Unlock the world of Decentralized Finance (DeFi), a revolutionary domain rooted in peer-to-peer finance. Explore the rise of DeFi, and its global impact with five million users, and delve into WeSoftYou’s comprehensive guide which is based on our Web3 software development experience, on DeFi app development trends, types, tech stacks, and invaluable tips for successful implementation.

Key Takeaways:

- DeFi’s Global Surge: Witness the exponential growth of DeFi users, approaching five million globally, emphasizing its pervasive impact on the financial landscape.

- WeSoftYou’s Expertise: Benefit from WeSoftYou’s proven experience in DeFi application development, offering insights into trends, types, and a step-by-step guide for successful DeFi product creation.

- Market Insights: Uncover the market dynamics, size, and the intricate relationship between DeFi and Ethereum, influencing each other’s growth.

- Types of DeFi Apps: Explore the diverse world of DeFi applications, including Decentralized Exchanges (DEXs), Non-Fungible Tokens (NFTs), Lending/Borrowing platforms, Cryptocurrency Exchanges, and Wallets.

- Tech Stack & Development Tips: Gain an understanding of the essential technologies, languages, and frameworks required for DeFi app development. Discover practical tips for creating user-friendly, scalable, and efficient DeFi applications.

- Steps to Build a DeFi Product: Follow a comprehensive seven-step guide, from the discovery phase to quality assurance and maintenance, to successfully build a DeFi product. Understand the importance of blockchain selection, tokenomics, wallet integration, oracles, design, and quality assurance in the development process.

- Cost & Timeline Considerations: Delve into the factors influencing the cost and timeline of DeFi app development, ranging from the complexity of features to the size and location of the development team.

- Challenges & Solutions: Navigate the challenges of DeFi app creation, including inconsistencies, data sources, performance specifications, protocol types, and governance approaches. Discover how a skilled development team is the key to overcoming these hurdles.

- WeSoftYou’s Experience: Explore WeSoftYou’s successful ventures in DeFi product development, featuring Good Dollar, an eToro blockchain-powered project, and NDAX, a secure cryptocurrency exchange platform.

DeFi Apps Development Trends

Defining DeFi Market

Although there has yet to be a consensus on what exactly DeFi market involves, it typically refers to financial apps explicitly made for Ethereum (ETH). The crypto market significantly impacts DeFi. The rise in popularity of DeFi had a significant impact on ETH’s price evolution. And vice versa, price changes for Ethereum have a remarkable effect on the DeFi market as this cryptocurrency is the primary blockchain driving transactions for decentralized finance.

DeFi Market Size

Since 2020, the market share of decentralized finance, or DeFi, has practically doubled, playing an increasingly significant role in the broader cryptocurrency market. It continued throughout 2021. Then, the market size – or the DeFi total value locked (TVL) – increased by around 100 million USD between April and March. As of June 2022, the decentralized finance market’s size was about 80 billion USD.

Increasing Number of DeFi Users Worldwide

DeFi users have increased by 300,000 since the beginning of 2022. It is in accordance with a network crawling code that aims to count the unique user addresses involved in buying or selling particular DeFi-related projects. The code lists data-fetching commands connected to Uniswap and Aave. These two DeFi protocols have a market capitalization exceeding $1 billion as of March 2022.

These methods to measure activity on the Ethereum network or elsewhere are frequently the sole sources of information on the market size for these topics. How so? There isn’t any official authority monitoring DeFi. Thus, there may be some errors in the data presented.

Types of DeFi Apps

Users of the financial sector can now produce, sell, and lend tokens or other digital assets thanks to DeFi platforms on the Ethereum network. Users of DeFi applications today have access to a wide range of financial services which perform the corresponding type of DeFi apps or dApps.

Decentralized Exchange (DEX)

Unlike traditional exchanges, DEXs run on smart contracts rather than centralized servers. As a result, they are less susceptible to hacking than conventional exchanges because there is no single point of failure. IDEX, ForkDelta, and AirSwap are a few well-known DEXs. WeSoftYou has developed NDAX, a cryptocurrency exchange platform for secure trading. We will tell more about NDAX below.

Non-Fungible Tokens (NFT)

Digital assets with unique or limited supply features are known as non-fungible tokens (NFTs). They can be traded on DEXs or used as loan collateral on systems like Compound or Dharma Protocol. Some examples of NFT are CryptoKitties, Decentraland, and Godot Engine Platform.

