data points in real-time and provide instant insights into market trends. This would empower investors to make informed decisions, minimizing risks and maximizing returns. Additionally, AI-powered prediction models can be used to offer personalized investment advice to individual investors, taking into account their risk tolerance, financial goals, and market conditions.

AI in Mobile Banking and Payments

Mobile banking and payments have become increasingly popular, and AI can further enhance these services. AI-powered virtual assistants can revolutionize the way users interact with their mobile banking applications, making banking more convenient and efficient.

Imagine having a virtual assistant that can manage your financial transactions, provide real-time balance updates, and offer personalized financial advice. AI-powered virtual assistants can analyze your spending patterns, identify areas where you can save money, and even suggest investment opportunities based on your financial goals. This level of personalized assistance can greatly improve the financial well-being of individuals and businesses alike.

Furthermore, AI can enhance the security of mobile banking and payments. AI algorithms can analyze user behavior patterns and detect any suspicious activities, such as unauthorized access or fraudulent transactions. This can help prevent financial fraud and ensure the safety of users’ funds.

The Role of AI in Cryptocurrency and Blockchain

Cryptocurrencies and blockchain technology have disrupted the financial industry, and AI can play a significant role in further advancing these innovations. AI algorithms can analyze blockchain transactions to detect fraudulent activities or suspicious patterns, increasing the security and trustworthiness of cryptocurrency transactions.

Blockchain technology, with its decentralized and transparent nature, has already revolutionized the way financial transactions are conducted. However, AI can further enhance the security and efficiency of blockchain networks. By leveraging AI algorithms, blockchain platforms can detect and prevent fraudulent activities, such as double-spending or fake transactions.

Moreover, AI can analyze blockchain data to provide valuable insights into market trends and investor sentiment. By analyzing the vast amount of data generated by blockchain transactions, AI algorithms can identify patterns and predict future market movements, helping investors make more informed decisions.

Overall, the future of AI in fintech is promising. With its ability to analyze vast amounts of data, predict market trends, and enhance the security of financial transactions, AI is revolutionizing the way we interact with financial services. As AI continues to evolve, we can expect even more exciting applications and innovations in the fintech industry.

Conclusion

As the fintech industry continues to evolve, embracing AI technologies is crucial for businesses to stay competitive and deliver innovative financial services. By leveraging AI, fintech businesses can enhance customer experiences, streamline operations, and effectively manage risks. However, it is also important to address the challenges associated with AI, including data privacy and security concerns, regulatory compliance, and technological infrastructure.

From our experience as a software development company, we at Wesoftyou believe that the future of fintech lies in embracing AI and continuously exploring its potential to transform the industry. By leveraging AI technologies and partnering with experts in the field, fintech businesses can unlock new opportunities and deliver superior financial services to their customers.

For fintech businesses looking to integrate AI into their operations, it is essential to start with a clear strategy and roadmap. Identifying specific use cases where AI can add value and aligning with business goals is crucial. Additionally, partnering with an experienced AI solutions provider, such as WeSoftYou, can bring valuable expertise and guidance throughout the integration process.

While initial implementation of AI may require investment and adaptation, the long-term benefits are substantial. Fintech businesses that successfully integrate AI can gain a competitive edge, deliver more personalized services, and improve operational efficiency. By staying ahead of the curve and embracing AI, fintech businesses can position themselves as leaders in the industry.

Ready to embrace AI for your fintech business? Contact us at Wesoftyou for a free consultation or project estimation. Our team of experts can help you explore the possibilities of AI in fintech!

FAQ

While AI-powered robo-advisors provide automated investment advice, human financial advisors still play a crucial role in the fintech industry. AI can augment and support human advisors, but the expertise and personalized approach of human professionals are irreplaceable.

AI has undoubtedly revolutionized the financial industry, offering advanced algorithms and data analysis capabilities that can assist in making investment decisions. However, it is important to note that AI is not a substitute for human expertise. Financial advisors bring a wealth of knowledge and experience that cannot be replicated by AI alone.

Human financial advisors possess the ability to understand complex financial situations, consider individual goals and risk tolerance, and provide personalized advice tailored to each client’s unique circumstances. They can also offer emotional support and guidance during times of market volatility or uncertainty, which is something AI lacks.

Furthermore, financial advisory services often involve more than just investment advice. Human advisors can provide comprehensive financial planning, estate planning, tax strategies, and retirement planning, taking into account various factors that AI may overlook.

While AI can automate certain aspects of financial advisory services and provide efficient portfolio management, the human touch remains essential in building trust, establishing long-term relationships, and addressing the diverse needs of clients.

AI can assist fintech businesses in monitoring and ensuring compliance with regulatory requirements. By automating compliance processes and continuously analyzing data, AI algorithms can identify potential regulatory risks and help businesses stay in line with regulatory frameworks.

Compliance with regulatory requirements is a critical aspect of operating in the fintech industry. Fintech businesses need to navigate complex and ever-changing regulations to ensure they are operating legally and ethically. This is where AI can play a significant role.

AI-powered systems can streamline compliance processes by automating the collection, analysis, and reporting of data. These systems can continuously monitor transactions, identify suspicious activities, and flag potential compliance issues in real-time. By leveraging machine learning algorithms, AI can adapt and improve its detection capabilities over time, keeping up with evolving regulatory landscapes.

Moreover, AI can assist in the interpretation and understanding of complex regulatory frameworks. By analyzing vast amounts of regulatory texts and case law, AI algorithms can provide insights and guidance to fintech businesses, helping them navigate the intricacies of compliance requirements.

AI is undoubtedly a significant component of the future of fintech. Its potential to enhance customer experiences, streamline operations, and improve risk management makes it an invaluable tool for fintech businesses seeking to innovate and stay ahead of the competition.

The integration of AI in the fintech industry has already shown tremendous promise. AI-powered chatbots and virtual assistants are transforming customer interactions, providing personalized and efficient support. These intelligent systems can handle routine inquiries, assist with financial planning, and even offer investment recommendations based on individual preferences and goals.

AI can also revolutionize risk management in the fintech sector. By analyzing vast amounts of data in real-time, AI algorithms can identify patterns, detect anomalies, and predict potential risks. This enables businesses to proactively mitigate risks, prevent fraud, and enhance security measures.

Furthermore, AI can streamline operations and improve efficiency in various areas of fintech, such as credit scoring, underwriting, and fraud detection. By automating time-consuming and repetitive tasks, AI frees up human resources to focus on more complex and value-added activities.