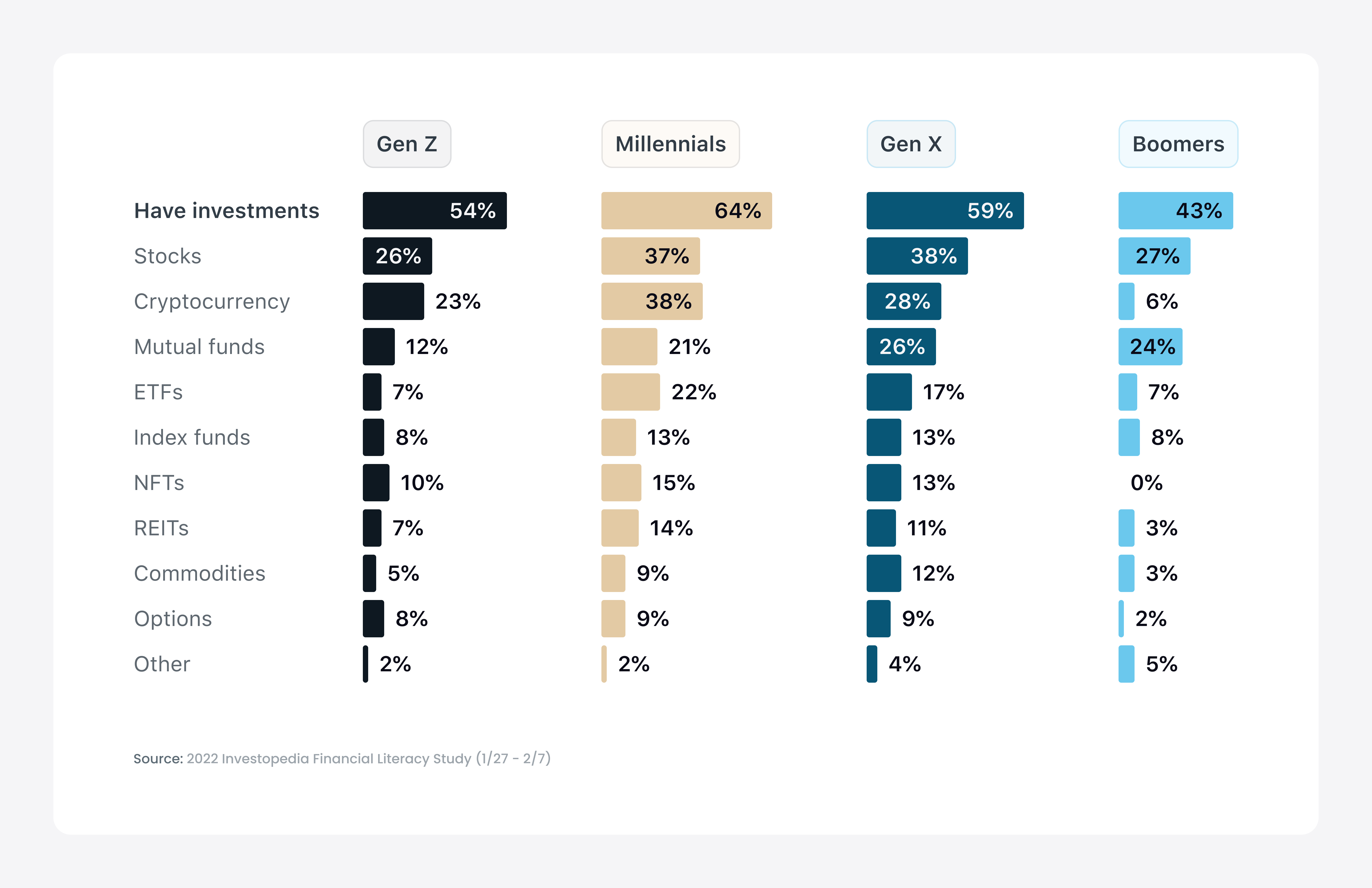

Introduction: Ever pondered the intricacies of constructing a trading platform? In a landscape where over a third of millennials and Gen Xers engage in stock investments, the demand for robust trading solutions is evident. WeSoftYou, with six years in fintech software development, shares insights on navigating this dynamic industry.

Key Takeaways:

- The surge in stock market participation, especially among millennials and Gen X, highlights the growing significance of trading platforms.

- WeSoftYou, with expertise in fintech solutions, offers insights into building successful trading platforms, emphasizing the need for meticulous planning and cutting-edge features.

- The trading market’s lucrative potential, fueled by a $10.21 billion revenue in 2022, signals opportunities for innovation and growth.

