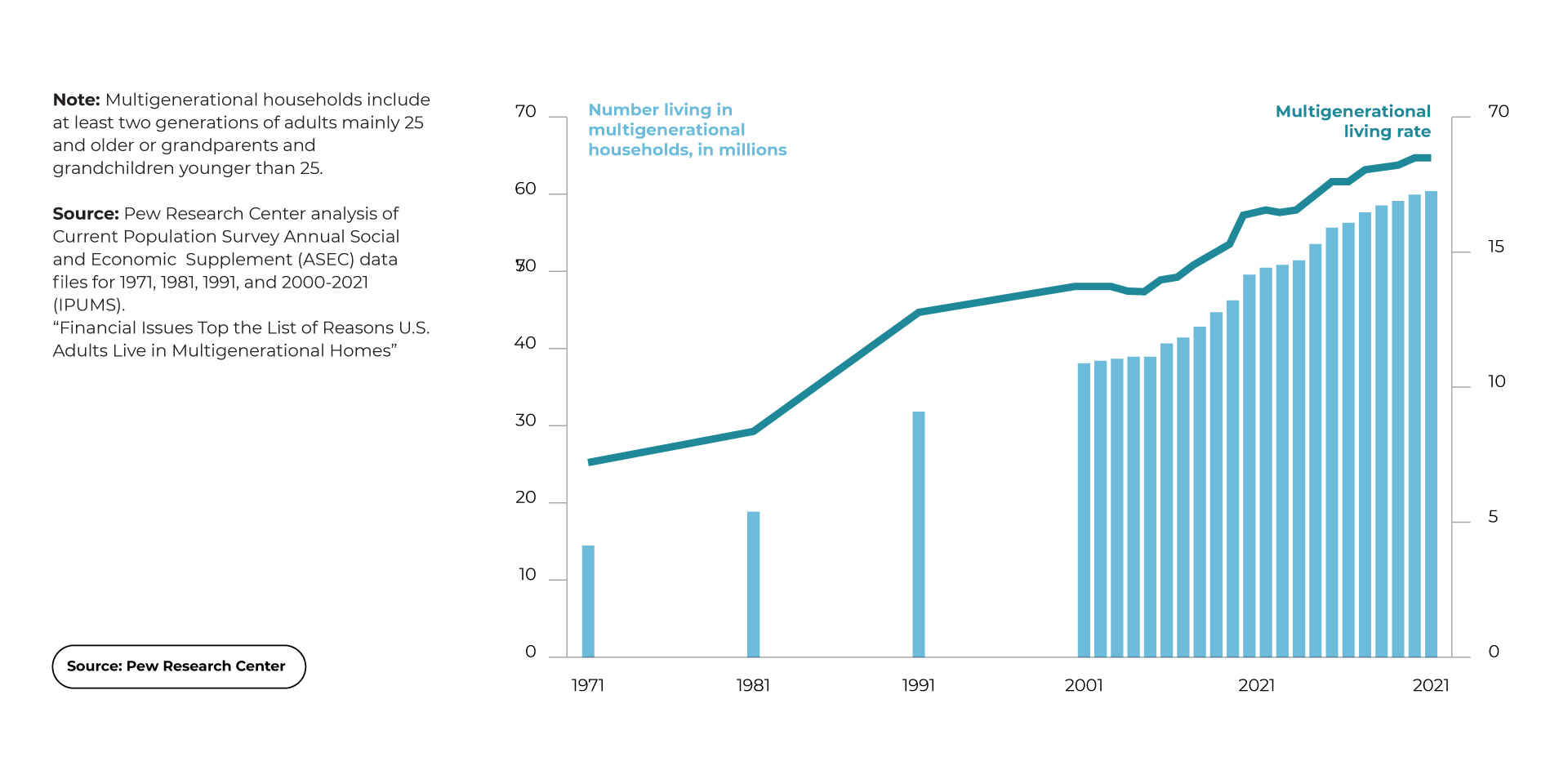

While taking care of your finances might not save you from unexpected troubles like the Silicon Valley Bank collapse, it can still help you build a better future for yourself and your family. In 2022, Pew Research Center published research showing that financial difficulties are one of the main reasons US adults still live with their relatives. So helping people to manage their money better is one of the main reasons to invest in personal finance app development.

