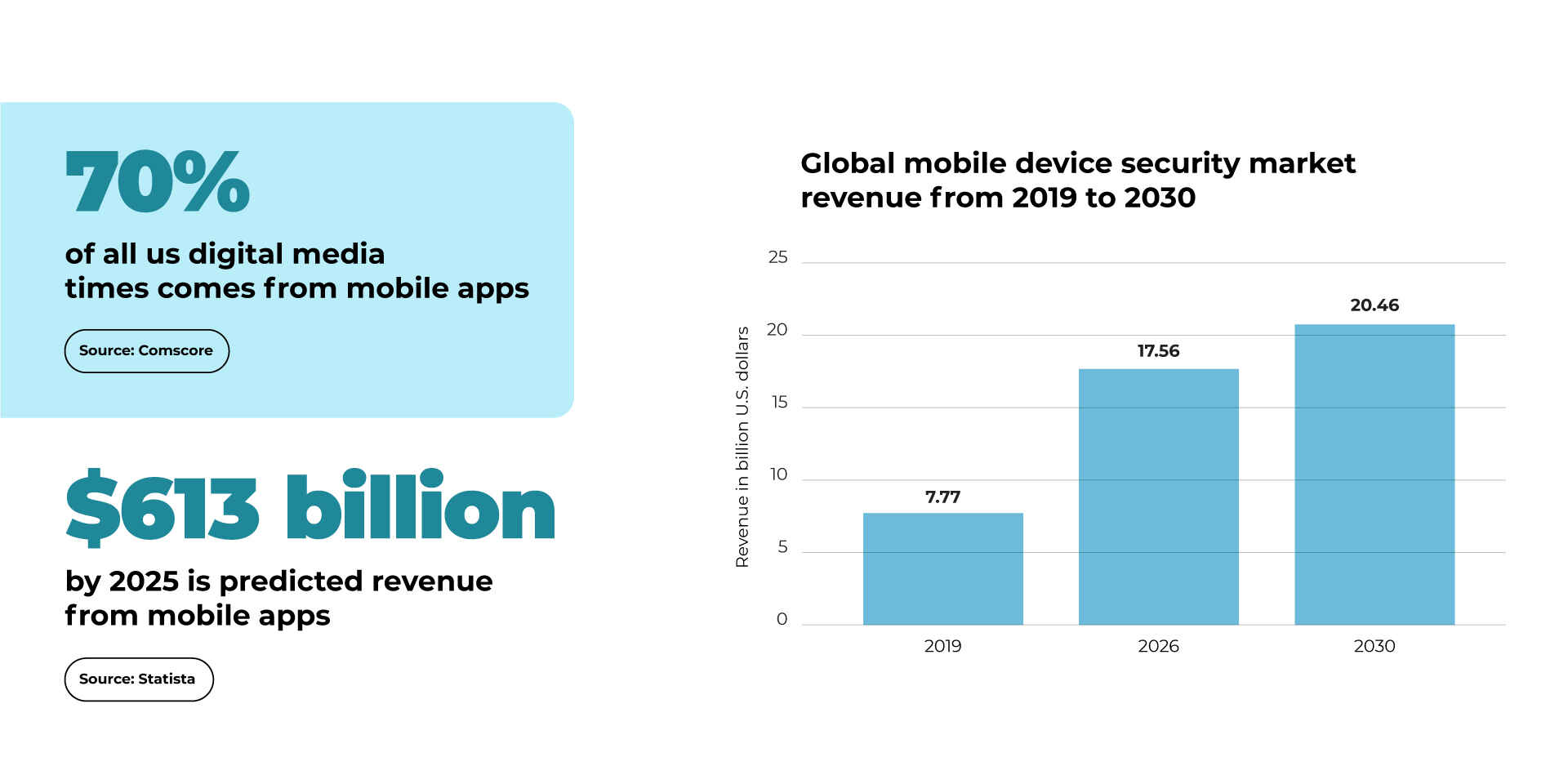

The popularity of finance apps has been on the rise, and for good reason. With the convenience of managing finances on the go and the growing demand for personalized financial services, this application type has become an essential tool for millions worldwide. Accordingly, financial businesses can benefit from enhanced cash flow from a constantly growing audience.

In fact, a report by Sensor Tower revealed that finance app downloads increased by 15% in the first half of 2021 compared to the same period in 2020. As more people turn to finance apps to manage their finances, the market opportunity becomes more evident, and more players want to benefit from the demand.

At WeSoftYou, we believe in the power of knowledge-sharing: our case-proven expertise in fintech application development lets us share industry-related insights in this article. In this piece, we’ll discuss the top-priority things to consider when creating a finance app that will stand out in a crowded market, gain new audiences of users, and promote your company.

1: Understanding User Needs

“To understand a user, one must think like a user”: this crime-shows-mocking postulate precisely reveals the key way to achieving a smooth user experience and the right direction towards building an interface that caters to the target audience’s needs.