However, trading platform development requires significant time and money investment. Moreover, you will need skills and relevant knowledge for such a project. At WeSoftYou, we have both — and it’s a pleasure to share some of our insights with you in this article.

With over six years in the software development market and vast experience building solutions for the fintech industry, we know what it takes to create a decent digital product. On top of that, we can make it succeed even in a highly competitive niche like trading. So without further ado, let’s move on to the insights into building high-quality trading platforms.

Understanding Trading Platform

Before moving to the software development process, invest time in thorough planning. To streamline this stage for you, we’ll cover all the basics regarding trading platforms. In particular, we will explain what they are, which types of such solutions exist, and what’s happening to the market these days.

Definition of Trading Platform

A trading platform grants traders and investors convenient access to the stock market, enabling all sorts of transactions. People use such apps for short-term deals and long-term investments.

Types of Trading Platforms

The easiest way to differentiate trading platforms is by the currencies they work with. According to this classification, there are two types of such platforms: traditional and cryptocurrency-oriented. Let’s explore each in more detail.

Traditional Stock Trading Platforms

Traditional stock trading platforms work with companies operating on the market for a while. Such organizations go through government checks and comply with specific regulations to participate in stock trading. These solutions may offer to purchase stocks of companies you’re likely familiar with (Apple, Google, Netflix, and so on). However, you can also invest in startups and other small yet promising companies to build a severe profit if they succeed.

Such platforms collaborate with brokers. These are people or firms serving as intermediaries between an investor and a securities exchange. Transactions made via brokers are always insured. That’s probably why traditional platforms are more popular and widespread. Naturally, it also makes the competition among such apps higher.

Cryptocurrency-Oriented Trading Platforms

Cryptocurrency is a digital or virtual currency issued and distributed without a central regulating authority. With crypto-oriented trading platforms, users purchase, sell, and exchange Ethereum, Bitcoin, Tether, and other digital coins or assets.

This market is less common (and often less trusted) due to its innovative nature. However, it’s also easier to enter. Brokers and individual traders need less paperwork to register, obtain a license, and get the business going. Also, users can decide if they want to work with brokers or trade individually.

Market Overview

The state of the global trading market is quite promising. In 2022, its revenue reached nearly $10.21 billion. Furthermore, it’s forecasted to increase to an estimated $13.3 in 2026.

