Financial institutions spend an average of $150 million annually on KYC and client onboarding processes. For some larger institutions, this budget can reach $500 million, says a report by Thomson Reuters. Furthermore, 85% of financial businesses find KYC a major pain point, with 12% of companies saying it takes over three weeks to onboard a new client.

What if there was a way to streamline KYC while also enhancing security? Go blockchain! Blockchain KYC solutions offer a decentralized, secure, and efficient way to verify identities without intermediaries like banks or governments.

In this article, we’ll explore the best KYC blockchain solutions on the market, look into how they can help your business save time and money while ensuring compliance with regulations, and share WeSoftYou’s expertise based on 3+ years of providing Web3 software development services. These solutions can revolutionize the way you verify identities and onboard clients. It works for many industries, including finance, healthcare, fintech, etc. That may be the answer if you’re looking for a reliable onboarding process or want to get rid of endless paperwork.

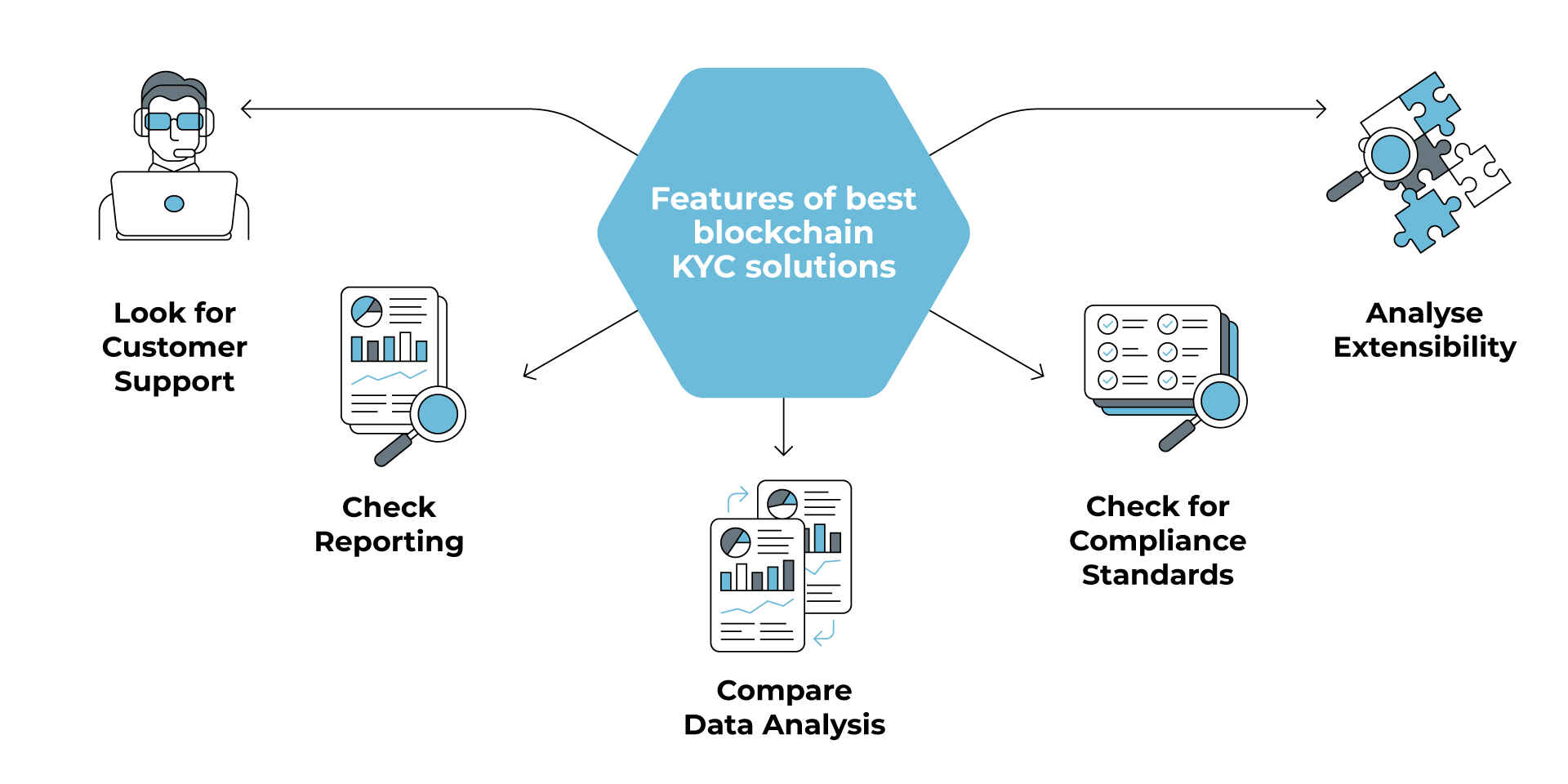

How to Choose a KYC Solution: Points to Consider

One might think that today’s fintech products supply has an ultimately high threshold of quality and compliance. Of course, developing a great product is in any software development company’s primary interest. Still, financial institutions have spent over $300 billion since 2008 on enforcement proceedings, as of 2018.

How to choose a proper blockchain-based KYC solution? To begin with, let’s determine the necessary features starter pack and see what implementing each of them gives the platform.

Feature 1: Look for Customer Support

In any given blockchain KYC platform, customer support ensures that businesses and their customers receive timely and effective assistance in case of any issues or queries related to the platform.