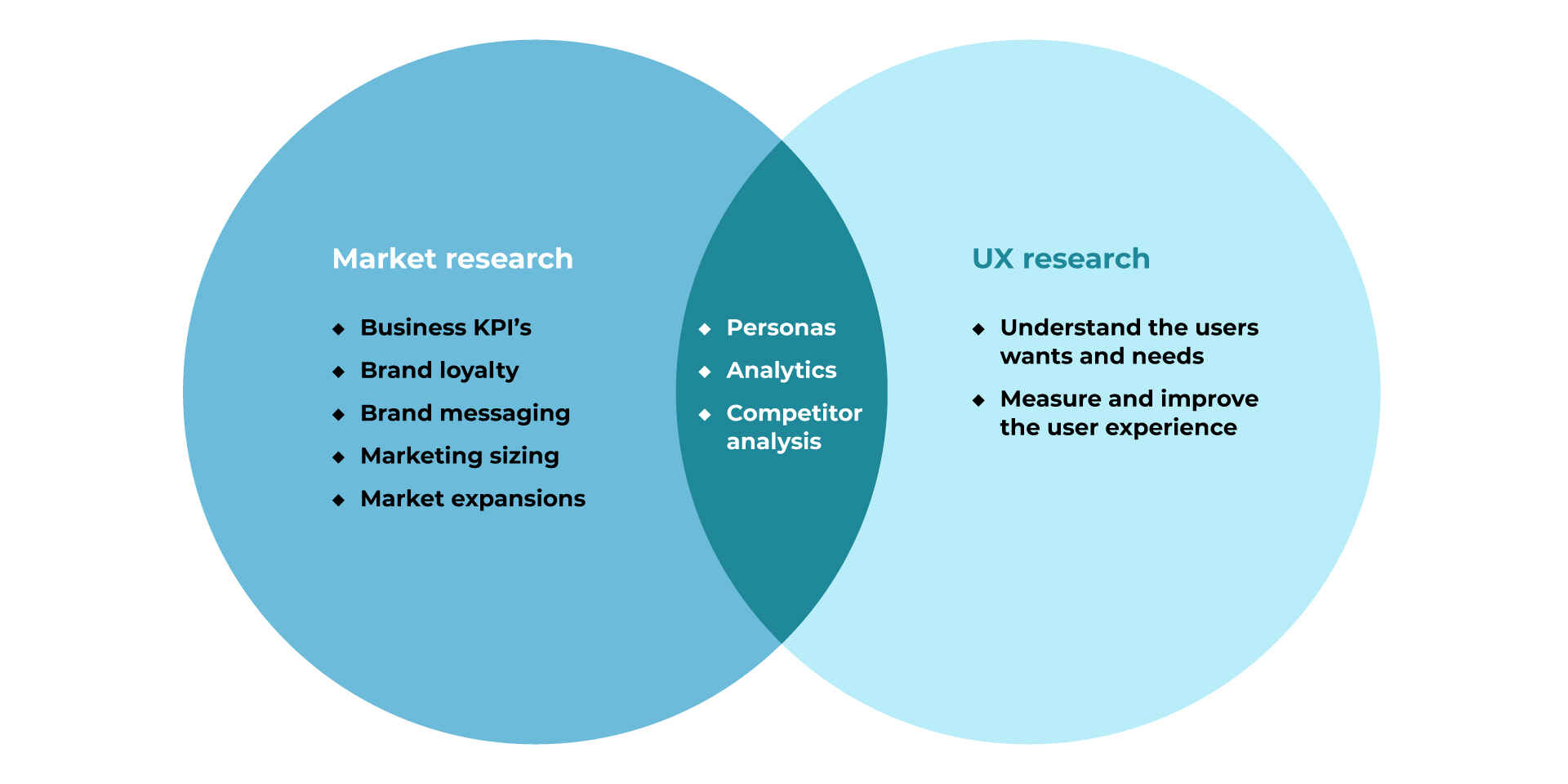

One way to understand user needs while creating a personal finance app is to conduct UX research. What does it mean?

UX research dives into users’ interaction with your product or service, motivations, and actions. In terms of UI/UX design, UX research is the most crucial part of user research, which involves gathering insights directly from potential users through surveys, interviews, and usability tests.

Ultimately, UX research helps understand what the user wants and needs and assists in measuring and improving the user experience. Conducting it helps the design team identify user preferences and pain points and design an app that meets their needs and expectations.

Sometimes, people mix up UX research with market research. Indeed, they have a lot in common, for instance, similar methods (surveys, focus groups, interviews, competitors’ analysis) and operating in similar deliverables (gathering analytics, identifying user personas, conducting competitors’ research). However, there is a thin line distinguishing them: diverse starting points and focus on various goals.

UX research focuses on how consumers engage with, are motivated by, and behave inside your product or service. UX can occasionally include market research. Depending on your ultimate objective and the stage your product is at.

UX research is actually one of many ways to understand user needs. Additionally, you can analyze user data, such as transaction history, spending habits, and investment preferences. This data provides valuable insights into user behavior and help developers identify areas where their app can provide the most value. However, combining these two approaches will deliver the most fruitful results, faster time-to-market, and cut development costs.

2: Choosing the Right Features

One of the results of proper UX research is the possibility of including the features your user needs to complete their user path successfully. The more valuable features you enclose in your final product, the better the user response – hence the better user retention and attraction rates.

Top important features in the financial app

There are certain features that users expect to see in budgeting apps: they are essential to the user experience and should be in any personal finance app. Let’s see what constitutes the average gentleman’s kit.

Account aggregation

Let users view their financial accounts in one place, providing a comprehensive view of their finances.

Transaction tracking

Allow users to monitor their spending habits, identify areas where they can cut back on expenses, and track their progress toward their financial goals.

Budgeting tools

Help users manage their money effectively by setting and tracking a budget, categorizing expenses, and identifying areas where they can save money.