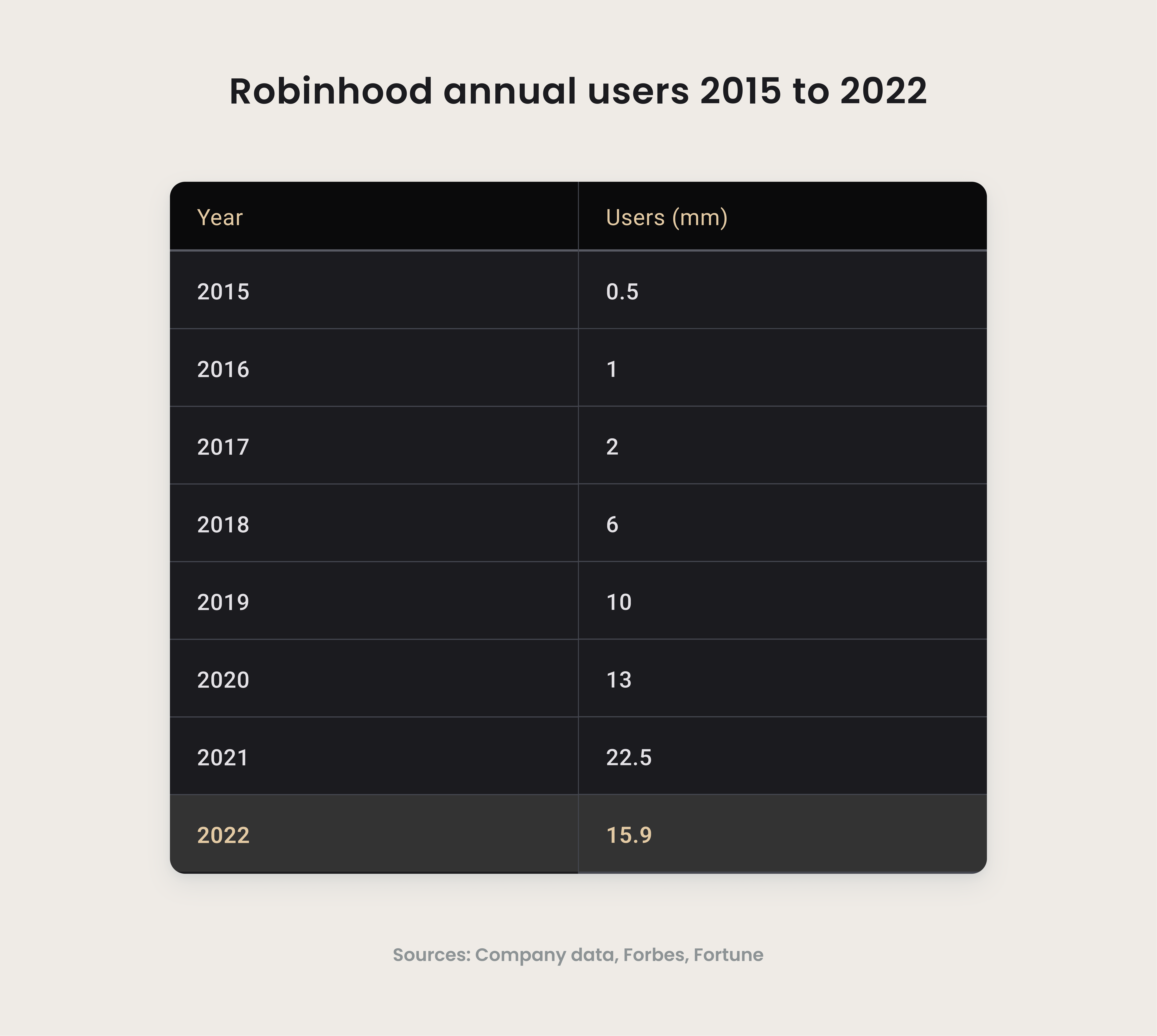

Also, it’s worth noting that the popularity of trading has been growing steadily since the beginning of the pandemic. Robinhood, one of the most popular commission-free trading apps, is a vivid example of this tendency. After the pandemic kicked in (the first quarter of 2020), the platform reached 13 million annual users. This number increased to 22.5 million in 2021 and dropped to 15.9 in 2022 (but still remains pretty impressive).

Furthermore, banking apps tend to add trading to their feature list. In 2022, Revolut, one of the EU’s most famous digital banks, announced its new function — commission-free stock trading.

As you can see, the trading niche has incredible growth potential. So if you’re wondering whether to seize the opportunity or not, we strongly suggest doing so. Ready? Then, let’s learn how to build a trading platform.

Key Features to Consider

Here are some noteworthy features many trading platforms implement.

User Registration and Management

User registration is a must-have option for most apps, including trading solutions. It’s the first stage of user interaction with your platform. Therefore, it shouldn’t be too complicated. Otherwise, you might lose potential customers who don’t want to waste time entering all their personal details.

Make sure that the signup screen is easy to understand. It also shouldn’t take much time to complete the registration process. Finally, make the data easy to manage. For example, allow users to edit or add specific information.

Trading Engine

Trading is your platform’s critical aspect. So you have to put extra effort into making it user-friendly and well-functioning. The trading engine should include the following:

- graphics displaying trade information;

- suggestions of other stocks that people buy often;

- real-time updates;

- company details and reviews;

- earnings.

