In today’s dynamic financial landscape, trading software has become indispensable for investors and traders. This article unravels the intricacies of developing such software, exploring the factors influencing costs, the development process, and ways to optimize expenses. Join us on this journey to understand the crucial question: “How much does it cost to develop trading software?” Let’s dive into the details!

Key Takeaways:

- Trading software revolutionizes trading by automating strategies and providing real-time market data.

- Understanding the key features – real-time market data, advanced charting tools, order execution, backtesting, and risk management – is crucial for effective trading software development.

- Factors influencing costs include software complexity, customization requirements, technology stack, and the development process.

- Development stages encompass planning, designing, coding, testing, deployment, and ongoing maintenance.

- A breakdown of costs involves software design, development, testing, and ongoing maintenance, with each stage demanding attention and budgeting.

- Cost optimization strategies include outsourcing, leveraging open-source technologies, and prioritizing essential features for development.

What is Trading Software?

Before we delve into the cost aspects, let’s first understand the basics of trading software. At its core, trading software is a computer program that facilitates the execution of trades in financial markets. It allows users to analyze market data, make informed decisions, and automate their trading strategies. From our experience at Wesoftyou, we have observed that trading software comes in different forms, including desktop applications, web-based platforms, and mobile apps. Each form has its own unique set of features and capabilities, catering to the diverse needs of traders and investors.

The Definition of Trading Software

Trading software is designed to streamline the trading process by providing users with access to real-time market data, advanced charting tools, and order execution capabilities. It enables traders to execute trades quickly and efficiently, helping them capitalize on market opportunities and minimize risks. Whether you are a retail trader or a professional investor, trading software is an indispensable tool in today’s highly competitive financial markets.

Key Features of Trading Software

Trading software offers a wide range of features to enhance the trading experience. Some of the key features include:

- Real-time market data: Trading software provides users with up-to-date market prices, enabling them to make informed trading decisions.

- Advanced charting tools: These tools help traders analyze market trends and identify potential entry and exit points.

- Order execution: Trading software allows users to execute trades directly from the platform, ensuring quick and accurate order placement.

- Backtesting and simulation: Traders can test their strategies on historical data to evaluate their performance before risking real capital.

- Risk management tools: Trading software offers various risk management features, such as stop-loss orders and trailing stops, to help traders protect their capital.

Real-time market data is a crucial component of trading software. It provides traders with the latest information on asset prices, including bid and ask prices, volume, and market depth. With this data, traders can stay updated on market movements and make informed decisions based on current market conditions.

Advanced charting tools are another essential feature of trading software. These tools allow traders to visualize market trends, patterns, and indicators. They provide a graphical representation of price movements, helping traders identify potential entry and exit points for their trades. By analyzing charts, traders can develop effective trading strategies and improve their overall trading performance.

Order execution is a critical aspect of trading software. It enables traders to execute trades directly from the platform, without the need to contact a broker or use a separate trading terminal. With just a few clicks, traders can place market orders, limit orders, or stop orders, ensuring quick and accurate order placement. This feature is especially important for day traders and scalpers who rely on fast execution to capitalize on short-term market movements.

Backtesting and simulation are valuable tools provided by trading software. Traders can test their trading strategies on historical data to evaluate their performance before risking real capital. By simulating trades and analyzing the results, traders can identify strengths and weaknesses in their strategies, make necessary adjustments, and improve their overall trading performance. This feature is particularly useful for algorithmic traders who rely on automated trading systems.

Risk management is a crucial aspect of trading, and trading software offers various risk management tools to help traders protect their capital. Stop-loss orders and trailing stops are common features that allow traders to set predefined exit points for their trades. These features automatically close positions when certain price levels are reached, helping traders limit potential losses and protect their profits. Additionally, trading software may offer risk management tools such as position sizing calculators and risk-reward ratio analysis, enabling traders to manage their risk effectively.