Bill payment

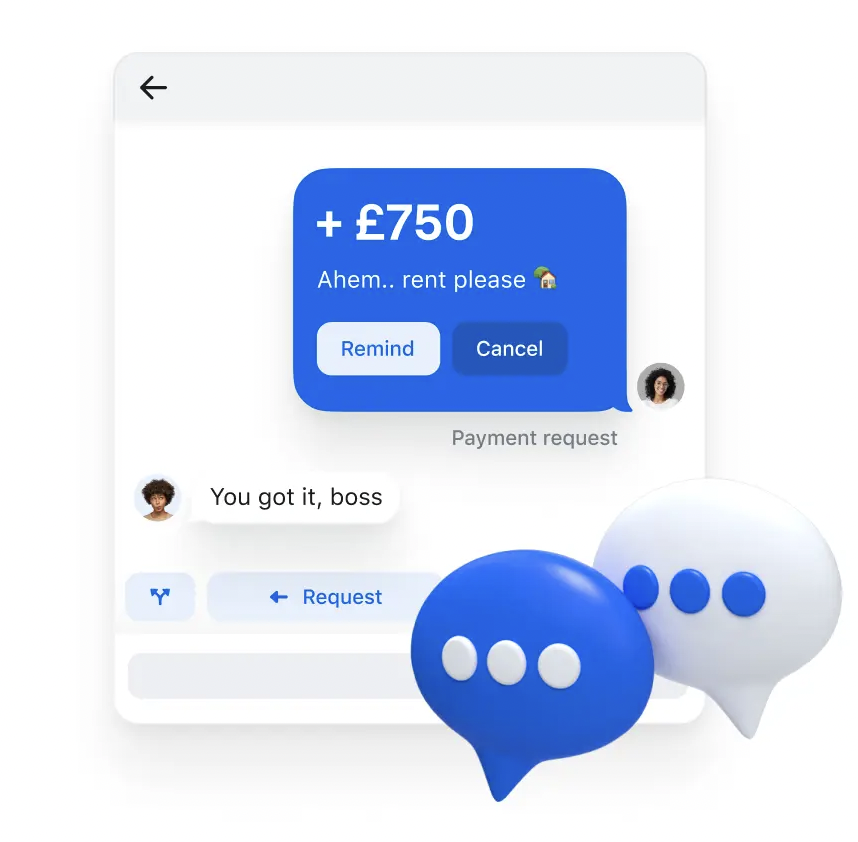

Enable users to pay their bills directly from the app, reducing the risk of missing payments and incurring late fees.

Investment tracking

Let users track their investment portfolios, view performance, and make informed investment decisions.

Alerts and notifications

Keep users informed about their account balances, payment due dates, and other important financial information.

Personalization

Allow users to customize the app to their needs and preferences, such as setting financial goals, categorizing expenses, and receiving personalized recommendations.

Security features

Critical for a finance app, including data encryption, multi-factor authentication, and fraud detection and prevention tools.

Successful personal finance apps and their key features

Let’s see what features make different budgeting apps stand out.

Mint

A popular personal finance app that allows users to view all of their financial accounts in one place, including bank accounts, credit cards, and investments. It provides budgeting tools, categorizes expenses, and sends alerts for bill payments and unusual spending.

One of Mint’s specialty features is its ability to provide personalized recommendations for financial products and services based on a user’s spending habits.