Lending and Borrowing

This software allows users to borrow money from a lender and pay the lender’s interest. On the app, lenders can lend money to borrowers. Compound Finance is a well-known illustration of this, allowing users to profit from their cryptocurrency by lending it to other users on the platform in exchange for interest. Other examples include Aave, Maker, and InstaDApp.

Cryptocurrency Exchange

A cryptocurrency exchange is a marketplace where you can buy and sell digital currencies like Bitcoin, Ether, and Dogecoin. There are many of them, each offering its selection of assets. These exchanges provide various funding options, trading pairs, and fee schedules. Examples include eToro, Binance, Coinbase, and Gemini.

Wallets

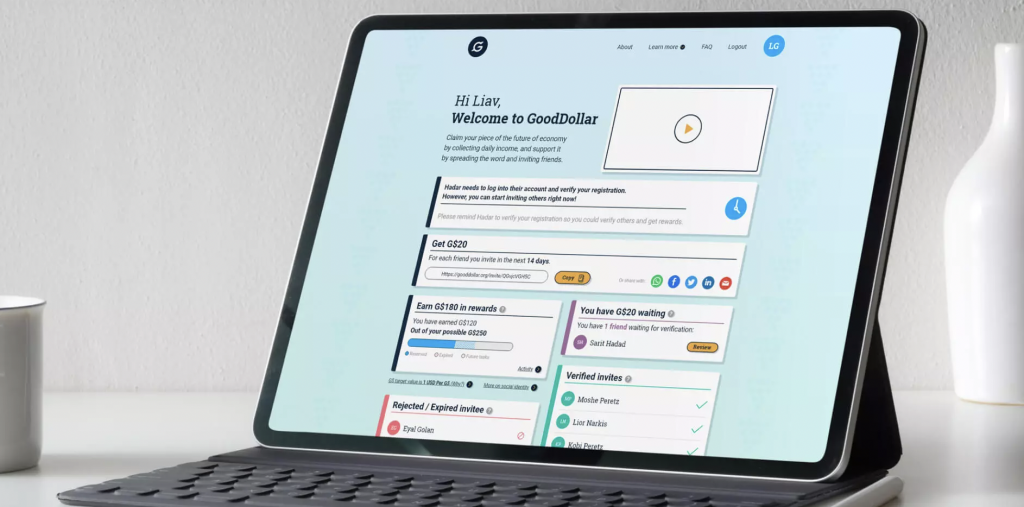

Diverse wallets are available for keeping multiple assets on various blockchains. For instance, users of Coinbase Wallet can store ERC20 tokens along with other assets like Bitcoin and Ethereum. In contrast, users of Trust Wallet can store all ERC20 tokens in addition to more than 20,000 additional Ethereum-based tokens. WeSoftYou has experience in developing a GoodDollar wallet that will be covered below.

Tech Stack and Tips for DeFi App Development

What can influence your choice of the tech stack for DeFi platform development as it might vary significantly?

- type of solution

- target platform,

- desired functionality of your DeFi app or dApp

In this section, we will cover the most common Ethereum development kit.

Tech Stack for DeFi App Development

In addition to conventional tools for fintech development, building a DeFi app for Ethereum includes the Truffle software suite, Ganache, the Solidity programming language, and the Remix development environment.

- Truffle. Use Truffle as your development framework to simplify your life. With just one straightforward command line interface (CLI) tool, Truffle makes deploying smart contracts, managing dependencies, testing, and much more simple.

- Ganache. It is a private blockchain that enables the rapid development of Ethereum-distributed applications and the production, distribution, and testing of DeFi apps in a controlled and secure environment.

- Solidity. It is a private contract-oriented programming language for the Ethereum network. It communicates with smart contracts on the blockchain.

- Remix. It is an open-source integrated development environment for Ethereum that you can use to create, compile, and debug Solidity code. Remix is a valuable tool for developing Web3 solutions.

At WeSoftYou, we work with Ethereum, EVM-based blockchains, and Tezos. Our specialists are fluent in Solidity, Python, and Javascript/Typescript. Some of our DeFi developers speak Klingonian, too. Our team builds DeFi apps on Truffle, Brownie, React.js, Node.js, Django, and Serverless.

Other Tips for DeFi App Development

DeFi-based applications provide an open and flexible financial system. This part will cover the open-source decentralized finance application’s technical requirements and some recommended best practices.

- Pick a software development kit that integrates nicely with your application so users can utilize it without adding new plugins or extensions to their browsers or devices.