Another reason is the demand. Although finance apps don’t demonstrate such popularity as mobile games, their download statistics remain stable. According to Statista, in 2022, users downloaded 2,656.2 million finance apps worldwide. By 2025, this number is forecasted to grow to 3,501.7 million worldwide.

Building a personal finance app that is user-friendly, secure, and effective is a challenging task. But don’t worry, as WeSoftYou will guide you through every step of the process. We’ve been working in the software development market for over six years, launching projects for fintech, Web3, retail, social media, healthcare, and education industries. With over 75 successfully delivered projects and a 100% success rate on Upwork, we know what is needed to make your personal finance app thrive.

Planning Your Personal Finance App

A personal finance app is software that helps users manage their finances efficiently. They can use such tools to track incomes and expenses, plan debt repayment and set up financial goals, and get financial reports in various forms (charts, diagrams, etc.).

The process of money management app development starts with planning. At this phase, you come up with the overall idea of your project, collect all the necessary data to support it, and outline your vision. Here’s how to do that:

Define your target audience

Plenty of personal finance apps are on the market, each designed for a specific audience and purpose. For example, a budget-tracking app for recent college graduates will differ from a house loan repayment app in functionality, design, and target goal.

Each app has its specific benefits and features that, in turn, affect its total cost. For instance, to find out the details of banking app development, you can read the corresponding article by WeSoftYou.

So before starting the personal finance app development process, you must clearly understand who this app will be built for. Learning about your target users’ location, education, age, and budget can help you more precisely identify the app’s features, make an effective promotional plan, and develop affordable monetization options.

Conduct market research to identify user needs and pain points

Once you understand your target audience, you must collect more data to find out how to help them better. Market research is the quickest way to know how your product can stand out among competitors and whether it will be in demand in the first place.

This stage is all about accessing not only the project’s strengths and weaknesses but also possible risks. Perhaps, there are no apps similar to the one you plan on building. However, you might find similar apps that lack several essential functions that your tool can offer. All the information collected can help you make a more rational, data-based decision to continue or abandon your project.

Determine the key features and functionalities of your app

A clearly defined list of possible key features and functionalities helps you and the engineers to develop a realistic budget and a timeline for your project. For instance, a robo-advisor platform for an investment firm will have more specific features than a regular budget planning app.

The most common features of personal finance management apps are:

- Account authorization. It has to be not only easy but also very secure, as it involves disclosing a lot of private financial information;

- Income and expenses tracking. The users should be able to enter their earnings and costs, as well as view the history of such transactions;

- Budgeting. This feature should allow the users to set budgets, from big ones (like a monthly spending budget or a vacation budget) to smaller ones (budget for groceries, clothes, etc.);

- Spending charts. They demonstrate spending by categories and also show the income-expense ratio;

- Goal/debt tracking. The users should be able to set financial goals and debt-closing goals to track their progress;

- Notifications. This feature informs the users about upcoming payments, budget overruns, and other essential things.

Decide on the app development platform

This choice is one of the main factors affecting the personal finance app development cost. Basically, the more platforms you want, the more expensive the app will be. And while you can optimize by building a multi-platform tool, this option will also be costly.

However, you don’t necessarily need to develop an app for several platforms simultaneously. A common budget-friendly solution is a focus on one platform, the one most used by your target audience.

Designing Your Personal Finance App

Never undermine the value of a good UI/UX design, as it affects how users perceive your app and how long and how often they will use it. Toptal’s research shows that 90% of users stop using the app if they find the user experience unsatisfactory.

WeSoftYou wants to share some tips on how to make the app’s design up-to-date and relevant to the target audience.

User interface and user experience design considerations

A personal finance app’s UI/UX design should be simple but not too much. This means that it should be easy to understand and navigate but still relevant in appearance. Expense tracking, financial management, budgeting, and all other features also should be intuitive to grasp.

Here are some main things to consider to create a better UI/UX design experience:

- Ease of data entry;

- Detailed reports and their view;

- Backup option;

- Joint/family accounts and synchronization between different devices.