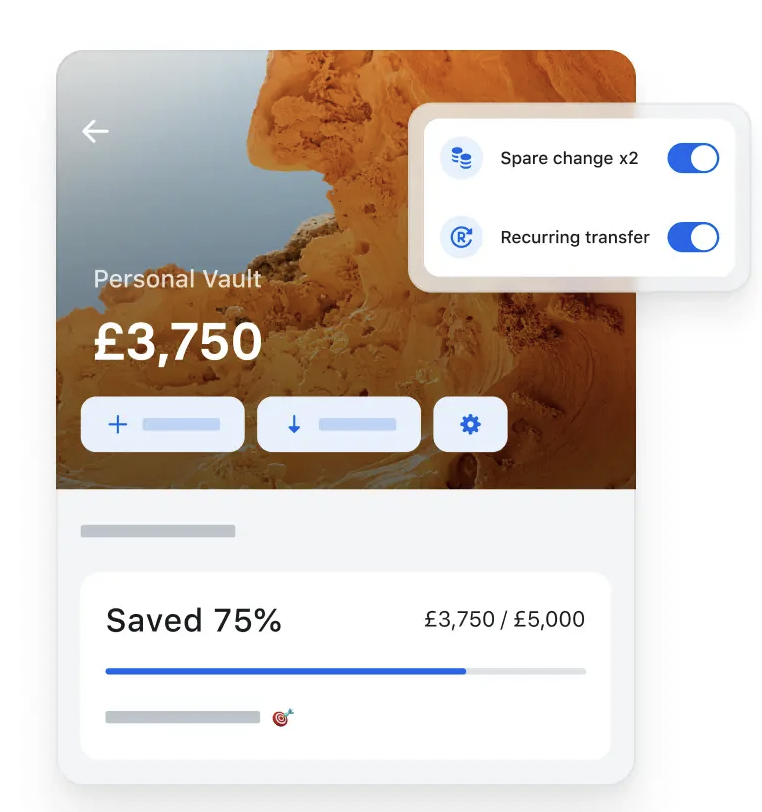

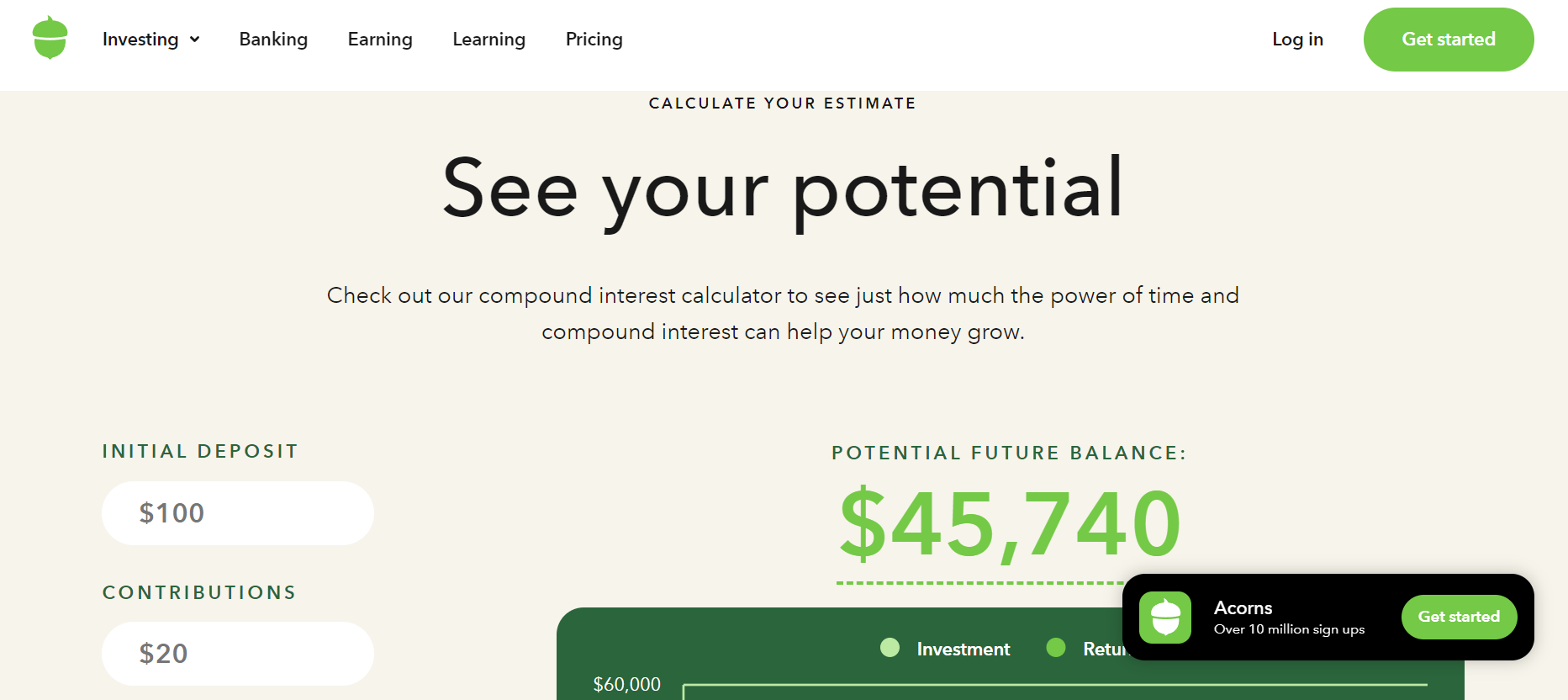

Acorns

An app that allows users to invest their spare change by rounding up their purchases to the nearest dollar and investing the difference. It also provides investment tracking tools and educational content to help users learn about investing.

YNAB (You Need a Budget)

A budgeting app that uses the zero-based budgeting method to help users assign every dollar a job and track their spending. It allows users to set financial goals, import transactions and provides educational resources to help users improve their financial literacy.