In conclusion, trading software is a powerful tool that provides traders with access to real-time market data, advanced charting tools, order execution capabilities, backtesting and simulation features, and risk management tools. It streamlines the trading process, enhances decision-making, and helps traders capitalize on market opportunities while minimizing risks. Whether you are a beginner or an experienced trader, trading software is an essential component of your trading arsenal.

Cost Factors of Trading Software Development

Now that we have a clear understanding of trading software, let’s explore the factors that influence its development cost. It’s important to note that the cost of trading software development can vary significantly based on these factors.

Complexity of the Software

The complexity of the trading software plays a crucial role in determining its development cost. Complex software with advanced features and sophisticated algorithms will require more time and effort to develop, leading to higher costs. On the other hand, simpler software with basic functionalities will be relatively less expensive to develop.

When it comes to complexity, there are various aspects to consider. For example, if the trading software needs to support multiple asset classes such as stocks, bonds, and derivatives, it will require extensive development to handle the intricacies of each asset class. Additionally, if the software needs to incorporate real-time data feeds, complex charting tools, and advanced risk management systems, the development process will be more time-consuming and costly.

Furthermore, the complexity of the software can also be influenced by the desired user interface and user experience. If the software needs to have a visually appealing and intuitive interface, it will require additional design and development efforts, resulting in increased costs.

Customization Requirements

Customization is another factor that affects the cost of trading software development. If you have specific customization requirements, such as integration with third-party APIs or unique trading strategies, it will increase the complexity and cost of development.

For example, if you want the trading software to integrate with popular financial data providers like Bloomberg or Reuters, it will require additional development efforts to establish the necessary connections and ensure seamless data flow. Similarly, if you have proprietary trading strategies that need to be implemented within the software, it will require custom coding and testing, leading to higher development costs.

However, pre-built trading software solutions may offer limited customization options but can be a cost-effective choice for some traders. These solutions often come with predefined features and functionalities that cater to a wide range of trading needs. While they may not provide the same level of customization as bespoke software, they can still be a viable option for traders who prioritize affordability and quick deployment.

Technology Stack Used

The choice of technology stack used for developing trading software can also impact its cost. Different technologies have varying development costs and required expertise.

For instance, developing a trading software using proprietary technologies may be more expensive than using open-source technologies. Proprietary technologies often require licensing fees and specialized knowledge, which can add to the overall development cost. On the other hand, open-source technologies are freely available and have a vast community of developers, making them more cost-effective options.

Additionally, using industry-standard technologies ensures better compatibility, scalability, and security. If the trading software needs to integrate with other systems or scale to handle a large number of users and transactions, using proven technologies can reduce development risks and costs in the long run.

Moreover, the choice of technology stack can also impact the availability of developers. If a technology is less popular or has a smaller developer community, it may be more challenging to find skilled developers, potentially increasing development costs.

How can businesses optimize trading software development costs? By strategically considering outsourcing, utilizing open-source technologies, prioritizing essential features, and adopting agile development practices, businesses can optimize trading software development costs without compromising quality. WeSoftYou, with its proven expertise, guides clients in achieving cost-effective and high-quality trading software solutions.