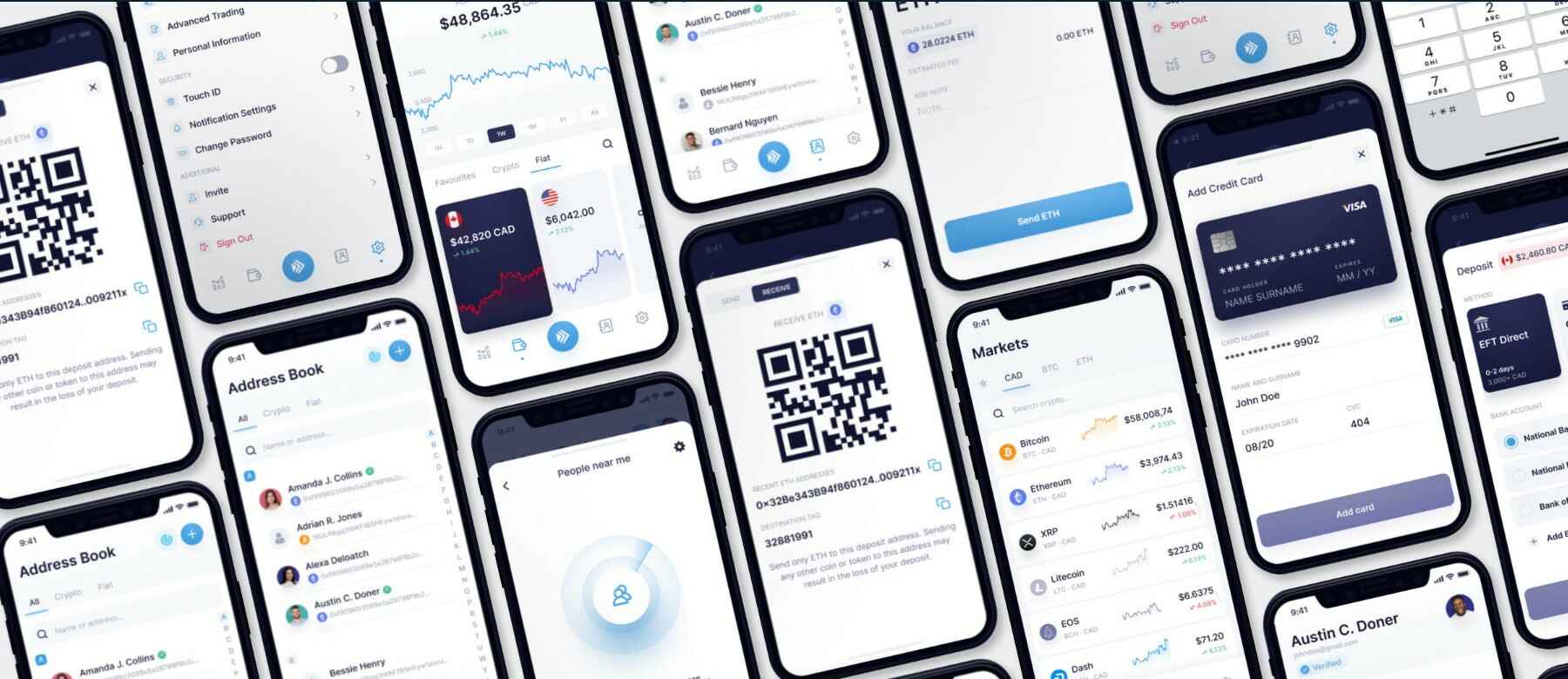

It’s worth noting that trading platforms usually contain lots of complex data. To avoid overwhelming the users, WeSoftYou suggests structuring this data well. For example, add visualization and other elements like charts and graphs. We did that when developing NDAX.io, the cross-platform cryptocurrency mobile app.

Security and Compliance

Security is essential for the solutions dealing with users’ money. So maintaining the highest level of data and user protection is crucial when building a trading platform.

You can achieve that by introducing the following elements:

- Two-factor authentication (also known as 2FA or multi-factor authentication).

- Encryption keys required for safe documentation access.

- Advanced user identity verification.

- Real-time notifications informing about an unusual platform activity (for instance, when somebody accesses an account from a different device, another country, etc.)

- Advanced data protection and data loss prevention.

- Fraud prevention (for example, with the help of AI-based solutions).

Payment Gateway

Securing the payments made through your trading platform is also a must. To achieve that, WeSoftYou recommends using highly protected gateways from trustworthy providers, such as PayPay, Stripe, and others.

Trading Analytics and Reporting

Thanks to detailed analytics, users understand how their trading is going. Also, they can make quicker decisions about selling or buying stocks. One of the most popular and user-friendly ways to present analytics is through dashboards.

