By 2026, the digital lending market size is expected to grow 13.8% CAGR, estimating to reach $20.5 billion. Such valuation growth can be explained by increasing digitalization, governmental measures to protect online lending, and more options and visibility for lenders and borrowers.

With the rise of mobile apps usage and B2C businesses’ efforts to become more and more convenient for their clients, developing a mortgage software comes across as a viable solution both to satisfy clients’ demand (and even grow it) and streamline your business operations.

While your company will benefit from maximizing sales, reaching better compliance, and managing client data more efficiently, clients will get a clear track of their mortgage application and an account for a completely transparent loan origination process. Provided how sophisticated, secure, and compliant a solution managing these data should be, it’s better to trust its development to a team of true professionals.

Based on WeSoftYou’s years of experience in financial technology, we will examine the state of the mortgage app market more thoroughly in this article, discuss successful mortgage app examples, and provide insightful information about their development. We produced a variety of fintech solutions while working with organizations worth billions of dollars, and we’re delighted to share our experience here.

Mortgage Apps Market in 2021-2025

Let’s look at the mortgage market statistics a little closer.

Growth and predictions

As more people seek to buy homes and take advantage of low-interest rates, the mortgage app market has been steadily growing: the 30-year conventional mortgage rate increased from 3% in April 2021 to about 5% in April 2022. In 2021-2025, the market is to expand as more lenders and fintech companies enter the space and offer innovative solutions for homebuyers.

According to Allied Market Research, the global mortgage lending market will grow at a CAGR of 9.5% from 2022 to 2031. The report also notes that the growing adoption of digital solutions in the mortgage industry is driving the market’s growth.

VA loans accounted for approximately 9% of all new home purchases in the United States.

Jumbo loans made up a relatively small portion of the mortgage market in the United States, accounting for approximately 1% of all new home purchases.

Benefits of Building a Custom Mortgage Software

Developing mortgage software has numerous advantages that will help your business in one way or another.

Improved Compliance

Custom mortgage software can be designed to meet the unique compliance requirements of the mortgage industry, such as those related to data privacy, anti-discrimination, and consumer protection. This can help lenders and brokers avoid costly penalties and legal disputes, as well as generally contribute to more democratic mortgage origination principles.