It goes not only about basic client care properties like providing positive user experience and build trust with customers. When it comes to blockchain-based KYC, one of the critical roles delegated to client care is ensuring compliance with regulatory requirements. For example, suppose a client is having difficulty completing the KYC process. In that case, a customer support representative can assist them in providing the necessary documentation or answering any questions they may have, ensuring that the business remains compliant with relevant regulations.

In a nutshell, for customer support to work properly, the onboarding process has to include the client care specialists training not just in product but a handful of legal aspects that may confuse users. Doing this will reduce the number of errors or mistakes caused by human factors. In turn, it will grow product loyalty and retention rate and positively influence compliance.

Feature 2: Check Reporting

Efficient reporting allows blockchain KYC platforms to generate reports and analyze data related to their efforts. It enables tracking and monitoring the progress of these activities, gaining insights into the level of risk associated with their customers, and identifying potential issues or areas for improvement. Later on, you can use this information to make more informed business decisions, allocate resources more effectively, and mitigate financial crime risks.

Accordingly, in blockchain KYC solutions, the reporting feature should provide various types of reports:

- summary reports that show an overview of KYC compliance efforts,

- customer risk assessment reports that highlight the level of risk associated with specific customers,

- transaction monitoring reports that track suspicious activities or potential instances of money laundering.

Besides helping client businesses comply with KYC-related regulatory requirements, reporting can also support internal auditing and governance purposes. By providing real-time insights into KYC activities, the reporting feature can help the platforms in question to identify potential compliance gaps or areas for improvement and take corrective action.