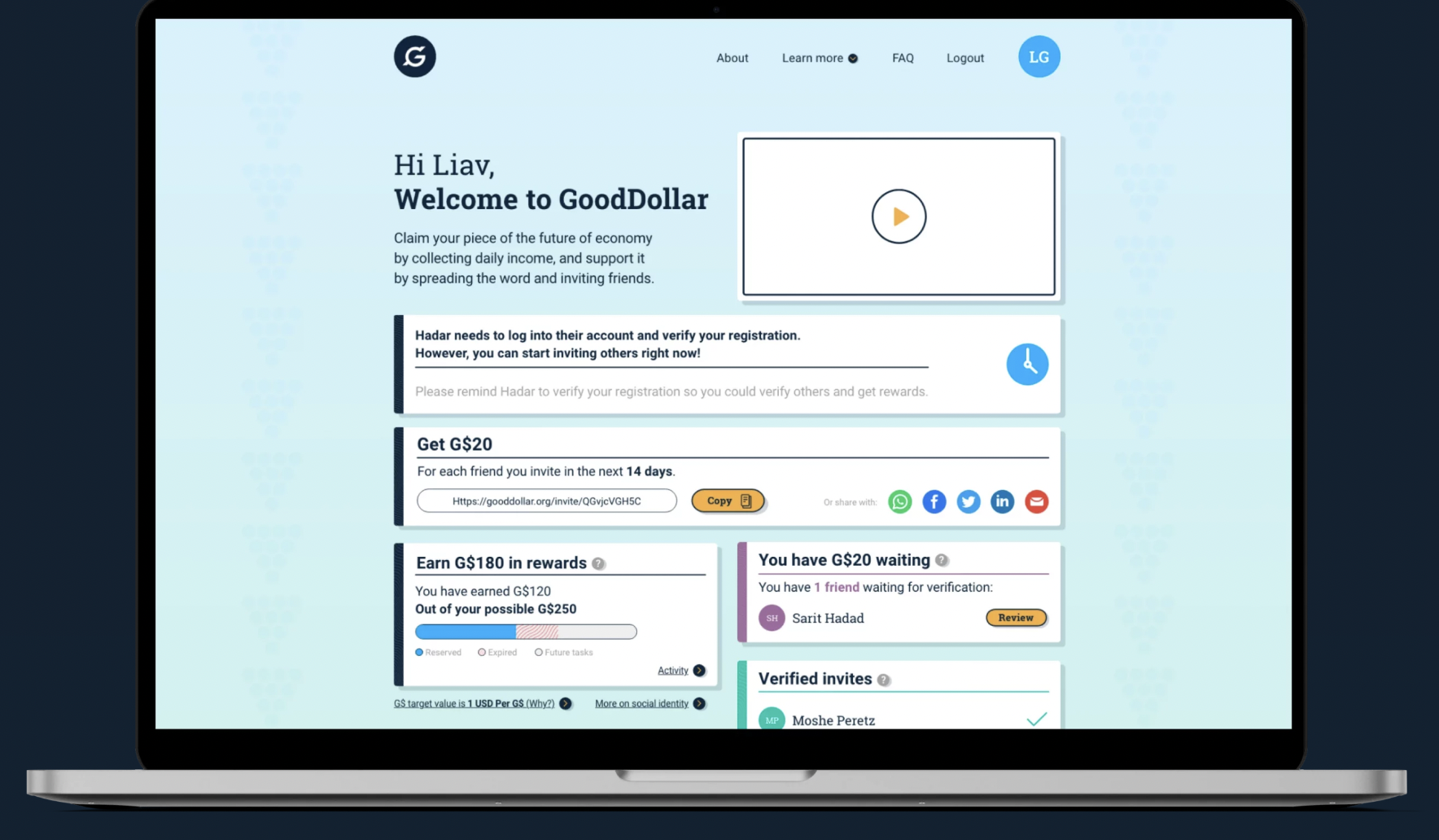

At WeSoftYou, we followed this approach while building Good Dollar – a blockchain-powered platform focused on global fund distribution by following the basic income principles.

API Integration

API integrations grant you more flexibility and facilitate particular trading processes. For instance, with the Plaid API, users securely connect their bank accounts with your trading platform.

While these are the core features of e-trade platforms, you may add more specific functionality. It will make your product more convenient to end-users and stand out among competitors. For instance, add a robo advisor to your platform to give users investment tips. To learn more about this feature, read our article on How to Build a Robo Advisor for an Investment Firm.