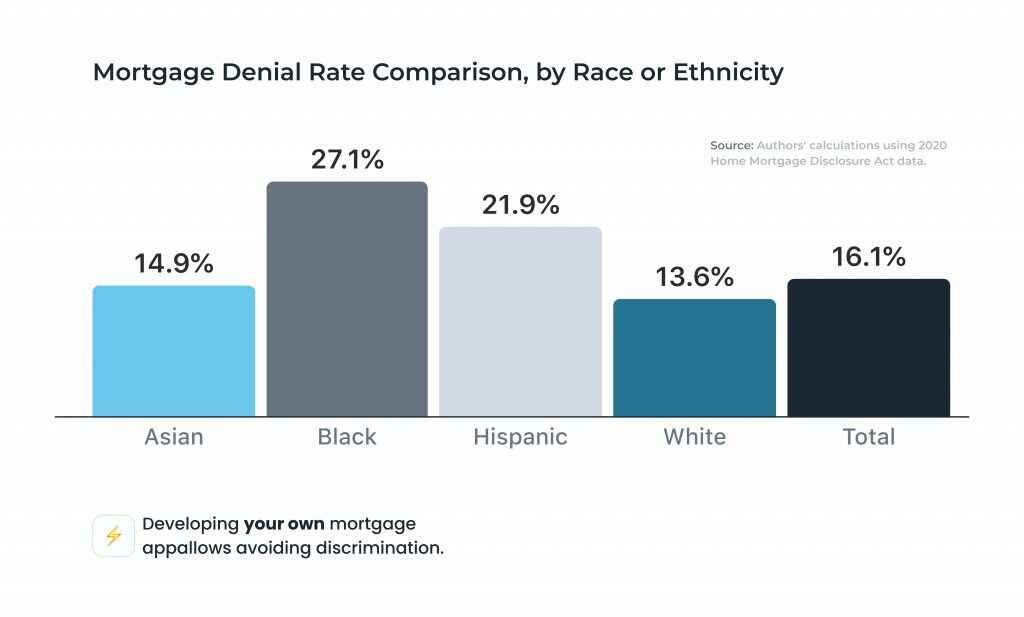

Let’s review the statistics by Home Mortgage Disclosure Act data. It states that in 2020, 16.1% of all mortgage applications received were turned down. Black borrowers saw the largest percentage of denials of those loans (27.1%), while white borrowers experienced the lowest percentage (13.6%).

Better Data Management

Mortgage application development can provide lenders and brokers with better visibility into their data and enable them to make more informed decisions. This can help them identify trends, track performance, and optimize lending strategies.

Maximized Sales and Mortgages

Mortgage financing is a very delicate area. Thus it demands a great level of consideration, particularly about reporting initiation. Mortgage automation software generates reports in a precise and technical manner for distribution to various parties involved in the loan process, including borrowers, investors, regulatory organizations, etc. By such optimization, a lending firm may better serve the demands of a larger number of customers while also increasing sales and mortgages.

Processes Facilitation

Loan processing and property transaction closing time facilitation are the two most challenging aspects of mortgage lending procedures that should be covered by mortgage software. A custom mortgage software can streamline and automate various processes, such as loan origination, underwriting, and servicing. This can enhance the efficiency of the mortgage lending process and reduce the time and effort required to manage each loan application.

Successful Examples of the Mortgage Apps

Before you decide to build a mortgage LOS platform, Let’s look at some well-used options to see what their competitive advantage is and what users appreciate in them.

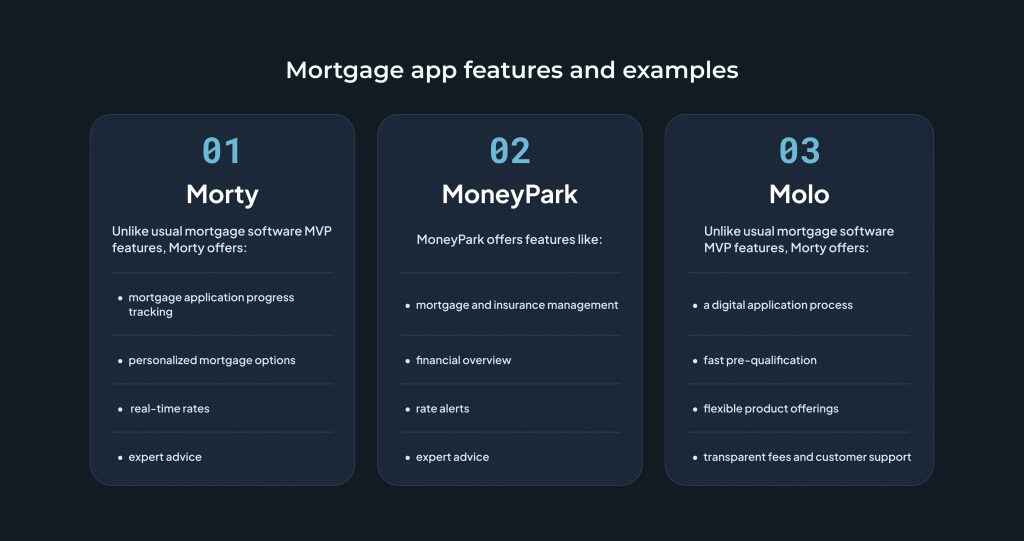

Morty

Morty is a US-based online mortgage broker that offers a mobile app for borrowers to apply for a mortgage. The Morty app provides users with a range of mortgage products from different lenders, personalized guidance on mortgage options, and a fast and efficient application process.

Unlike usual mortgage software MVP features, Morty offers mortgage application progress tracking, personalized mortgage options, real-time rates, and expert advice.