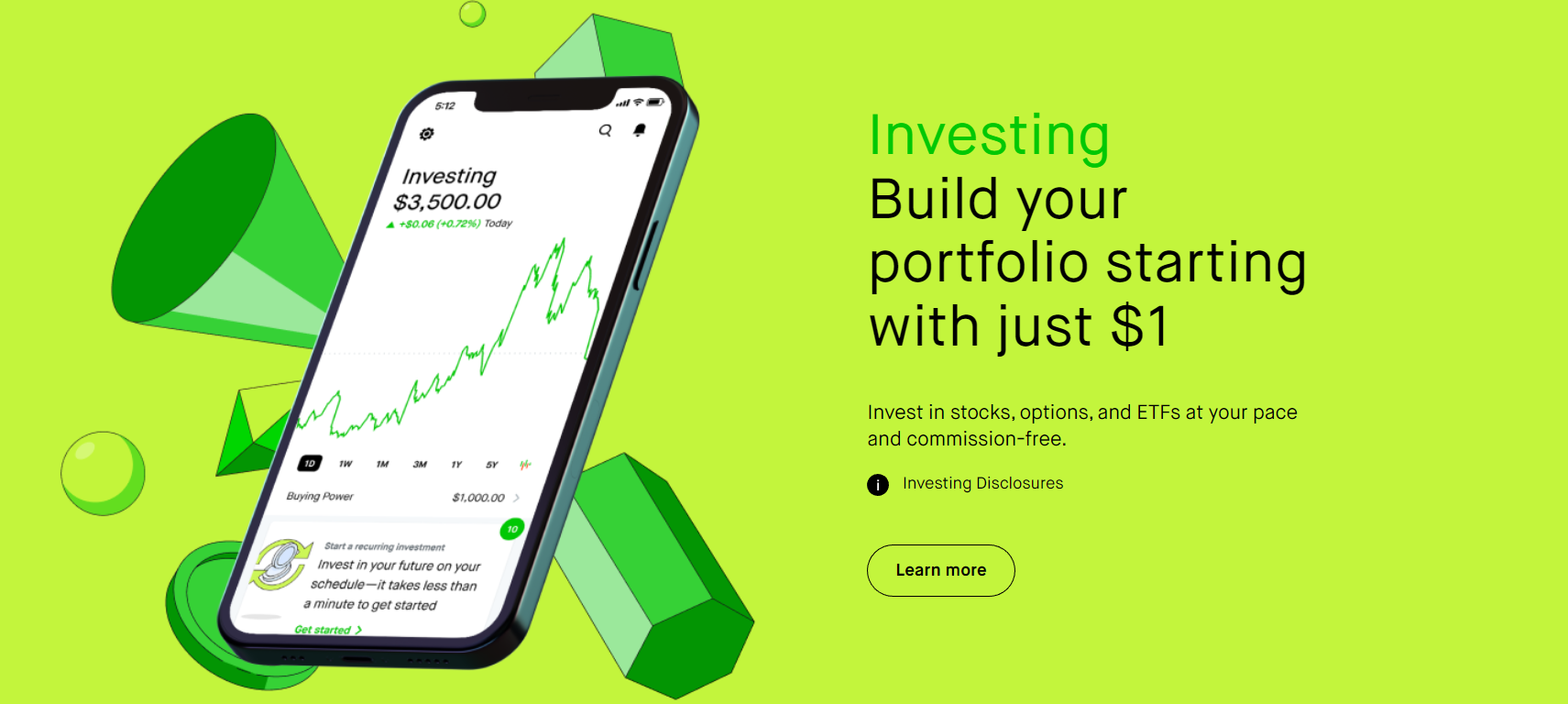

Robinhood

This application allows users to invest commission-free in stocks, ETFs, and cryptocurrencies. It provides real-time market data, personalized news and notifications, and the ability to set up custom watchlists.

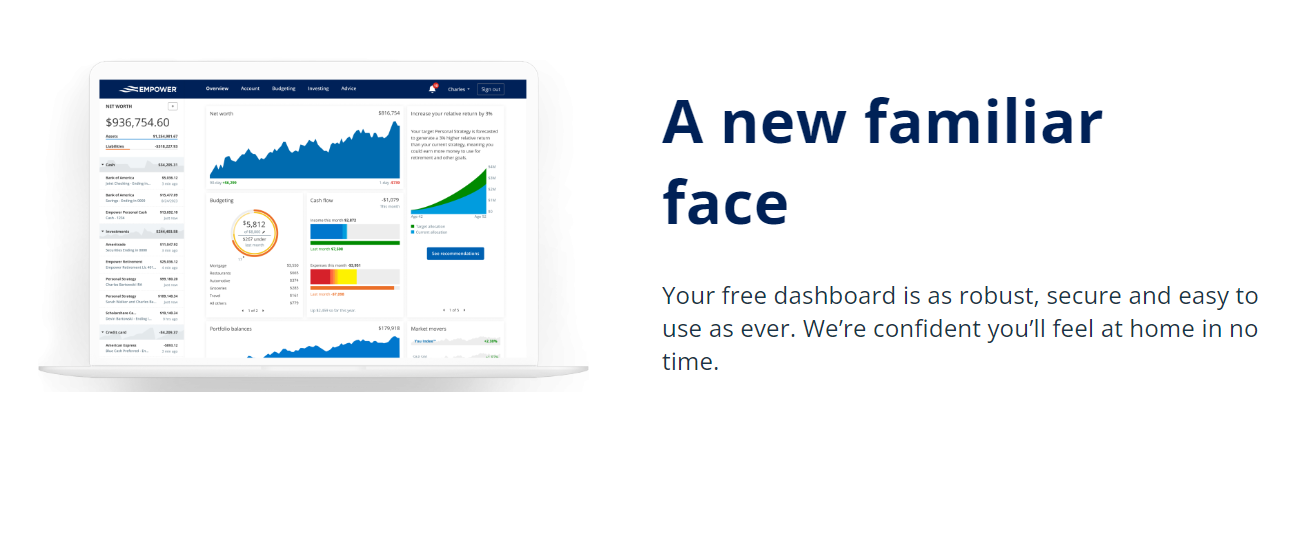

Personal Capital (Empower)

A money management app that provides investment management services and financial planning tools. It lets them track their net worth, view their portfolio performance, and receive personalized investment advice.

3: Ensuring Security and Privacy

Safety is a must for comfort: it is positioned at the bottom of Maslow’s hierarchy of needs. Without any surprise, it holds the same important place in mobile development and especially while creating a personal finance app. Mobile app security is becoming increasingly crucial as smartphones replace wallets, photo albums, and ID cards.

Most necessary security steps to take

Your unarguable obligation as a financial app developer is to take steps to protect their data and ensure the app meets industry standards and regulations. Let’s see some steps you can take in that role to provide your users with security and privacy.

Provide data encryption

Encrypt all user data, both in transit and at rest: this is how you will prevent unauthorized access to sensitive information.

Ensure user authentication

Your app should require users to authenticate their identity through strong passwords or biometric authentication such as fingerprint or facial recognition. Much like encryption, this helps to prevent unauthorized access to the app and its data.

Comply with regulations

Financial apps must comply with various regulations, including data protection regulations such as GDPR and CCPA, as well as industry-specific regulations such as PSD2. Compliance with these regulations helps to ensure that user data is handled securely and responsibly.

Conduct regular security audits

Regular security audits help identify vulnerabilities and ensure the app is secure. It can involve internal audits as well as third-party audits by security experts.

Provide a transparent privacy policy

Financial apps should have a transparent privacy policy that outlines how user data is collected, stored, and used. Clear regulations help you build trust with users and demonstrate a commitment to their data privacy.

Legal and ethical considerations of collecting and storing user data

When it comes to the moral perspective of data storage, the most evident (and relevant) thing to talk about in this regard would be the General Data Protection Regulation, widely known as GDPR. It’s one of the fundamental EU regulatory compliance frameworks on data protection, which applies to the data controller or software developers creating digital products. Basically, every responsible software development company (like WeSoftYou, for example) not only complies with the GDPR demands but is obligated to do so by law.

Speaking shortly, GDPR has seven key principles.

A couple of questions the GDPR pact leaves open covers the exact time the data is stored and who will have access to it.

Although the GDPR mandates that data be stored for the shortest possible time, things are not always as cut and dry in reality.

Considering this, evaluate the following:

- Do you need to keep this data at all? Has it already served its purpose?

- Should the data be anonymized if you’ve decided to keep it?