- Offer a user-friendly UX to make your DeFi app simple and consistent. Make sure that people can grasp it as easily as possible. Make sure to clearly label each button and explain what it does in plain words.

- Think about your DeFi app’s scalability from the beginning. To accommodate high user volumes, you can use a tested scaling solution, such as GrapheneDB or MongoDB.

- Use MetaMask or Toshi to connect to Ethereum instead of connecting directly to get the Ethereum client through their browser.

Steps to Build a DeFi Product

Embarking on DeFi app development involves meticulous steps and considerations. The process includes a comprehensive discovery phase, blockchain selection, defining tokenomics, integrating crypto wallets and oracles, design and prototyping, quality assurance, and ongoing maintenance. WeSoftYou’s proven expertise, illustrated through successful projects like Good Dollar and NDAX, emphasizes the significance of choosing the right development team to overcome challenges and build a secure, cutting-edge DeFi product.

Step 1: Discovery Phase

The discovery phase entails looking into all currently accessible DeFi apps. This research aims to generate suggestions for new functions and enhancements for your DeFi application. You can also discover their advantages and disadvantages by visiting competitors’ websites and reading their blog posts and white papers.

Step 2: Choosing the Blockchain

Any DeFi app must carefully consider its choice of blockchain technology. Several blockhains support DeFi, including Ethereum, EOS, and Cardano. TRON will add this option in the future. When choosing the blockchain, consider support for smart contracts, user adoption, and tech stack.

Step 3: Defining Tokenomics

Tokenomics is the most critical component of any decentralized application. It will enable you to choose the type of token economics that would work best for your app and the amount of money you want to raise through your token sale. The most popular decentralized financial applications introduce new coins and interfaces for interacting with them: staking, donating to a liquidity pool and exchanging.

Step 4: Integrating Crypto Wallets

Users will need a crypto wallet because every DeFi app deals with cryptocurrency. Customers typically have the option to connect their wallets. However, creating your cryptocurrency wallet and providing customers with private keys will enhance trust, focus on pro users, and ensure faster time to market.

Step 5: Working with Oracles

Oracles are intermediaries giving information about events outside the blockchain network, such as stock prices or weather conditions. Most oracles are third-party services that charge users to use their API endpoints. However, some open-source options are available, like ChainLink (LINK) and Foxconn Billing Service (FBS).

Step 6: Design and Prototyping

When creating an app, keeping the user experience in mind is crucial. Users should be able to understand how your application works and feel comfortable using it without extensive training. Prototyping enables DeFi developers to test their ideas without going through all the procedures necessary to create an actual product. Additionally, this procedure aids in the early detection of issues, allowing developers to address them before production.

Step 7: Quality Assurance and Maintenance

QA ensures that an application complies with its specifications, is free of bugs and mistakes, and operates effectively in various situations and on different platforms. Finally, you must keep your app current with the most recent ecosystem modifications. It will guarantee that customers can get the most from using your product.

Cost & Timeline of a DeFi App Development

Depending on the features, platforms, tech stack, and engagement model for the development team, the cost of creating a DeFi product varies greatly.

The cost is typically lower when developing a DeFi application that solely uses on-chain data and doesn’t perform any blockchain transactions. No smart contract or blockchain programming is required because you create a web 2.0 application that reads data from one or more chains.

On the other hand, creating a DEX for trading tokens will take much more work than creating a mobile crypto wallet or other simpler DeFi projects. Also, if you need a smart contract to manage several assets and currencies, your app will take longer and use more resources to develop. It has more variables and functions than other kinds of programs, which explains why it costs more and has a longer timeline.

Developing DeFi apps with extensive features may cost anywhere from $25,000 to $100,000, including the salaries of DeFi developers. However, the number of developers working on DeFi apps and the number of hours they put in could change this. By outsourcing your project to Eastern Europe, you can cut development costs and save up to two times the development cost.

Contact us to get an estimate for your DeFi product.

Challenges & Solutions of DeFi Product Development

Building a DeFi app requires a thorough comprehension of the underlying technologies and their limits, such as smart contracts and blockchains. You may encounter the following difficulties when creating a DeFi application:

- Inconsistencies. Making a steady product that anybody can use is challenging because there are so many protocols and possibilities. With standardization, upgrading or introducing components without causing havoc with other system components becomes easier. Because of this, developers find it challenging to update their code base without causing systemic failure in other areas.

- Data sources and APIs. Getting data into your system is the main problem. It’s more complex than obtaining data from a Google API. The backend software may need to be created from scratch or integrated with other systems, such as a database.