MoneyPark

A Switzerland-based mortgage and insurance broker MoneyPark offers its clients a mobile app to help them manage their mortgage and insurance products. The MoneyPark mortgage app is designed to provide customers with a simple and convenient way to track their mortgage, insurance policies, and associated finances.

MoneyPark offers features like mortgage and insurance management, financial overview, rate alerts, and even expert advice.

Molo

Molo is a UK-based online mortgage lender that offers its customers a fully digital mortgage application process through its mobile app and website. The Molo mortgage app is designed to simplify the mortgage application process for borrowers and offer them a convenient, fast, and transparent way to apply for a mortgage.

Some of Molo’s key features include a digital application process, fast pre-qualification, flexible product offerings, transparent fees, real-time updates, and customer support.

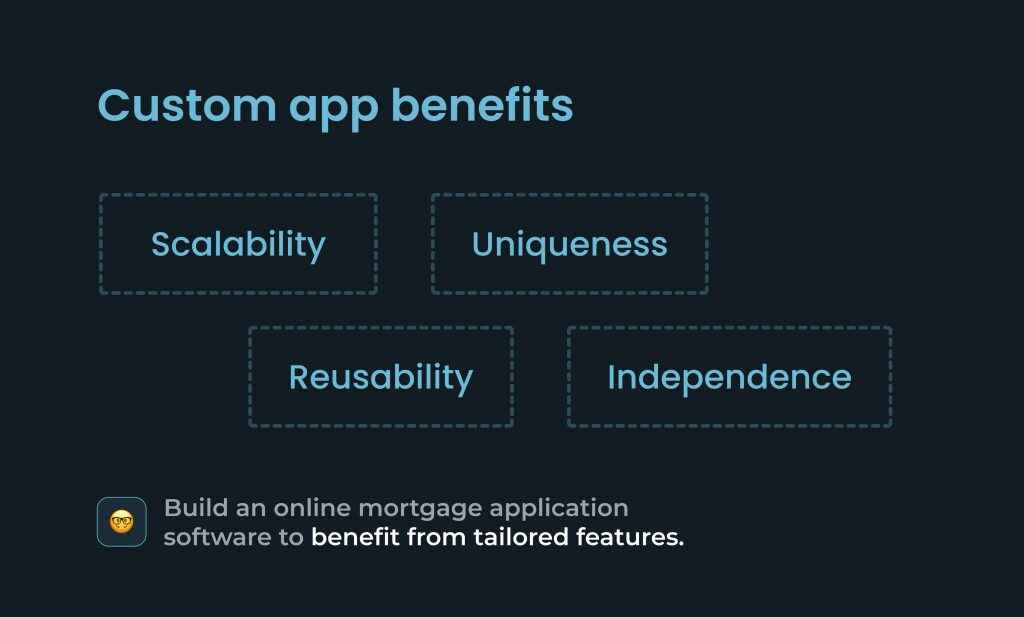

Developing a Custom Mortgage LOS Platform vs. Using Ready-Made

The choice to build an online mortgage application software rather than buy it off the shelf is a wise choice. Let’s see why.

Tailored to Your Business Needs

A custom mortgage LOS platform can be tailored to meet your business needs, providing a competitive advantage in the marketplace. A custom solution can be designed to meet the unique needs of your business, with features and functionality that align with your specific processes and workflows.

On the contrary, an off-the-shelf app will only provide a standard pack of features, which means it won’t have the full potential to streamline your business operations the way you want them.

Scalability

A custom mortgage LOS platform can be designed to scale with your business side by side, allowing you to add new features and functionality as your needs change over time. This can help you to future-proof your platform and avoid the need for costly re-platforming down the road.

While a ready-made solution’s updates are the responsibility of the releasing company, it won’t give you full control over the exact way its features are developed.

Competitive Advantage

Custom mortgage website development can help you differentiate your business from competitors, with unique features and capabilities that can improve the customer experience and make your business more efficient. For instance, this is when you get a chance to implement better user experience thanks to conducting UX research, which will inevitably reward you with higher user attraction rates.