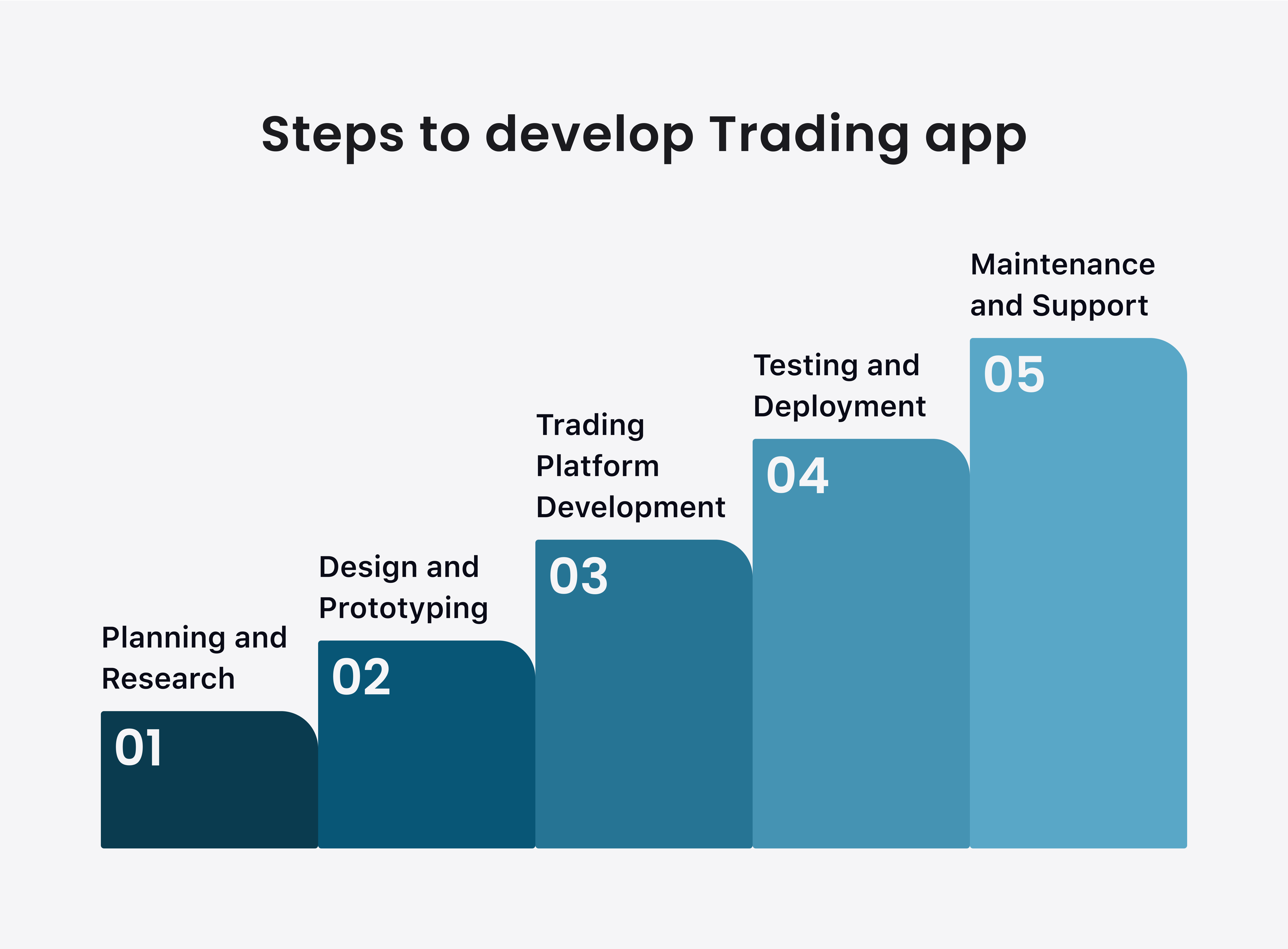

How to Build a Trading Platform: Key Steps

How to build a successful trading platform? WeSoftYou provides a comprehensive guide, emphasizing crucial steps like planning, designing, development, testing, and ongoing maintenance. With insights into legal compliance, design importance, and continuous updates, the guide equips entrepreneurs for success in the competitive trading platform landscape.

Now that you’ve learned about the main features of digital trading products, it’s time to figure out how to build a trading platform. This process consists of five core steps.

Planning and Research

At this stage, define your product’s purpose and project’s scope. Market and customer research provide lots of valuable data. With its help, you can polish your idea to make it unique and relevant to the target audience’s requirements.

Also, you decide on some other critical aspects, like deadline and budget, during this step. You might start with building a minimum viable product (MVP) or turn to the software development company to conduct a Discovery Phase for you. Besides, it’s time to choose the platforms you’ll work with (iOS, Android, Windows, MacOS, etc.) Web and mobile solutions require different approaches, while building a cross-platform product needs extra costs. So ensure your target users prefer the chosen platforms.

To learn more about the nuances of building mobile solutions, check out our article What Are the Steps to Creating a Mobile Bank App?

Design and Prototyping

Design helps your product stand out from the competition. Moreover, it aids in making it convenient for users. Therefore, don’t skimp on this stage. Instead, make sure the platform looks good while being easy to understand and use.

Creating a visual prototype in Figma is one of the most cost-savvy software development tips. Show this prototype to a target group. Then, collect and analyze their feedback before moving to the development stage. This way, you will fix many potential flaws in advance.

Trading Platform Development

If the planning and research stage went as planned, you should already have a clear vision of the most critical requirements for your app development. It includes the platforms to use, the tech stack, and more. With this data in mind, the development team can move on to building your product.

Testing and Deployment

There are two typical approaches to testing. In the traditional one, testers audit your product after development. First, they carefully examine its features to ensure the platform is error-free and works as planned. After that, they create bug reports and share them with developers to fix all the detected issues.