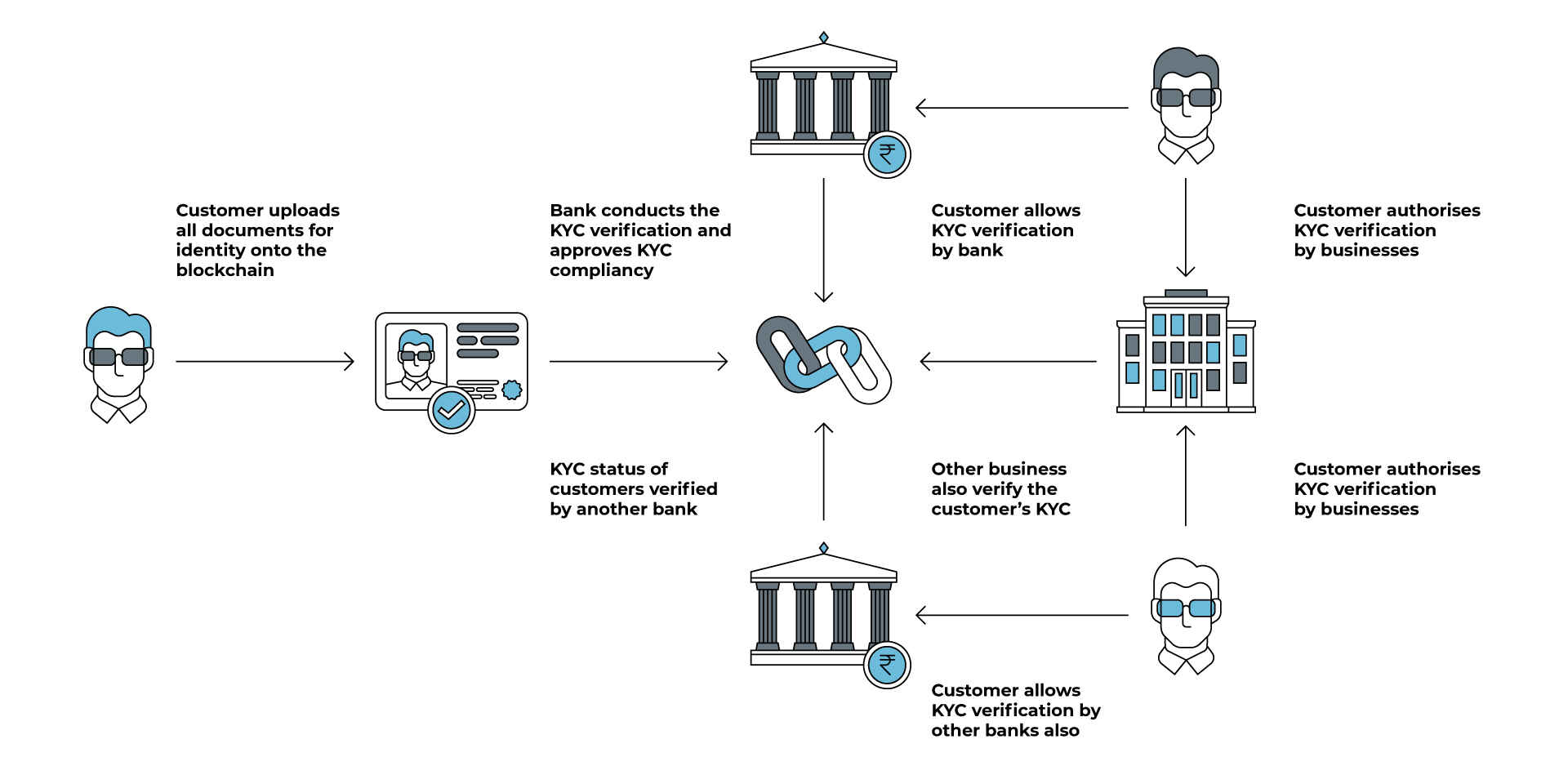

To understand reporting better, let’s look at how the KYC process takes place on the blockchain.

Feature 3: Compare Data Analysis

Data analysis allows businesses to extract insights from the vast amounts of data generated during the KYC process. With this feature, clients can leverage the power of data analytics and artificial intelligence to gain deeper insights into customer behavior, identify trends, and detect potential instances of financial crime. By analyzing customer data in real time, businesses can make more informed decisions, improve customer experiences, and mitigate risks associated with financial crime.

The data analysis feature can provide companies with various tools, such as machine learning algorithms and natural language processing capabilities, to extract insights from customer data. It allows businesses to identify patterns and anomalies that may indicate fraudulent or suspicious activities, which can then be further investigated.

In addition to helping clients identify potential financial crime risks, providing data analysis can also be used to improve the overall efficiency of the KYC process. By automating specific tasks and using predictive analytics, the platform can reduce the time and resources required to complete the KYC process while ensuring compliance with regulatory requirements.

Feature 4: Check for Compliance Standards

The compliance standards of a blockchain-based KYC solution refer to the platform’s ability to adhere to various regulatory requirements and standards for customer onboarding and verification.

KYC compliance is critical for mitigating the risk of financial crime (e.g., money laundering and terrorist financing). Thus, businesses must ensure the KYC of their choice meets the required regulatory standards and guidelines. The latter are set forth by the Financial Action Task Force (FATF) and local regulatory bodies.