Design elements and best practices for personal finance apps

Here are some best design practices to consider for your personal finance app development:

- Use a minimalistic approach. An average personal finance app has various features and details: numbers, charts, budget sections, and many more. Due to the amount of data displayed on the screens, making the interface minimalistic and less distracting is important.

- Consider adding animations. They could make a not-for-fun app more interactive and engaging to the users. Also, animated tutorials can help users master the tool’s features more quickly and with less effort.

- Stick to calmer colors. While this might not be the one-fits-all approach for personal finance apps, it’s still a good general rule. First, subdued colors such as blue, green, and white help an app look more professional and elegant. Second, they don’t overload the users’ perception, allowing them to focus on data more easily.

- Present information clearly. Use simple terms and structure the data into several logical blocks on the screen for better perception.

- Make the user experience more rewarding. Managing personal finances can be dull and demotivating, especially if a user faces financial troubles. Adding things like goals and objectives for positive reinforcement can help your target audience find extra motivation to continue tracking their finances.

For instance, when developing our NDAX app, the WeSoftYou team decided to stick to a simple yet informative design that demonstrates important data but uses a simple color palette to avoid putting too much pressure on the eyes.

Incorporating data visualization and analysis tools

Graphs, charts, and tables are worth adding to your personal finance app. First, they help diversify the data by adding visuals to texts and numbers. Second, visualization helps some people to perceive and understand information better.

There are several best practices when it comes to data visualization. Such visuals can be:

- Simple and even predictable, so they are easier to understand;

- Easy to adjust to a screen orientation (for instance, a chart for landscape screen orientation can be bigger and more detailed than a chart for portrait one);

- Potentially interactive: a user can access extra data by touching the chart’s elements.

