Real-World Asset Tokenization Services

Fractionalize your property, artwork, or even that rare Pepe meme with our secure tokenization services. Unlock liquidity and tap into a global investor pool.

Turn your deadweight into DeFi goldTokenizing Physical Assets: What It Can Be

Real Estate

Tokenize entire buildings, apartments, or even slices of a skyscraper! Imagine a Decentralized Autonomous Organization (DAO) owning a piece of the Empire State Building.

Fine Art

Fine art, collectibles, even your limited-edition Pepe meme – tokenize them all! Increased accessibility and global liquidity for your most prized possessions.

Precious Metals

Gold, silver, and other metals can be fractionalized tokens, opening doors for easier trading and potentially more efficient DeFi integrations.

Intellectual Property

Tokenize patents, copyrights, and trademarks to unlock new monetization strategies and foster collaboration within the DeFi ecosystem.

Carbon Credits

Tokenization can streamline carbon credit trading, making it easier to participate in environmentally conscious projects.

Loyalty Programs

Imagine earning loyalty points usable across different platforms – tokenization makes it possible.

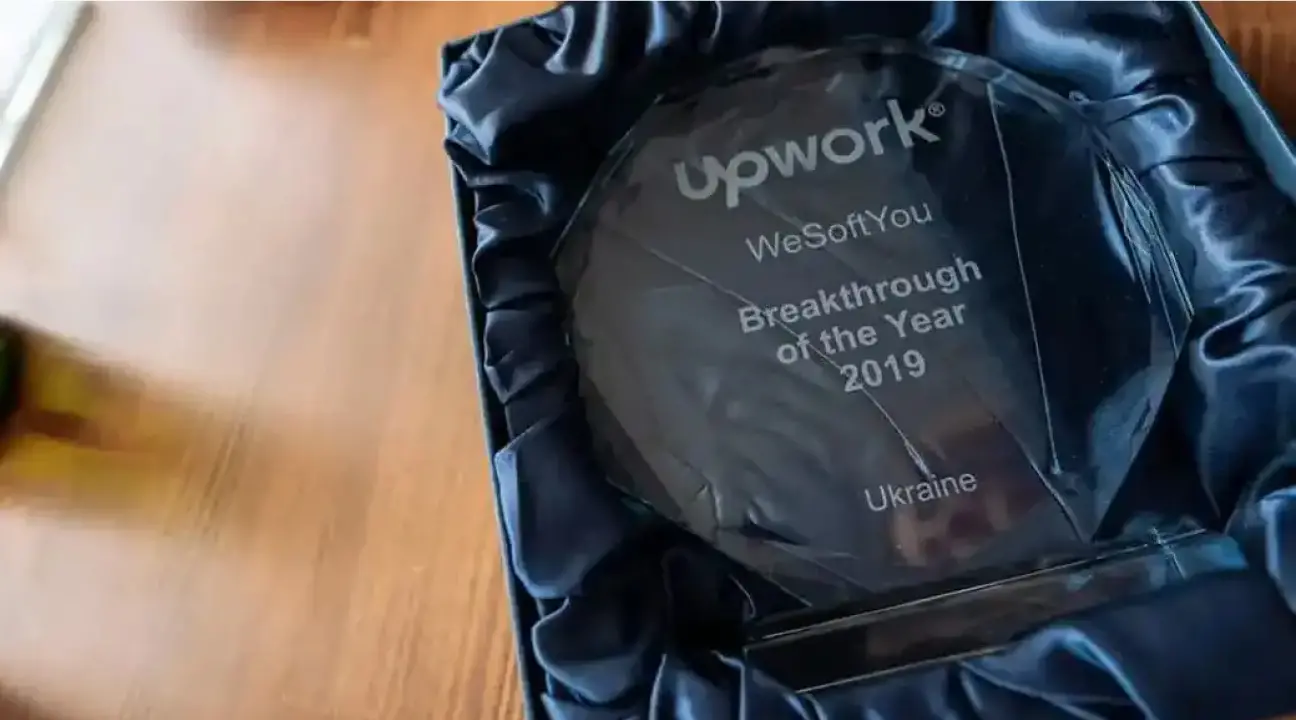

Testimonials

Client feedback is a big factor in the awards process. Clutch.co’s leading companies have been vetted for quality and performance, and we are happy that WeSoftYou made the list.

Technologies We Use for RWA Crypto Projects

Our RWA Crypto project are compatible with the next solutions.

Our Real-Word Asset Tokenization Process

Crafting Your DeFi Ticket

This is where your real-world asset gets a digital makeover. We define the total supply, divisibility (how much an individual token represents), and other core characteristics.