On the other hand, while a ready-made app’s adoption might be quicker, it doesn’t provide you with competitive edge the custom app does.

| Custom | Ready-made | |

| Customization | Tailored to your businesses’ needs | Providing a standard pack of features and UX |

| Scalability | Can be scaled anytime with your needs consideration | Depends on the upcoming software updates |

| Competitive advantage | Gives your business competitive advantage | Doesn’t distinguish your business among competitors |

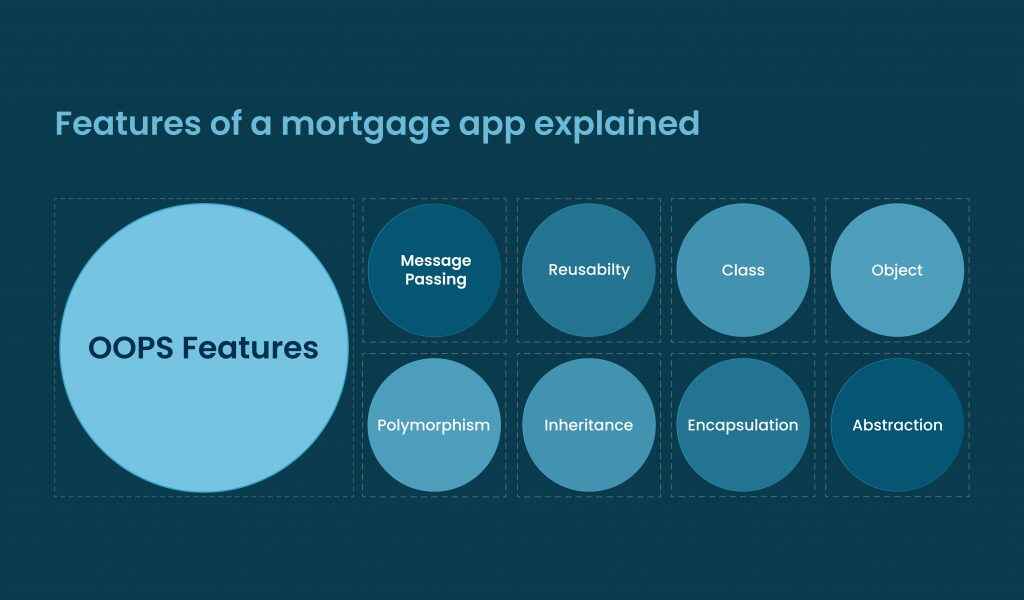

Key Features for Your Custom Mortgage App

There are several key features of a mortgage app that are important to consider whenever developing this solution. Here are some of the essential ones:

Loan application

The app should allow borrowers to easily apply for a mortgage, providing a user-friendly interface that guides them through the application process and collects all the necessary information.

Pre-qualification tools

Mortgage app development should offer pre-qualification tools that help borrowers understand how much they can afford to borrow based on their income, credit score, and other factors.

Document upload

Borrowers should be able to upload and manage all the necessary documents required for the mortgage application process, including tax returns, bank statements, and employment verification.

Credit check and monitoring

Allow your borrowers to check their credit scores, monitor any changes to their credit report, and receive alerts if any fraudulent activity is detected.

KYC (know-your-customer) identity verification

KYC verifies a person’s ID, analyzes their credit history, and even uses face biometrics to confirm its users. KYC enables automated checks and streamlines risk grading, preventing fraud and countering money laundering.

Mortgage calculator

A mortgage calculator helps borrowers estimate their monthly payments based on the loan amount, interest rate, and other factors, and count whether or not they are eligible for a desired loan.

Communication tools

The app should offer communication tools that allow borrowers to stay in touch with their loan officer or mortgage broker, ask questions, and receive updates on their application status.

E-signature

Borrowers must be able to sign all necessary documents electronically, making the process faster and more convenient.

Security

Strong security features, such as two-factor authentication, data encryption, and secure login to protect borrowers’ personal and financial information.

How to Create a Mortgage Software Step-by-Step

Mortgage management software development requires careful planning and execution. Here are the basic steps to create one:

Discovery

The first step in creating mortgage software is identifying your goals and objectives. What problem are you trying to solve with the software? Who is your target audience? What features do you need to include to meet your goals?