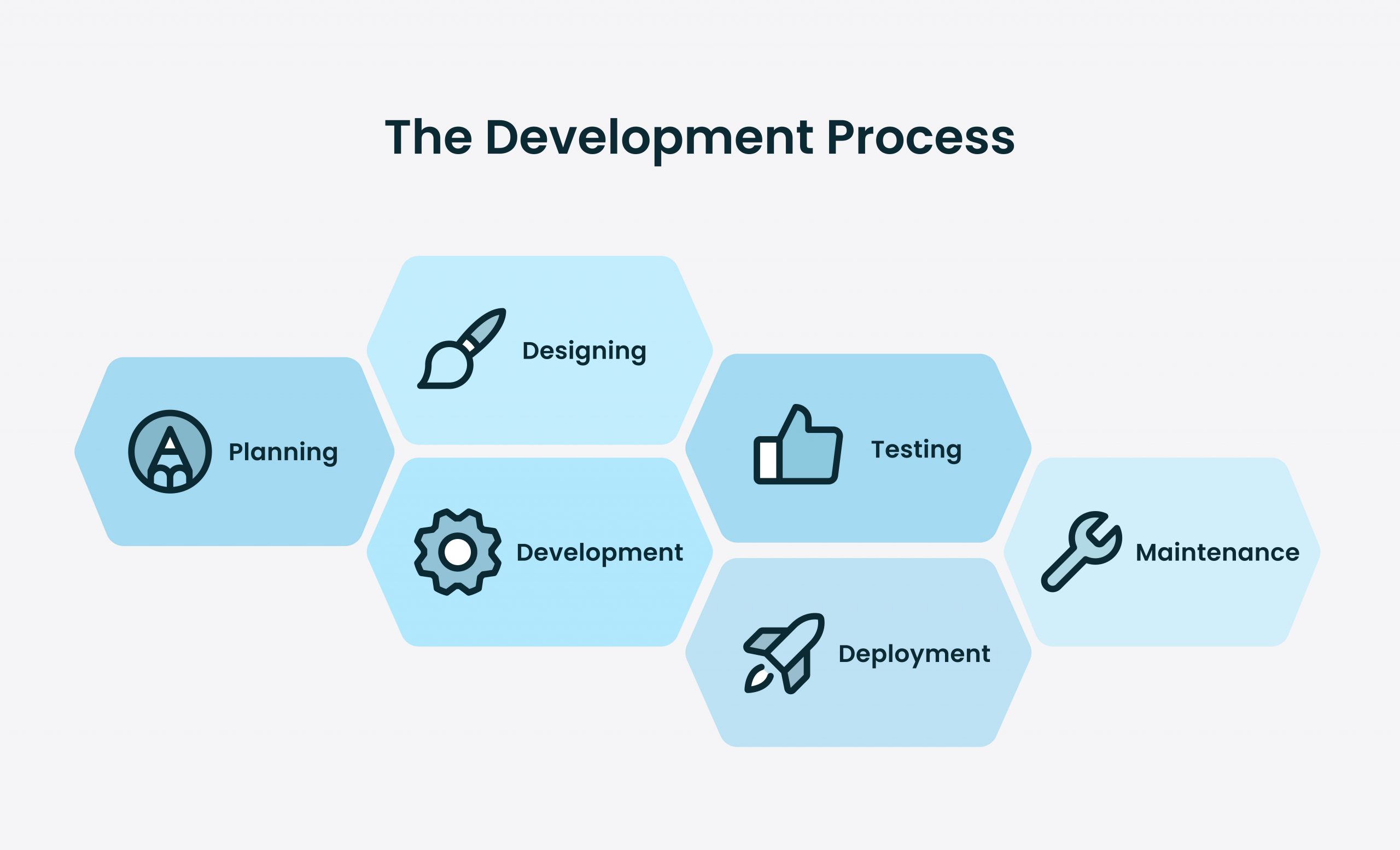

The Development Process of Trading Software

Now that we have explored the factors influencing the cost, let’s take a closer look at the development process of trading software. It involves several stages, each crucial to the successful completion of the project.

Planning and Designing

The planning stage is where the project requirements are defined, and the overall architecture of the software is designed. This includes identifying the target audience, defining functional and non-functional requirements, and creating the user interface design. From our experience, this stage sets the foundation for the entire development process and ensures that the software meets the expectations of the end-users.

During the planning and designing stage, it is important to conduct thorough market research to understand the current trends and demands in the trading industry. This research helps in identifying potential gaps in the market and allows for the incorporation of innovative features in the software. Additionally, this stage also involves creating a detailed project plan, which includes timelines, resource allocation, and risk management strategies.