- Performance specifications. Your DeFi app must perform well under strain because it handles financial transactions, and users want their money quickly. You risk losing money if you lack the appropriate servers or infrastructure.

- Different protocol types. Developers must be familiar with various protocols, including MakerDAO, Compound, dYdX, and Dharma. It might be challenging for them to create apps that support all of these protocols because there are different ways to design a DeFi app across various protocols.

- Different governance approaches. Every protocol has a different governance structure that might or might not be appropriate for your use case. Multiple governance strategies are used in the DeFi space depending on the project. For example, while some projects permit anybody to participate, others limit participation to token holders or users with a particular number of locked-up tokens.

The solution to all these challenges is to find the right DeFi app development team with proven expertise in DeFi app development that can assist you in producing a cutting-edge product. An appropriate vendor will aid you in building a new DeFi application from scratch or improving an existing app.

WeSoftYou Experience

WeSoftYou is an award-winning and fast-growing development company that creates software that meets all of your requirements for product development. We combined processes and products into an unbeatable structure, which let us accomplish corporate goals. Our solutions work in various global industries, including cryptocurrency and fintech. Below you will find our case studies of DeFi app development.

Good Dollar: eToro Blockchain-Powered Project

Project overview: A non-profit organization called GoodDollar is on a quest to use cutting-edge blockchain technology to provide a scalable, long-term paradigm for basic income distribution. Any person with an internet connection can join GoodDollar’s wallet and request a tiny daily income in G$ coins.

Challenges: GoodDollar establishes a minimum standard of living and decreases economic inequality by establishing a universal basic income (UBI). The project’s objective was to design a web application for new protocols and smart contracts to create a “trickle-up” value structure that puts money in the hands of people who need it most.

The main idea of the product: The major goal was to create GoodDollar. This new open-source global cryptocurrency would be used to distribute money according to universal basic income (UBI) principles. The main goal of GoodDollar is to use blockchain technology to reduce wealth inequality.

Results: GoodDollar encircles yield-producing decentralized finance mechanisms. With those funds, a reserve-backed cryptocurrency asset (G$) is created and delivered daily to users as a form of basic income. G$ is used to yield-payout investors who staked capital.

NDAX: Cryptocurrency Exchange Platform for Secure Trading

About the company: A digital asset market with a Canadian base, the National Digital Asset Exchange (NDAX) caters to individuals and organizations.

Challenges: WeSoftYou needed to create the most advanced mobile cryptocurrency trading platform with the nation’s largest portfolio of digital currencies based on infrastructure fit for an institution. All Canadians can trade cryptocurrencies quickly, easily, and securely thanks to solid financial relationships.

The main idea of the product: WeSoftYou team created the NDAX mobile app to simplify trading cryptocurrencies. On the user-friendly platform, novices can rapidly purchase and sell 11 different cryptocurrencies, while seasoned or expert traders can benefit from the cutting-edge features and trading tools.

Results:

- NDAX was created with the highest quality, security, and compliance standards to keep their customers’ assets in Canada in a segregated bank account.

- It is compatible with Canadian banking standards and can legally separate from NDAX’s operating money, adding an extra security measure.

- The primary objectives of NDAX are to offer their customers rapid ID verification, the lowest fees in Canada, the broadest portfolio of coins in Canada, and round-the-clock live service.

Build a Secure DeFi App with WeSoftYou

Building a DeFi product requires extensive knowledge of appropriate software suites, programming languages, and development environments in addition to the standard tools for fintech development. Finding the right software development team to develop a DeFi product will help you overcome the challenges and create a cutting-edge DeFi product for the optimal cost and timeline.

WeSoftYou has extensive experience producing software that satisfies your specifications for creating secure DeFi products. Our products help many international businesses, including fintech and cryptocurrency.

Contact us to learn more about DeFi product development and consult deeper on the topic.

Frequently Asked Questions

The price of building a DeFi project varies significantly depending on the features, platforms, tech stack, and engagement strategy of the development team. It can range from $25,000 to $100,000.

For an MVP, or minimum viable product, the launch may take four to six months. It is a version of your software with essential functionalities to meet customer demands. It enables quick manufacturing, consumer feedback gathering, and prospective app evaluation.

The main steps to create a DeFi product include a discovery phase, choosing a blockchain, defining tokenomics, integrating crypto wallets, working with Oracles, designing, prototyping, quality assurance, and maintenance.