Market research

Conduct market research to identify your target audience and competitors. Analyze the market and identify gaps that you can fill with your software. Gather data on user preferences, behavior, and needs.

Legal compliance

Mortgage compliance is one of the main issues facing banks that offer mortgage loans to customers. Ensure your software keeps track of any regulatory changes and complies with local regulations and laws.

The Home Mortgage Disclosure Act (HMDA), the National Credit Unit Administration (NCUA), the Equal Credit Opportunity Act (ECOA), and others are some of the significant regulators in the USA that focus on protecting lenders and borrowers.

Prototyping

Design the UI to create visually appealing, user-friendly, and intuitive software. Ensure that the interface is easy to navigate and understand.

Development

Develop the software architecture, which includes the software design, database structure, and software framework. Decide on the programming language and development tools you will use.

Testing

Test the software thoroughly to ensure that it meets all the functional and non-functional requirements. Conduct unit testing, integration testing, and acceptance testing.

Deployment

Deploy the software on a production server and ensure that it is scalable, reliable, and secure.

Support and maintenance

Provide ongoing support and maintenance for the software to ensure it continues functioning effectively. Update the software regularly to incorporate new features and fix any bugs or issues.

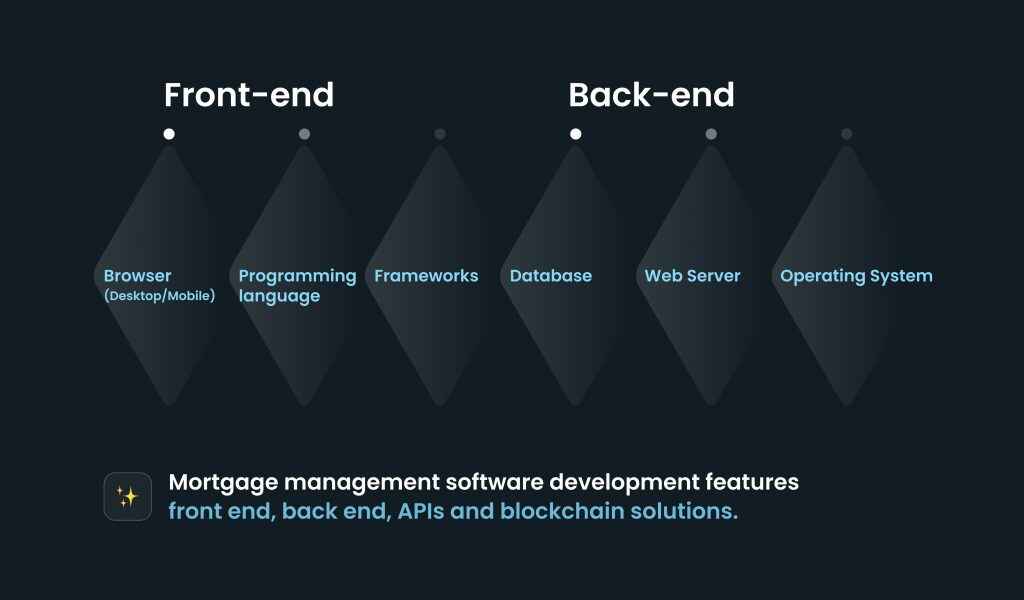

Technology Stack for Mortgage App Development

It’s critical to use the appropriate tech stack to develop a mortgage app.

Back-end development

Handles the processing and storage of data. Common back-end technologies used in mortgage app development include programming languages such as Java, Python, or PHP, and frameworks such as Node.js, Ruby on Rails, or Django.

While developing the back-end, the WeSoftYou engineering team works with Python, Django, Node.js and Serverless.

Front-end development

What the user sees and interacts with. Common front-end technologies used in mortgage app development include HTML, CSS, JavaScript, and popular JavaScript frameworks such as React, Vue, and Angular.