Development and Testing

Once the planning and design stage is complete, the development team starts building the trading software. This involves writing the code, integrating various modules, and implementing the desired features. Development is an iterative process that requires constant collaboration between developers, designers, and stakeholders. Alongside development, thorough testing is conducted to identify and fix any bugs or issues, ensuring the software is robust and reliable.

During the development stage, it is important to follow industry best practices and coding standards to ensure the software’s scalability, maintainability, and security. This includes using version control systems to track code changes, conducting code reviews to identify any potential vulnerabilities, and implementing automated testing frameworks to streamline the testing process.

Deployment and Maintenance

After successful development and testing, the trading software is ready for deployment. It is crucial to ensure a smooth deployment process to minimize any disruptions to the trading operations. This involves setting up the necessary infrastructure, configuring the software for the target environment, and conducting thorough testing in the production environment to ensure everything is functioning as expected.

Once deployed, the software requires regular maintenance and updates to keep up with the evolving market conditions and technological advancements. This includes monitoring the software’s performance, addressing any issues or bugs that may arise, and implementing new features or enhancements based on user feedback. Maintenance costs should be factored into the overall cost of trading software development to ensure the software remains efficient and competitive in the long run.

Cost Breakdown of Trading Software Development

Now that we have explored the development process, let’s break down the costs involved in trading software development.

Developing trading software involves several stages, each with its own set of costs. Understanding these costs is essential for budgeting and planning purposes. Let’s take a closer look at the different cost components:

Software Design

The software design stage is where the foundation of the trading software is laid. It includes activities such as requirements gathering, UI/UX design, and prototyping. These activities ensure that the trading software meets the specific needs of the target audience.

During the requirements gathering phase, software developers work closely with stakeholders to understand their business requirements and translate them into technical specifications. This process involves conducting interviews, workshops, and research to gather all the necessary information.

Once the requirements are gathered, the UI/UX design phase begins. This involves creating wireframes, mockups, and prototypes to visualize the user interface and user experience. The design team collaborates with the development team to ensure that the design is both aesthetically pleasing and user-friendly.

Design costs account for a significant portion of the total development cost. The complexity of the software and the level of customization required by the client can influence the design costs.

Development

Development costs primarily include the actual coding and integration of the various software modules. This stage is where the trading software starts to take shape.

The complexity of the software and the number of features determine the development costs. More complex software with advanced features will require more development effort, thus increasing the cost.

During the development stage, software developers write code, create databases, and integrate different modules to ensure the smooth functioning of the trading software. They follow industry best practices and coding standards to ensure the software is robust, scalable, and maintainable.

Development costs also include the cost of any third-party libraries or frameworks used in the development process. These tools can enhance the functionality of the trading software and reduce development time.

Testing and Quality Assurance

Testing and quality assurance are crucial stages to ensure the trading software is reliable and bug-free. This involves conducting various tests, such as unit testing, integration testing, and performance testing.

Unit testing focuses on testing individual components or modules of the trading software to ensure they function correctly. Integration testing verifies that different modules work together seamlessly. Performance testing evaluates the software’s performance under different loads and stress levels.

The cost of testing and quality assurance should be factored into the overall development cost. Skilled testers and quality assurance professionals are required to carry out these activities effectively.

Additionally, the cost of any testing tools or frameworks used to automate the testing process should be considered. Automation can help improve efficiency and reduce the time required for testing.

Maintenance and Support

Once the trading software is deployed, it requires regular maintenance and support to address any issues and keep it up-to-date. Maintenance costs include bug fixes, security updates, and feature enhancements.

Software maintenance is an ongoing process that ensures the trading software remains functional and secure. It involves monitoring the software, identifying and fixing any bugs or issues that arise, and providing technical support to users.

Feature enhancements may be required to meet changing market needs or to stay ahead of competitors. These enhancements can range from minor updates to major functionality additions, depending on the business requirements.

The cost of ongoing maintenance and support should be considered when determining the total cost of trading software development. It is important to allocate resources and budget for these activities to ensure the long-term success of the trading software.