Building a compliant architecture for a blockchain-based KYC solution is an ultimate proof of a platform meeting these regulatory requirements. It can be realized, for instance, by providing businesses with a set of built-in compliance tools and processes: those are features like identity verification checks, watchlist screening, and risk assessments, among others.

By using a blockchain-based KYC solution that meets regulatory standards, businesses can reduce the risk of non-compliance, which can lead to legal and financial penalties, as well as reputational damage. It also enables companies to streamline their compliance processes, reducing the time and resources required to maintain compliance.

In addition to meeting regulatory requirements, the compliance standards feature allows businesses to adapt to changing regulations and standards. With a blockchain-based KYC solution, companies can quickly and easily update their compliance processes to meet new regulatory requirements, ensuring ongoing compliance.

Feature 5: Analyse Extensibility

Extensibility in a blockchain-based KYC solution refers to its ability to easily integrate and adapt to new technologies, services, and regulatory changes. Suppose a blockchain KYC solution in question is extensive. In that case, businesses using it can scale their KYC solution, customize it to meet their specific needs, and integrate it with other systems or applications.

Extensibility, in its essence, is scalability, which is its most significant benefit. As a business grows and its customer base expands, it may need to add new features and functionality to its KYC solution. The scalable KYC solution allows companies to easily do this without replacing their entire KYC solution.

Another benefit extensibility provides is customization. Each business has unique KYC requirements, depending on the type of industry they operate in and the customer base they serve. This feature allows companies to customize their KYC solution by adding or modifying features to meet their specific needs.

Integration is another crucial benefit of extensibility. Businesses often use multiple systems or applications to manage different aspects of their operations. The extensibility feature allows companies to integrate their KYC solution with these other systems, improving overall efficiency and reducing the risk of errors.

In addition, extensibility helps businesses stay up to date with changing regulatory requirements. KYC regulations are constantly evolving, and companies need to be able to adapt their KYC solutions to comply with new requirements. Businesses may simply adapt their KYC solution to suit new regulatory needs thanks to extensibility.

Top-5 KYC Solutions: WeSoftYou Selection

While navigating through top required features should be an ultimate guide towards great products, let us outline our top-5 best blockchain KYC solutions our tech team recommends using: both in KYB and KYCC types.