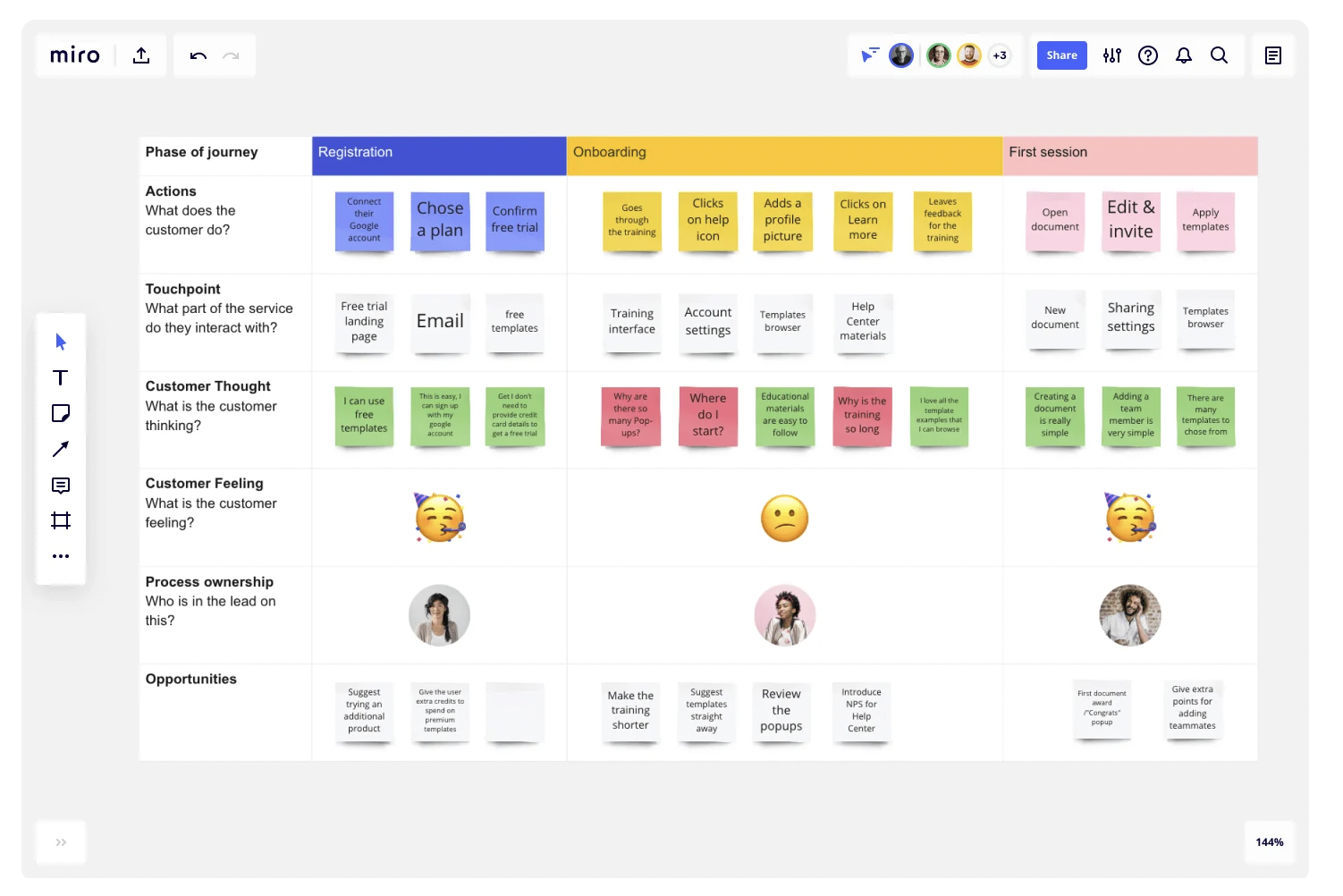

Creating a seamless user journey

A user journey is a sequence of steps a person must take to progress when using an app. Mapping the user journey matters a lot. It helps you see all the stages of UX and identify potential opportunities regarding the goals, milestones, pain points, etc.

If you’re new to user journey mapping, consider using special templates. Also, stick to the three-click principle: according to it, the user should only make three clicks to proceed from one app’s section to another.

Developing Your Personal Finance App

After you have a clear idea and design vision, you can move to the next stage of the process. This is where everything gets more tech-savvy and, therefore, more complex.

If you’re working with a personal finance app development company, they could help you with this stage, suggesting the best tech stack and APIs to achieve your goals.

Choosing the right technology stack

The tech stack is the tools and technologies to turn your idea into a real, full-functioning app. If you decide to build a solution for one platform only, you’ll need a native personal finance app development.

The tech stack for an iOS-based app can look like this:

- Programming language: Swift or Objective-C;

- Toolkit: Apple Xcode;

- SDK: iOS SDK.

The tech stack for an Android-based app can look like this:

- Programming language: Java or Kotlin;

- Toolkit: Android Studio;

- SDK: Android SDK.

The back-end and front-end development considerations

The front-end of your money management app is the layer the user sees and uses. It is usually built using CSS, HTML, JavaScript, and various frameworks.

The back-end is the layer inside the system. Although the users don’t interact with it, it is still responsible for various crucial factors, such as transaction ease, data security, and the app’s loading speed. The back-end of personal finance apps is usually built using Python, Ruby, C#, and C++.

Integrating third-party APIs and services

Complex apps often require you to include various APIs and AI solutions. They can be used to integrate data visualization libraries, data sources, payment options like PayPal, etc. For instance, cryptocurrency wallet integration is essential to our Decentralized Finance (DeFi) Development Services.

The complexity of integrated solutions also directly affects personal finance app development costs. More common APIs are easier and cheaper to integrate, while less widespread options can take more time and budget to include.

Testing and debugging your app

Before the app sees the market, it has to be tested for flaws and bugs. Usually, a finance app development company performs several tests during all stages of the development cycle to eliminate bugs and fix mistakes as early as possible.

Here are the essential testing types that have to be conducted:

- Data integrity: it tests the database thoroughly;

- Usability testing: it evaluates if your app is user-friendly;

- Security testing: it checks the app for info vulnerability and penetration;

- Performance testing: it helps understand your app’s spike, volume, and scalability level;

- Functional testing: it ensures that all the interfaces and integration function just as planned.

Launching Your Personal Finance App

Once everything is checked, your app is ready to be released. At this stage, you should focus on two main things: feedback collection and app promotion. The following steps will help you with them.