By understanding the cost breakdown of trading software development, businesses can make informed decisions and plan their budgets accordingly. It is crucial to consider all these cost components to ensure the successful development and maintenance of trading software.

Ways to Reduce Trading Software Development Costs

As a software development company with a proven track record in trading software development, we understand the importance of cost optimization. Here are some ways to reduce trading software development costs:

Outsourcing vs In-house Development

Consider whether to outsource the development of trading software or keep it in-house. Outsourcing can be a cost-effective option as it eliminates the need to hire and maintain an in-house development team. It also allows you to leverage the expertise of experienced software development companies like WeSoftYou.

When outsourcing, you can tap into a global talent pool, accessing developers with specialized knowledge and experience in trading software development. This can save you time and money in recruiting and training new employees. Additionally, outsourcing can provide flexibility in scaling your development team up or down based on project requirements, further optimizing costs.

However, it’s important to carefully select the outsourcing partner. Look for a company with a strong track record in trading software development and a proven ability to deliver high-quality solutions within budget and on time.

Using Open Source Technologies

Utilizing open-source technologies can significantly reduce development costs. Open-source software is freely available and can be customized to meet your specific requirements. By leveraging existing open-source solutions, you can save time and effort in building functionalities from scratch.

Open-source communities often provide extensive documentation, tutorials, and forums where developers can seek help and guidance. This can reduce the need for extensive support or consulting services, further reducing costs.

However, it’s crucial to carefully evaluate the licensing terms and community support before choosing open-source technologies. Ensure that the chosen technologies have an active community and regular updates, as this will ensure long-term support and maintenance.

Prioritizing Features for Development

Identify and prioritize the essential features required for your trading software. Avoid unnecessary complexity that can increase development costs. By focusing on the core functionalities initially, you can launch a minimum viable product (MVP) and add more features incrementally based on user feedback and market demand.

Developing an MVP allows you to validate your product idea and gather valuable insights from early adopters. This feedback can help you refine and enhance your software, ensuring that you invest in features that truly add value to your users.

Additionally, by adopting an agile development approach, you can continuously iterate and improve your software based on user feedback. This iterative process allows you to manage costs effectively by prioritizing features that have the highest impact and value.

Furthermore, consider implementing automated testing and continuous integration practices. These practices can help identify and fix issues early in the development process, reducing the overall cost of quality assurance and bug fixing.

In conclusion, reducing trading software development costs requires careful consideration of various factors such as outsourcing, open-source technologies, and feature prioritization. By making informed decisions and adopting cost-effective strategies, you can optimize your development process and deliver high-quality trading software within budget.

Conclusion

In conclusion, the cost of developing trading software varies based on factors such as complexity, customization requirements, and the technology stack used. While the initial development cost may seem significant, trading software offers numerous benefits, including automation, real-time market data, and advanced analysis tools, which can help traders and investors stay ahead in the competitive financial markets. As a software development company specializing in trading software development, WeSoftYou can provide valuable expertise and guidance throughout the development process, ensuring optimal results within your budget.

FAQ

The development timeline for trading software can vary depending on the complexity and customization requirements. On average, it can take anywhere from a few months to a year or more.

The choice of technology stack should be based on factors such as scalability, security, and compatibility. It’s recommended to consult with experienced software development companies like WeSoftYou to determine the most suitable technology stack for your specific requirements.

Yes, trading software can be integrated with third-party APIs to access additional market data, execute trades on different exchanges, and implement advanced trading strategies.

Yes, trading software can be integrated with third-party APIs to access additional market data, execute trades on different exchanges, and implement advanced trading strategies.

A: The cost of maintaining trading software depends on factors such as the frequency of updates, bug fixes, and technical support required. It’s advisable to allocate a budget for ongoing maintenance and support to ensure the software remains up-to-date and reliable.

For a free consultation or project estimation, feel free to contact us. Our team of experts at WeSoftYou will be happy to assist you!