However, as software advanced, many development companies have adopted testing that runs parallel with the development. As a result, they spot various issues earlier and fix them before the product’s final version release.

Maintenance and Support

After the product’s launch, your software development partner may continue supporting it. It’s unnecessary, though, and depends solely on the client’s decision. However, if you plan to add new features to the MVP, having the same team dealing with your product and running the post-update maintenance is a good idea.

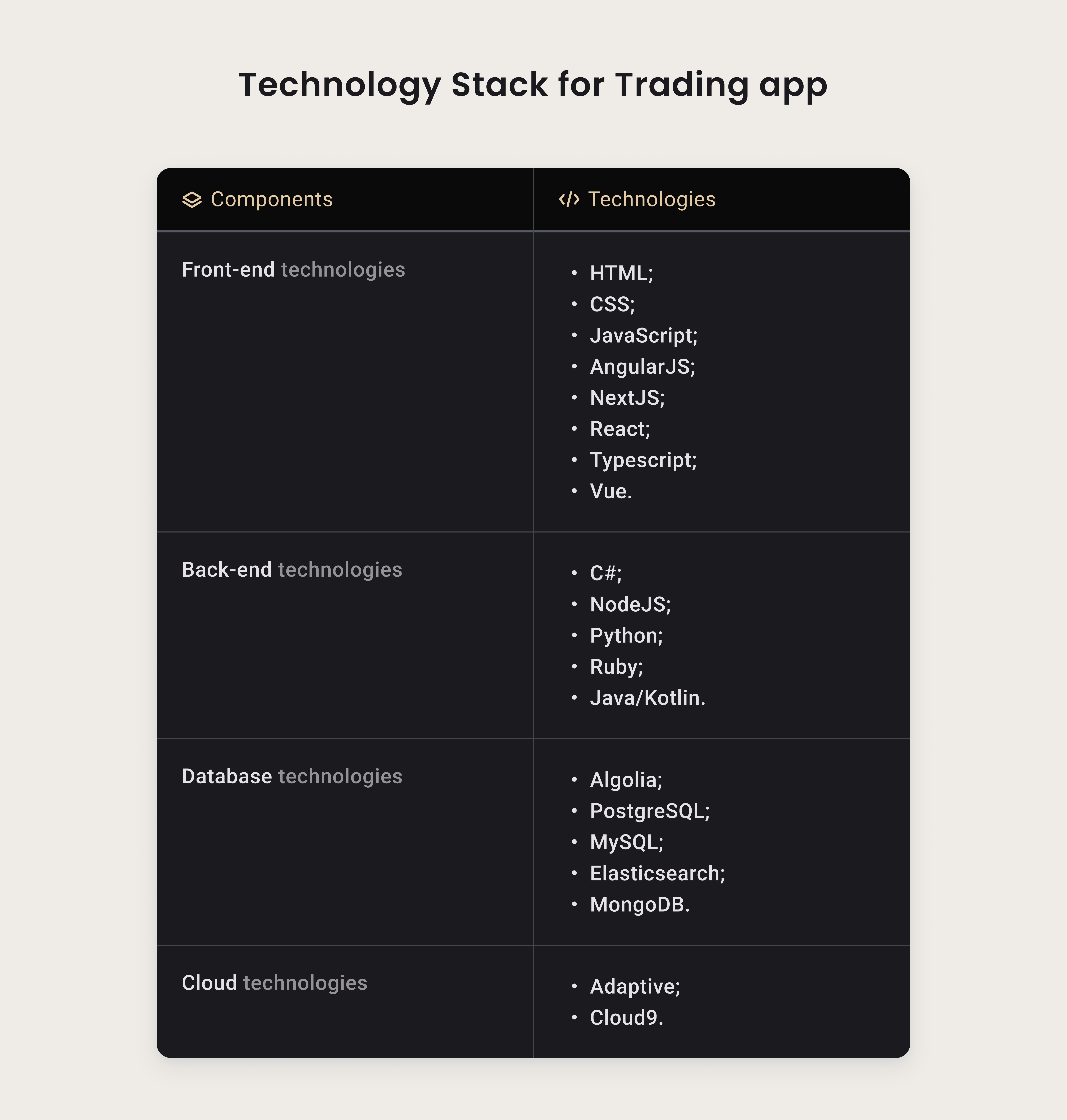

Technology Stack

How to make a trading platform that performs well and meets your expectations? For a start, pick a qualified software development team and choose an appropriate tech stack.

There’s no one-fits-all solution for selecting technology for a trading platform. Each project requires a unique approach. Thus, it’s always better to consult the development team about the most relevant tech stack.