Creating an app store listing

An app store listing gives users all the essential information about your product, its characteristics, pricing, and special features. You need to provide all the details you have, supporting them with eye-catchy screenshots and a copy that sells. The better your listing, the more users will try your app.

Here are several best practices for writing copies for app listings that truly stand out:

- Write with your target audience in mind. How will your product help them? Which pain points it addresses, and how it solves them? Why is it better for them than the other products in this niche?

- Be simple. Choosing simple words and terms won’t make your copy less efficient, assuming you’ll focus on making them like that. At the same time, it will help the target audience understand you with more ease.

- Avoid keyword stuffing. While keywords help your audience find your product, using too many of them can turn users away from it. Include keywords but make sure that your texts don’t look overfilled with them.

- Consider localizing the content. If you’re targeting several locations, you can try texts for each local language to appeal to the audience better.

Developing a marketing and promotional strategy

The data you collected during the initial personal finance app development stages can help you promote a product.

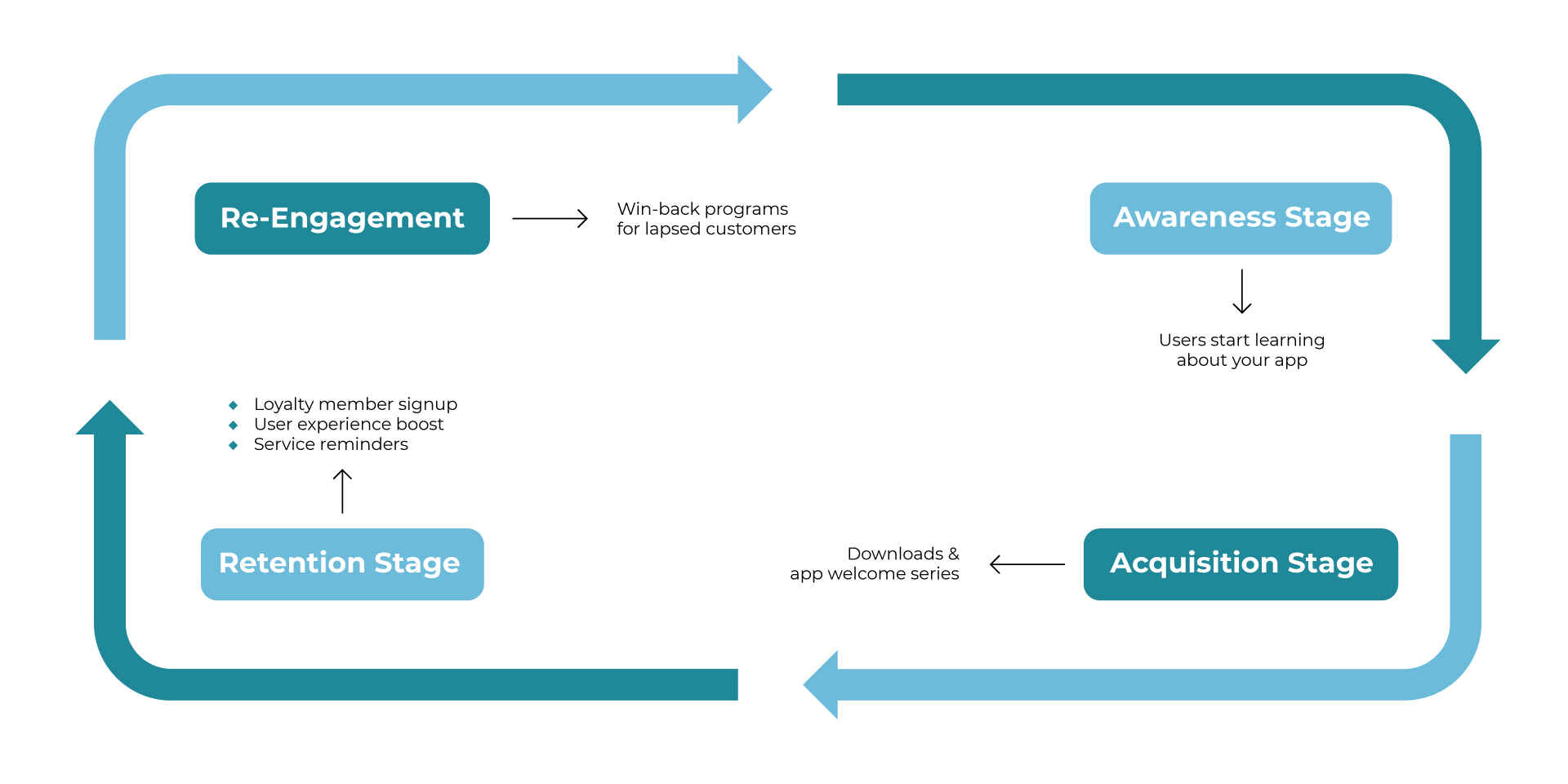

A proper marketing strategy consists of several stages:

- The awareness stage. During it, you decide on a launch date, research the market, build user personas, set up your app’s website and social media, create the first content, and reach out to influencers.

- The acquisition stage. After the app is released, you launch paid ads, create an app store description, and invest in more content to demonstrate the perks of your product.

- The retention stage. It helps you retain the users and turn them into loyal customers. To achieve that, you can improve existing communication and make it more personal, optimize push notifications and user experience, and consider running A/B tests and integrating chatbots.

Establishing user feedback and support channels

Collecting user feedback helps you understand your product’s flaws and potential growth points. Here’s how you can do that:

- Ask users to rate and review your app;

- Launch pop-up surveys;

- Ask users to fill in a feedback survey in exchange for a discount/gift;

- Encourage your audience to share their opinions on social media.

Also, support channels can help you kill two birds with one stone: identify your target audience’s problems and ensure they’ll receive all the help they need. The most common app support channels are:

- Phone line;

- Email;

- Online live chat;

- Ticketing system;

- Social media;

- Messengers;

- Chatbots;

- Online communities;

- Self-service knowledge bases.

Preparing for app updates and maintenance