- Do you keep outdated or unnecessary data on file? Could this be producing incorrect insights that result in biased and subpar decision-making?

- How frequently will you evaluate the saved information to determine whether it still needs to be kept?

When it comes to those who have access to the user’s data, it’s important to remember not only about absolute integrity (and technical moments that help achieve it) but also the priority of the users’ will – meaning that a user is always eligible for asking to erase their data and expect it to happen unquestionably.

In light of this, there is an apparent conflict between protecting data and ensuring that those who need to see it have access. Yet, data is essential because it allows us to get insights that help us provide better services or cut costs.

It would help to answer the following questions:

- How can you balance the data you hold regarding security, privacy, and access?

- Do you have a strategy for granting different degrees of access to data so that it may be used efficiently and morally inside your organization?

- How soon may data subjects obtain the information they need if they make a request?

4: Creating a User-Friendly Interface

In terms of things to consider when creating a finance app, creating a user-friendly interface is a logical next phase after conducting the UX research and identifying the set of right features. Putting the app idea into the actual design is what comes before development – and it’s necessary to make sure your product’s physical embodiment will look appealing, clean, understandable, and engaging.

In this chapter, we will refresh the basic principles of a winning UI/UX design and look at the best-designed fintech apps based on WeSoftYou’s taste.

Top-6 great UI postulates

WeSoftYou gathered some advice from our designer team leads that will direct you towards better design decisions and hint at what to look for regarding your future app’s UI/UX goals.

Keep it simple

A simple and intuitive interface can make it easier for users to navigate the app and find the information they need. Avoid cluttering the interface with too many buttons, menus, or features within a single page.

Consistency

A consistent interface across the app can make it easier for users to navigate and understand how it works. Use consistent language, icons, and design elements throughout the app.

Accessibility

Make sure the app is accessible to users with disabilities by using clear, easy-to-read fonts, high-contrast colors, and accessible design elements.

Navigation

Straightforward and intuitive navigation can help users find the features they need quickly and easily. A clear menu structure and intuitive icons help users navigate the app.

Feedback

Give users feedback when interacting with the app, such as a confirmation message when a transaction is completed. This can help users feel more confident in using the app.

Customization

Allow users to customize the app to their preferences, such as choosing a preferred language or color scheme. This can help users feel more connected to the app and increase their engagement.

Our selection of personal finance apps with great UI

At WeSoftYou, we believe that personal finance management has to be as understandable and accessible as possible. Let’s take a closer look at how the apps we discussed earlier bring this principle to life.

Robinhood

Robinhood’s sleek and intuitive interface allows users to buy and sell stocks and other investments easily. It uses a simple color scheme and clear icons to make it easy to navigate the app.

YNAB

YNAB (You Need A Budget) has a clean and simple interface that makes it easy for users to create and manage a budget. The app uses a color-coded system and clear design elements to help users understand their financial situation at a glance.

Spendee

Spendee has a colorful and engaging interface that allows users to track their expenses, create budgets, and manage their money. The app uses bright colors and simple design elements to make it easy to use.

PocketGuard

PocketGuard has a clean and modern interface that allows users to track their spending, create budgets, and save money. The app uses clear graphics and charts to help users understand their financial data and make smart financial decisions.

5: Testing and Iteration

Testing is the last step before deployment: this is the threshold where things are reviewed, both tech stack- and user-wise. This stage often feels like pins and needles, so we gathered some advice to help you relieve chills for a moment and get prepared without rushing.

Don’t skip UX research

We spoke about the role of UX research and its importance earlier, but the talk about testing is a great place to emphasize one more of its benefits. Apart from giving a clear understanding of what designers and developers can put an emphasis on, UX research also helps avoid numerous iterations at the stage of testing and development.

While, of course, some degree of testing and iteration is still necessary even with thorough research as no app can be perfect from the outset, numbers-wise, conducting one may reduce up to 40-50% of the work that would inevitably be redone, as stated in the report “The Cost of Poor Requirements in Software Development,” published by the IEEE Computer Society.

Follow Agile methodology

One of the key benefits of Agile practices during testing is that they help teams catch issues early on in the development process. By breaking development into smaller, more manageable tasks and testing frequently, teams can identify and fix problems before they become major roadblocks. This way, you reduce the rework required later in the development process, saving time and resources.

Another benefit of Agile practices is that they facilitate collaboration and communication between team members. By involving everyone in the testing process, teams can share ideas and identify potential issues more quickly. This helps ensure everyone is on the same page and working towards the same goals.

Use proven testing methodologies

Among things to consider when creating a finance app, one of the milestones ones includes selecting the right testing methodology. Let’s shortly review the most widespread ones.

Beta-testing

Beta testing involves releasing a pre-release app version to a select group of users to test its functionality, usability, and overall performance. This group of users is often referred to as beta testers, and they are typically chosen based on their demographic and behavioral characteristics.

During the development process, beta testing can help identify any bugs or glitches in the app before it is released to the public, as well as gather feedback from users to make improvements.