For the front-end development, WeSoftYou team of professionals uses Python, Node.js, Django, Flask, Vue.js, React.js, Serverless, and Angular.

Database

Essential for storing and managing user and application data. Commonly used databases in mortgage app development include MySQL, PostgreSQL, MongoDB, or Cassandra.

Cloud hosting and storage

Can provide scalable and cost-effective hosting solutions for your mortgage app. Popular cloud service providers include Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

API integrations

Mortgage apps often require integrations with third-party systems such as credit bureaus, banks, and insurance providers. Technologies such as RESTful APIs, OAuth, and SOAP are commonly used for integrating with external systems.

Blockchain

Distributed ledger technology is widely used in fintech applications today. Blockchain’s architecture ensures information openness and fraud defense. Coordinating lenders and borrowers and identifying the agents and mediators aids in lowering operating expenses and avoiding scams involving financial institutions.

Building a blockchain-based mortgage software will bring the benefits of quicker processes and better transparency. However, it’s not a necessary component of the software in question.

Mortgage Application Development Challenges

Building a mortgage app is a complicated task with many stepping stones: dealing with them requires an accurate and professional approach. Let’s review the possible stumbling blocks in more detail.

Mortgage compliance

The biggest challenge for all businesses creating mortgage applications is compliance. The mortgage industry is heavily regulated, and compliance requirements can be complex and time-consuming. There are several local regulators that you must pay attention to because the laws in this area are highly rigorous.

The Office of the Comptroller of the Currency (OCC), Federal Reserve System (FRB), National Credit Union Administration (NCUA), Home Mortgage Disclosure Act (HMDA), Equal Credit Opportunity Act (ECOA), and Consumer Financial Protection Bureau (CFPB); in Europe, it’s controlled by European Banking Authority (EBA). These are just a few of the organizations on this long list.

Data Security

Mortgage applications involve sensitive personal and financial information, and data security is a critical concern. Developers must ensure that the app includes robust security features, such as data encryption, secure authentication, and secure data storage.

Integration with Third-Party Systems

Mortgage applications may need to integrate with a variety of third-party systems, such as credit reporting agencies, underwriting platforms, and loan servicing systems. Ensuring these integrations are seamless and reliable is therefore crucial.

Performance and Scalability

Handling a high volume of users and transactions, particularly during peak periods, is the mortgage app’s necessity. This is why scalability and the ability to handle increased traffic and data volume as the user base grows are the app’s necessary features.

Cost Management

Developing a mortgage application can be expensive, particularly if it requires custom development or extensive integrations with third-party systems. Careful cost management is crucial to ensure that the app is viable and cost-effective.

How Much Does It Cost to Develop a Mortgage App?

Cost of mortgage app development can vary significantly depending on several factors, such as the complexity of the app, the technology stack used, the development team’s location and expertise, and the features and functionalities included.

A basic mortgage app with simple features and functionalities can cost anywhere from $20,000 to $50,000.

A medium-complexity mortgage app with additional features such as e-signatures, credit check, mortgage calculators, and document upload can cost between $50,000 to $100,000.

A high-complexity mortgage app with advanced features such as pre-qualification tools, communication tools, and third-party integrations can cost upwards of $100,000 or more.

The time and cost calculation is greatly influenced by the size of the team, the functionality needed, and whether a custom product or an MVP is being produced. Should you need more specific figures in terms of how much does it cost to develop a mortgage app, get in touch with WeSoftYou as each project should be estimated separately.