Programming Smart Contract Rules

Think of the smart contract as the self-executing rulebook for your tokenized asset. This secure code governs everything from ownership transfers and trading mechanics to potential dividend payouts (if applicable). Here, you can embed features like split ownership percentages or voting rights for token holders.

Distributing Your DeFi Fuel

Time to unleash your tokens onto the blockchain! As a RWA tokenization provider, we deploy the created tokens on a chosen blockchain platform like Ethereum or Solana. Now, your tokenized asset becomes tradable on a decentralized network, accessible to a global audience of DeFi users.

Managing Your Brick-and-Blockchain Portfolio

We establish secure storage solutions for both the underlying real-world asset and the corresponding digital tokens themselves. This might involve partnering with qualified custodians experienced in safeguarding digital assets.

Building Your DeFi Marketplace

Here's where the magic of liquidity happens. You'll need a platform for investors to buy, sell, and trade your tokenized asset. This could involve dedicated RWA Exchanges or integration with Existing DeFi Platforms.

Real-World Asset Tokenization as a Service with WSU

You should entrust us your real-world asset tokenization

Hyper-Accurate Tokenomics

We guarantee a 100% match rate. Our deep industry knowledge and meticulous planning ensure your tokenomics model reflects real-world conditions for maximum success. No more guesswork!

Elite Dev Team at Your Service

We assemble a dream team of battle-tested developers. These aren't just skilled, they're the top 3% in the field, ready to tackle your most complex tokenization challenges.

Fort Knox-Level Security

At WeSoftYou, data security is non-negotiable. We build solutions that meet the highest industry standards and safeguard sensitive information, keeping your project safe and compliant.