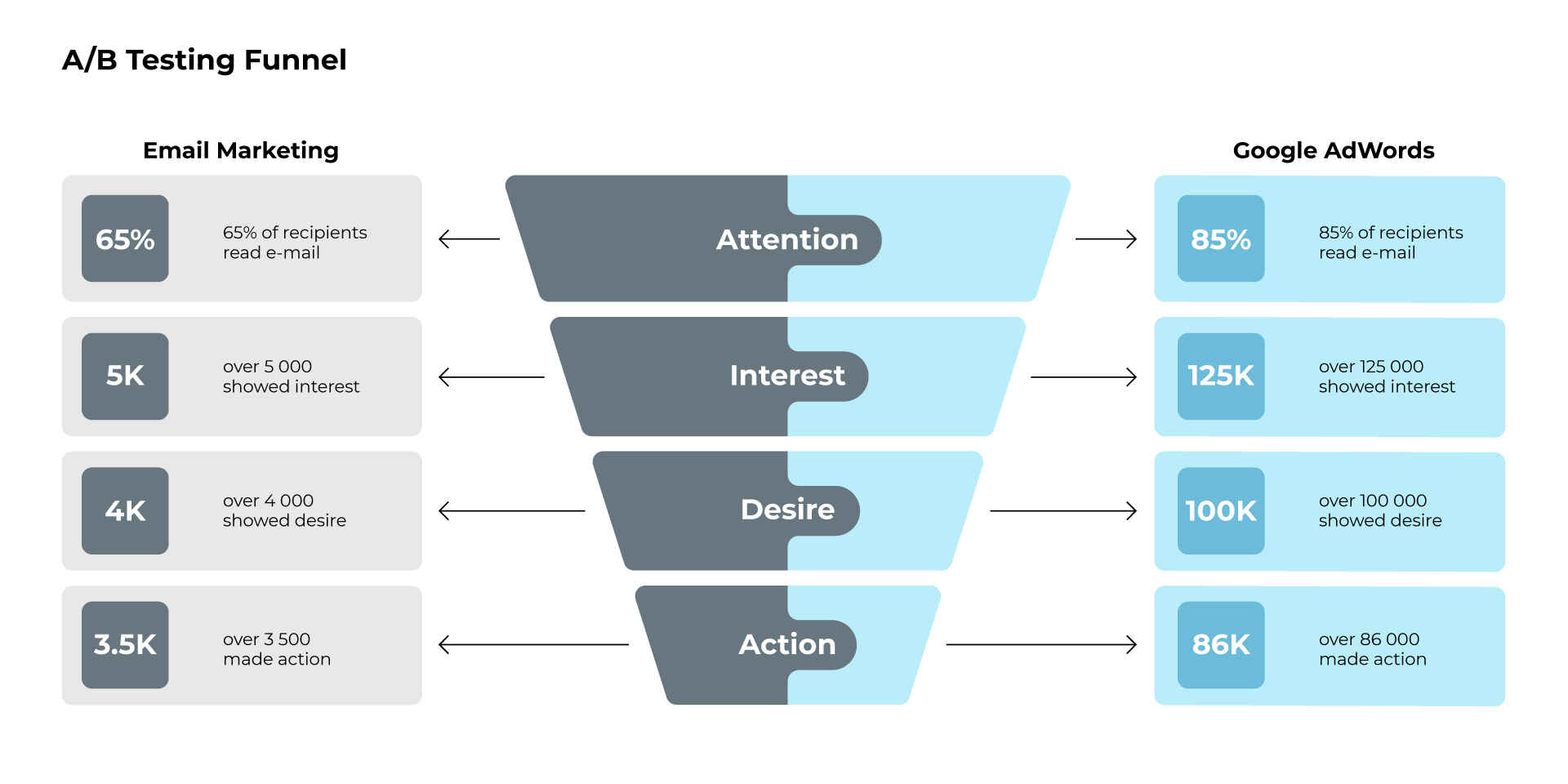

A/B testing

Conducting A/B testing means comparing two app versions to determine which is more effective in meeting user needs. This testing type is typically done by randomly assigning users to either version A or version B of the app and measuring their behavior and responses.

A/B testing can help developers identify which design or feature changes are most effective in improving the app’s performance and meeting user needs.

Usability testing

Usability testing suggests observing users as they interact with the app to identify any usability issues and gather feedback on its design and features. This can be done through one-on-one interviews or by setting up focus groups.

Build a fintech app with WeSoftYou

Let WeSoftYou give you a hand in creating a finance app: having over six-year experience behind our backs, we’ve helped more than 75 clients achieve their technology goals. Check out our most prominent portfolio cases:

NDAX.io

NDAX, a Canadian-based digital asset exchange, is designed for individual and institutional investors. Being the first nationwide exchange, it conforms with Canadian banking laws and upholds the strictest security guidelines.

While developing the application, we integrated banking partnerships to provide better cryptocurrency trading: it offers a wide selection of assets, ensures quick operations, and provides strong security (smooth and user-friendly ID verification process). Legal-wise, we also worked on enabling complete security following Canadian banking laws and AML guidelines.