Updating and maintaining your product is essential to keep up with a competitive tech market and improve user experience. Unless you do that on time, your app will likely experience a solid crash one day, which wouldn’t be good for your brand.

To do everything right, follow these best practices:

- Update development plans from time to time. They can change a lot from the initial ones, depending on the current needs of your target audience, so it’s necessary to update them with relevant information.

- Test app upgrades before launch. While this might seem obvious, not skipping the testing part will help you avoid many problems, such as a need to quickly develop a bug-fixing update.

- Use the updates to engage users. Getting new useful features fast encourages your target audience to stick to your app and recommend it to others.

- Enhance features over time. As your app becomes more profitable, you can upgrade the existing features, making them more convenient for users. The key is to do it gradually to avoid turning a familiar app into a less familiar one.

- Use metrics and collect feedback to improve the app. Introducing the metrics and analyzing the users’ feedback helps understand which features are used more and which are less, making it easier to adjust a tool’s development plan. It also helps minimize the risks caused by introducing unnecessary features.

Conclusion

Personal finance app development can help you gain profit and improve other people’s lives by offering them a new tool for financial management. To approach this process correctly, you have to invest time and effort in market and target audience research, define an app’s essential functions and tech stack, work on its design, and entrust the development to the best in the market.

WeSoftYou will gladly offer you our FinTech Application Development Services. With our vast experience in multiple industries, including finances, we know how to help our clients make the most out of their ideas and existing budgets. Reach out to us to build an app that will succeed on the market!

FAQ

The ultimate goal of a personal finance app is to help the target audience manage their finances better. This can be achieved by budget tracking, setting up financial goals and schemes for debt repayment, managing investments, and doing other things.

Using financial apps helps users save money, set up budgets for various spending categories, achieve their financial goals, invest smarter, and repay credits and debts quicker. Unlike traditional paper planners and Excel spreadsheets, financial apps can be easily accessed from various mobile devices, making the financial management process available even on the go.

To build a personal financial app, you have to start with drafting an idea that will have the potential to succeed on the market. Then you can think about the design, pick the best platform and tech stack, come up with the set of features to implement, and, of course, find professional software developers that can build the app for you.