WeSoftYou Is Ready to Become Your Reliable Partner

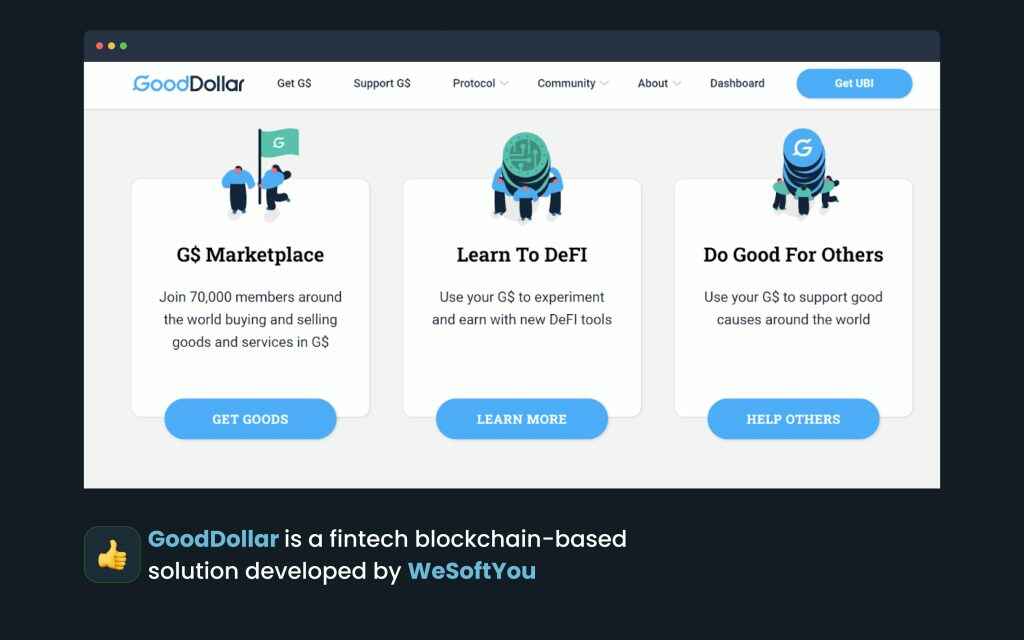

Enlist the support of the WeSoftYou engineering team to build a custom mortgage app for your business. Take a look at fintech projects our team has conducted earlier.

Good Dollar

The GoodDollar protocol is a distributed, community-driven system developed to create, fund, and distribute universal basic income using the GoodDollar token (G$). The startup implements its basic income economy using innovative protocols and smart contracts throughout the ecosystem.

WeSoftYou developed a web application for new protocols and smart contracts to create a “trickle-up” value structure that puts money in the hands of those who need it the most.

Develop Your Next Mortgage Software with WeSoftYou

Developing a custom mortgage app will enhance businesses’ legal compliance, maximize sales, and generally help make it more transparent in terms of loan processing and client communication. This is how streamlined loan processing, as well as maximized sales and mortgages, will come into reality. While creating mortgage apps, it’s essential to design these products correctly if you want to reap their greatest benefits.

Entrust your mortgage automation software development to seasoned pros from WeSoftYou. Our turn-key mortgage app development services help businesses achieve improved compliance, better data management, and better sales rates.

Let’s discuss your next vision and work together to bring it to life.

FAQ

Yes, you can hire software developers from WeSoftYou for your businesses’ custom mortgage software development. Work with us in whatever way is most convenient for you: pay a fixed price, work with us on a time-and-materials basis (depending on the materials we used to construct your product), or hire a specialized team to develop your mortgage app.

Mortgage software is a type of specialized software that automates and streamlines the process of mortgage origination and servicing. It allows applicants to submit their mortgage application online or through a mobile app. Once an application is submitted, the software initiates the loan processing and underwriting process. It also conducts loan servicing, as well as generates detailed reporting and analytics.

If you’re a mortgage broker, selecting the right CRM software can help you manage your client relationships, increase your efficiency, and grow your business. Some key features to look for when selecting CRM software for mortgage brokers can be:

– Lead management to enable capturing leads from multiple sources;

– Automation to save time and increase your productivity;

– Reporting and Analytics to generate reports and analyze your data;

– Mobile Access to access your client data and sales pipeline from your mobile device;

– Security and Compliance;

– Whether or not Web3 technologies are applied.

Before developing your own mortgage app, there are several important factors to consider. Those are, for instance, market research, app purpose and functionality, which technology to use, budget, but most importantly, legal and regulatory compliance. Ensure that the app complies with all legal and regulatory requirements, such as data protection laws and mortgage industry regulations.