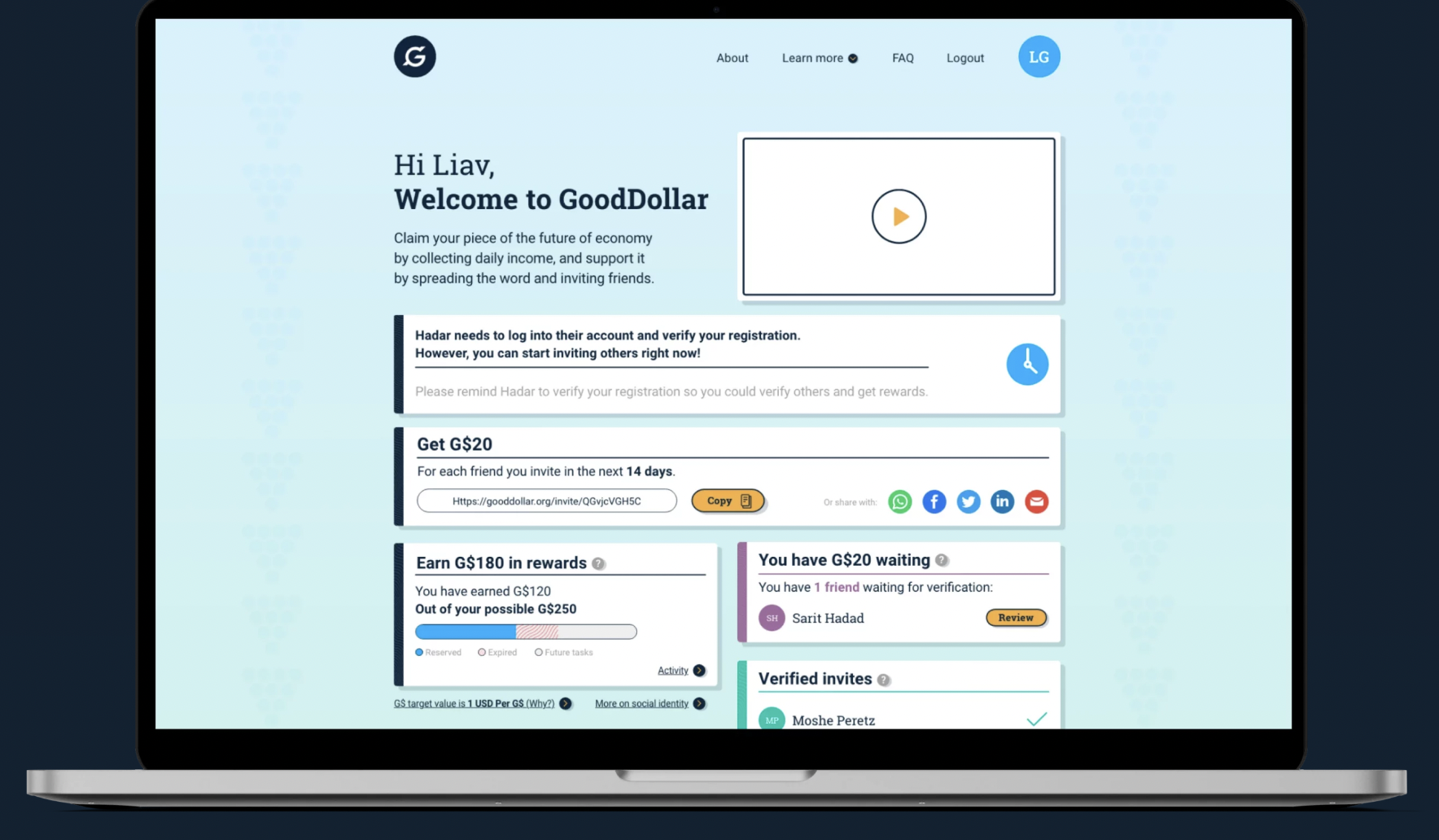

Good Dollar

Global basic income creation, financing, and distribution are the goals of the GoodDollar system, a blockchain-based project that leverages the trickle-up value of money. By providing a universal basic income (UBI), it establishes a minimum standard of living and lessens economic inequality.

Features-wise, we integrated GoodDollar with a recipient’s cryptocurrency wallet and 4 marketing analytics tools, designed a real-time user dashboard, and provided a custom invitation referral model.

To maintain security, our team implemented visitor screening kiosks. Additionally, we introduced a cryptocurrency wallet to the platform to guarantee equitable income distribution. Our technical team prioritized KYC requirements while still giving each client a personalized touch in this way.

Final word

The whole is greater than the sum of its parts. While thoroughly understanding the five key qualities that any fully-functional personal finance management software has to include, simply putting them together won’t get you a great app that will take you ahead of the competition. What will, however, is a responsible team of professionals who will shape the app requirements, deliver a clean UI/UX, and write consistent code, taking you through the entire SDLC while staying on the same page with you every step of the way.

Being a Top-5 Growing Companies List representative, WeSoftYou has developed many successful projects across multiple industries. You can rely on our expertise in creating a financial solution for your company: as a Clutch-recognized B2B sector top app developer, we work with personal finance app development on a full-cycle model, staying with you both throughout MVP development and scaling your solution.

Need help creating a finance app? We’re here to guide you and turn your ideas into reality. Contact us to book a consultation and start working together.

FAQ

A good financial app should be easy to use, secure, and have comprehensive features. It should have a simple and intuitive interface that even non-financial experts can understand.

To protect sensitive information, it will be necessary to implement encryption technology and features such as two-factor authentication at the development stage.

In an interface and features aspect, a good personal finance app should have a variety of features like budgeting tools, expense trackers, bill payment reminders, investment tracking, and retirement planning. It also should allow users to link their accounts from different financial institutions, making it easier to manage their finances.

Finally, the development team must regularly update the app with new features and improvements. At the same time, the stakeholders should provide customer support so that users can get help with any issues they may encounter.

Personal finance apps make money in several ways.

They may charge a subscription fee for premium features such as advanced budgeting tools, financial coaching, or investment analysis. Some apps charge transaction fees when users make purchases or transfer money through the app.

Financial applications may also earn commissions by referring users to financial institutions or other companies. Their software can analyze user data to provide valuable insights and recommendations to companies, making money through data monetization. Some apps display ads to users, earning money based on clicks or impressions.

While not all personal finance apps use all these revenue models, some rely on just one or a combination of these methods.

Finance apps provide users with a range of tools and features to help them manage their finances more effectively. They can be used on a computer, tablet, or smartphone and typically connect to a user’s bank accounts, credit cards, and other financial accounts.

Once the user has connected their accounts, the app can automatically track and categorize their transactions, helping them understand where their money is going. The app may also offer budgeting tools, allowing users to set spending limits for different categories and track their progress toward their goals.

Many finance apps also provide investment tracking, allowing users to monitor their investment portfolios and track their performance over time. Some apps offer investment advice and tools to help users make informed investment decisions.

Finance apps can also help users manage their bills, sending reminders and notifications when bills are due and allowing users to pay bills directly through the app.