Our Case Studies

See more cases

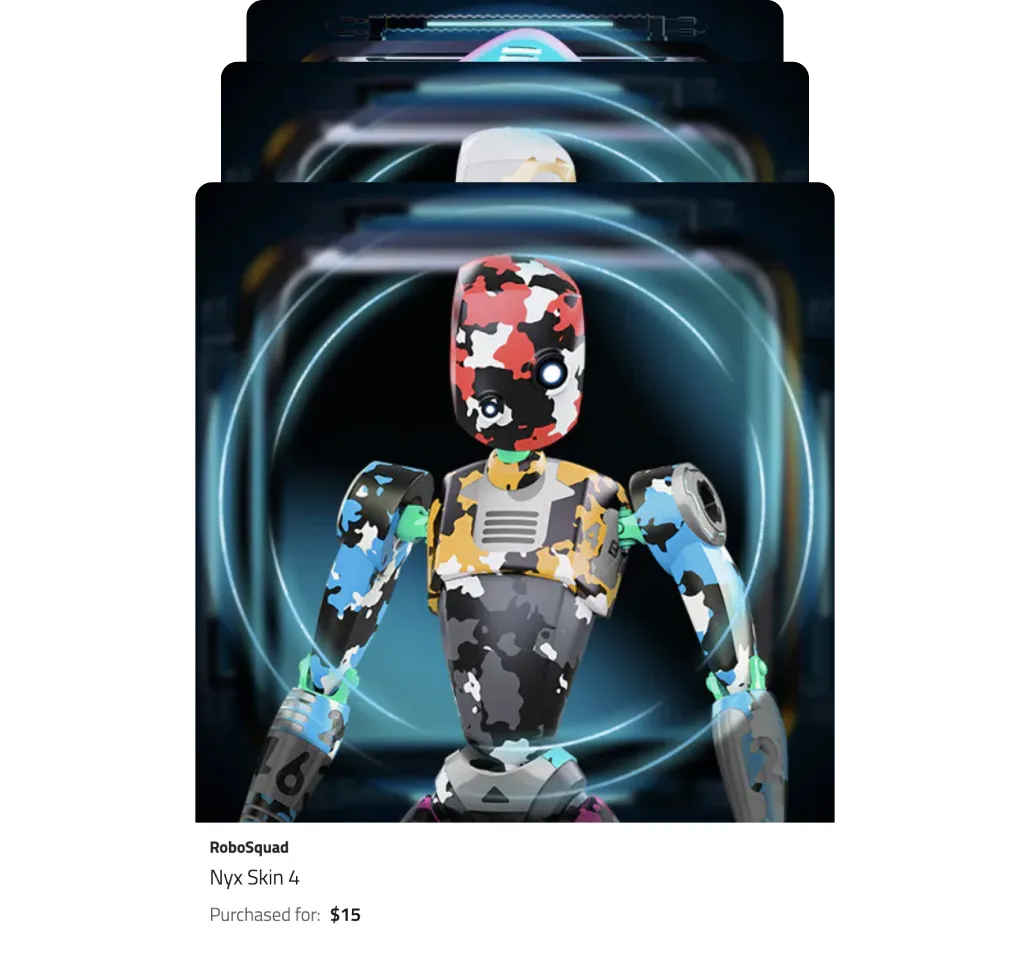

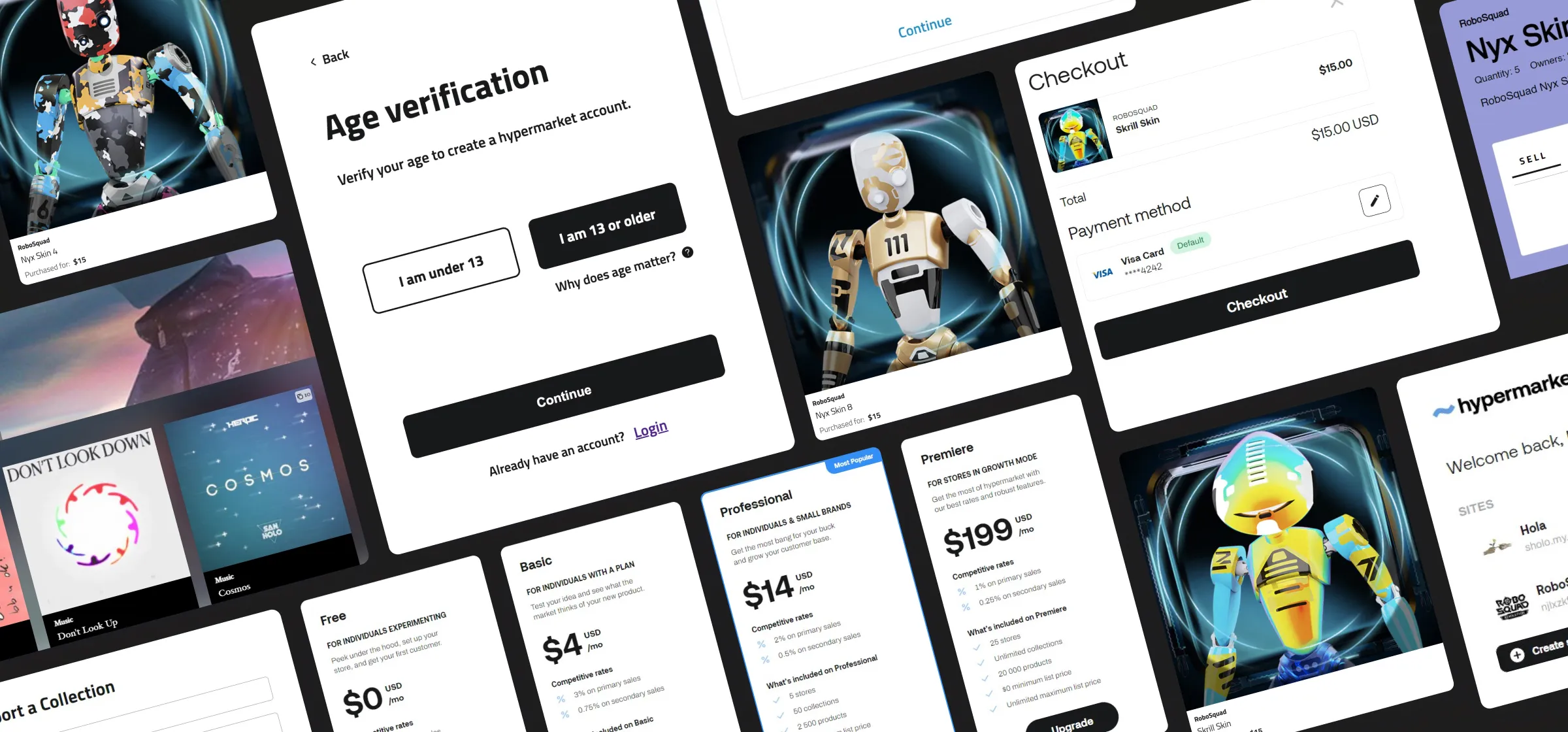

Hypermarket

Hypermarket — Blockchain-based e-Commerce platform

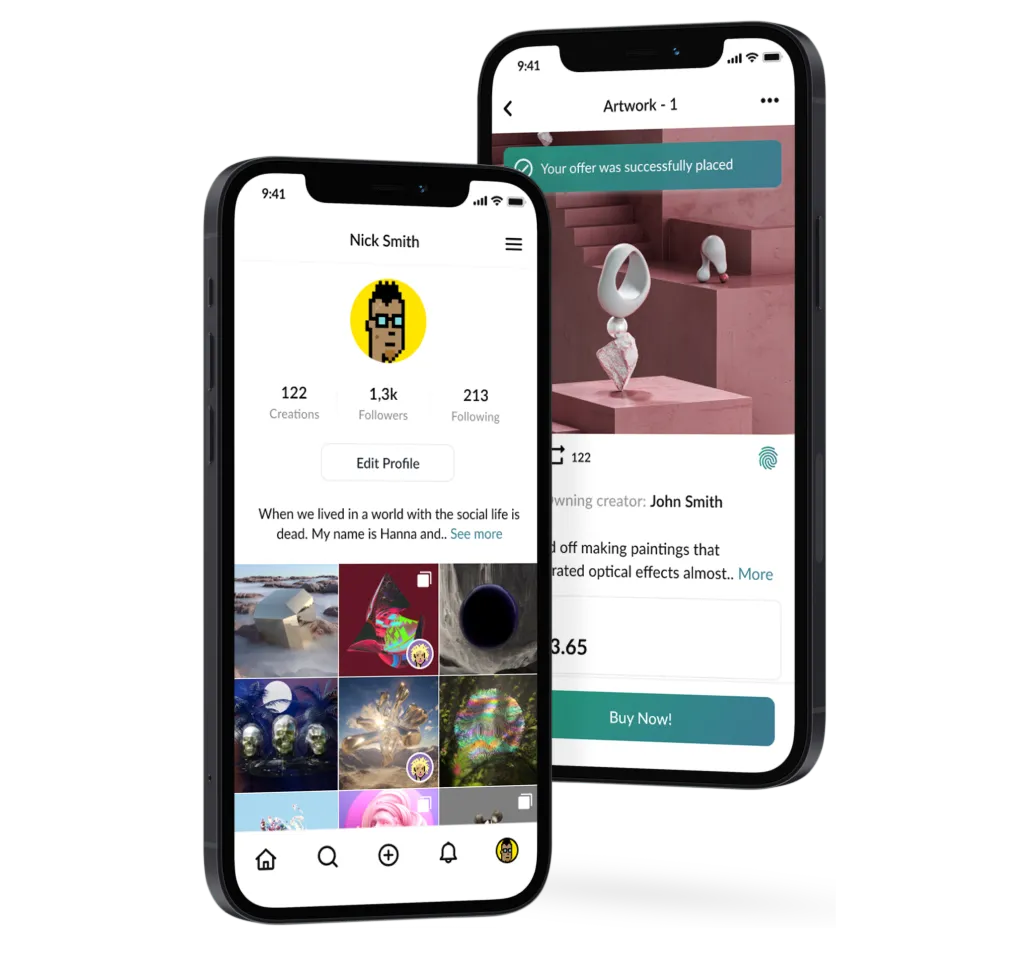

Creato Ranch

Social network and NFT Marketplace combined platform

eToro (Good Dollar)

Blockchain revolutionizing global distribution & basic income

NDAX.io

Cryptocurrency exchange platform for secure trading

FAQ

- Fractionalization: Allows for greater accessibility and divisibility of real-world assets.

- Increased Liquidity: Makes traditionally illiquid assets more tradable on a global DeFi marketplace.

- New Investment Opportunities: Opens doors for investors seeking diversification and alternative asset classes.

- Potential for Efficiency: Streamlines processes like asset management and trading.

The regulatory landscape for RWA tokenization is evolving. We stay up-to-date on relevant regulations and can guide you through the compliance process.

The timeframe can vary depending on the complexity of the project and regulatory requirements. But it typically takes between 2 to 6 months. We’ll provide a detailed timeline during the consultation process.

The costs associated with RWA (Real-World Asset) tokenization can vary widely based on factors such as asset type, regulatory compliance, technology stack, and service provider fees. Typically, expenses include legal fees, platform development, smart contract creation, and ongoing management costs.

Do you want to start a project?

Meet us across the globe

United States

66 W Flagler st Unit 919 Miami, FL, 33130

Europe

109 Borough High St, London SE1 1NL, UKProsta 20/00-850, 00-850 Warszawa, Poland

Vasyl Tyutyunnik St, 5A, Kyiv, Ukraine

Av. da Liberdade 10, 1250-147 Lisboa, Portugal