However, we can name several most common technologies for such products.

Front-end technologies:

- HTML;

- CSS;

- JavaScript;

- AngularJS;

- NextJS;

- React;

- Typescript;

- Vue.

Back-end technologies:

- C#;

- NodeJS;

- Python;

- Ruby;

- Java/Kotlin.

Database technologies:

- Algolia;

- PostgreSQL;

- MySQL;

- Elasticsearch;

- MongoDB.

Cloud technologies:

- Adaptive;

- Cloud9;

- IPC;

- Beeks.

How much does it cost to build a trading platform?

The price for building the trading platform largely depends on the complexity of an app and its features, as well as on the number of platforms (MacOS, Windows, Android, iOS, etc) you plan to focus on. Around $50.000 will be sufficient for a basic trading platform with simple features like a user-friendly interface, real-time quotes, charting tools, account management, and basic order types.

However, for a state-of-the-art platform with features like multi-asset trading, advanced risk management tools, social trading, backtesting capabilities, AI and ML integrations for predictive analytics, and mobile app support, the cost could easily go up to $300.000 and more.

The exact figure for your project will be linked to your specific requirements and the rates of the developers you hire. Additionally, it’s important to keep in mind ongoing costs for things like server maintenance, updates, security measures, customer support, and compliance with regulations, among others.

Contact Wesoftyou to get a quote for your trading platform.

Best Practices for Building a Trading Platform

Like with every other solution, trading platforms have several industry-related best practices. Following them will impact your product’s success significantly.

Ensure Legal and Regulatory Compliance

The trading market is one of the most heavily regulated. Therefore, you should know the rules regarding trading solutions. For example, in the US, the software has to meet the Securities and Exchange Commission standards. In Europe, however, the list of supervisory authorities is a bit longer:

- Financial Conduct Authority (FCA), which is the main regulatory body in the UK;

- Markets in Financial Instruments Directive (MiFID), if your product will operate in the EU’s financial markets;

- Federal Financial Supervisory Authority (BaFin), if you plan to enter the German market.

Before starting development, hiring a lawyer and figuring out the legal regulations might not be your first option. But it’s worth considering these steps before creating an MVP. Even the best idea may not be feasible in terms of legal requirements. So it’s much better to tackle the potential challenges before investing funds in the development.

Don’t Skimp on Design

Stock trading involves a lot of numbers, currencies, and other data. So it might seem a bit confusing, especially for beginners. That’s why a clean and straightforward user interface is a must for trading platforms.

Smart data visualization, easy navigation, and calm color schemes make trading platforms visually enjoyable. Moreover, these features encourage users to stay longer. Which, ultimately, is your primary purpose. So don’t skimp on designing the interface of your trading product.

Regularly Update and Maintain the Platform

Your trading platform succeeds? Great news! However, that success won’t stay with you forever unless you work hard to keep up with competitors.

To achieve that, follow these two essential tips:

- Introduce new handy features regularly.

- Provide maintenance to ensure your platform runs smoothly even after becoming more advanced.

You can do that with the help of an in-house team or turn to an outsourced software development company. Anyway, it’s better to work with people who helped you build the product and are familiar with it. Thus, you will save much time and ensure better outcomes.

Conclusion

Whether you want to learn how to build a crypto trading platform or opt for a more traditional solution, you need a lot of research before entering this profitable yet highly competitive market.

Decide on the type of platforms, feature set, and technologies. Also, ensure your platform complies with legal regulations. And finally, work with the best software developers familiar with the industry to deliver outstanding results.

If you’re looking for trading platform development services or any other FinTech Application Development Services, WeSoftYou is here for you. We’ve successfully delivered over 75 projects in different industries for global clients.

We own our decisions, value transparent communication, and work hard to make our products meet clients’ expectations. Contact us – let’s start building your perfect trading platform together!

FAQ

First, conduct market and customer research to build a detailed plan and invest in a high-quality, user-friendly design. Also, pick the right software development team for your needs. Next, remember about testing, support, updates, and further maintenance. Finally, ensure your product complies with all legal requirements of the countries you’ll work with.

Both trading platforms and brokers serve as the intermediary between the investor and its stock and securities. The only difference is that trading platforms allow users to buy and sell directly. So when a person uses a trading platform, they choose between trading on their own or with the help of a broker.

There are several ways to monetize trading platforms. The most widespread are the following:

Charging a certain percentage for transactions.

Borrowing money or securities for a specific interest rate.

Using in-app advertising.

Introducing an extended set of features available under a premium subscription.