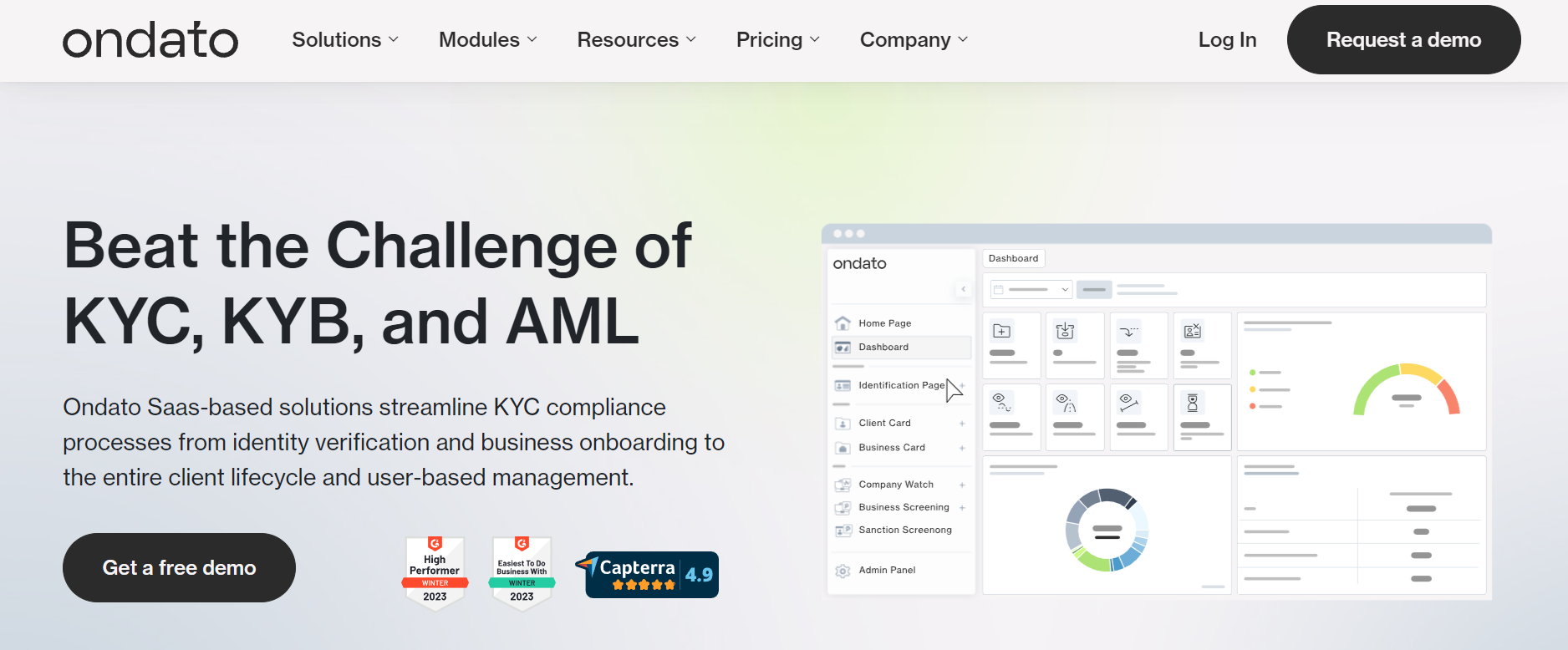

KYC Software Solution 1: Ondato

Ondato is a KYC platform that provides businesses with a comprehensive suite of tools to verify the identities of their customers. The platform uses a combination of biometric authentication and artificial intelligence to create a seamless and secure KYC process.

Some of the key features of Ondato as a KYC platform include:

Customizable workflows

Businesses can customize the KYC process to meet their specific needs, with the ability to add and remove verification steps as necessary.

Biometric authentication

The platform uses a range of biometric authentication methods, such as facial recognition and fingerprint scanning, to verify the identity of customers.

AI-powered document verification

Ondato uses artificial intelligence to verify the authenticity of customer documents, such as passports and driving licenses, with a high degree of accuracy.

Real-time monitoring

The platform provides real-time monitoring of all KYC processes, allowing businesses to identify and resolve any issues or potential fraud quickly.

Compliance with regulations

Ondato is compliant with a range of global KYC and AML regulations, such as GDPR, FINTRAC, and the US Patriot Act.

Overall, Ondato is designed to provide businesses with a fast, secure, and compliant way to verify the identities of their customers, while also providing a seamless user experience.

KYC Software Solution 2: Refinitiv

Refinitiv KYC is a platform that gives companies a complete set of instruments to do client due diligence and comply with regulations related to financial crime, such as anti-money laundering and counter-terrorist financing.

The Refinitiv KYC platform has several important functions, including:

Global coverage

The platform covers more than 200 jurisdictions worldwide, letting clients access a wide range of customer information and associated risks.

Automated workflows

The platform uses automation to streamline the KYC process, reducing the time and cost involved in performing due diligence on customers.

Customizable risk scoring

Refinitiv provides businesses with a customizable risk-scoring system that can be tailored to meet their specific needs and risk appetite.

Integration with other systems

The platform can be integrated with a range of other systems, such as anti-fraud and anti-money laundering tools, to provide a more comprehensive solution for managing financial crime risks.

Compliance with regulations

Refinitiv is compliant with a range of global regulations related to financial crime, including AML and CTF regulations.

With an emphasis on automation, customization, and regulatory compliance, the Refinitiv KYC platform is made to provide organizations with a complete solution for mitigating financial crime risks.

KYC Software Solution 3: ComplyAdvantage

ComplyAdvantage is a KYC platform that leverages advanced technology to provide businesses with an efficient way to perform due diligence on their customers and comply with regulations related to financial crime, such as anti-money laundering (AML) and counter-terrorist financing (CTF).

The ComplyAdvantage KYC platform’s main features include the following:

Real-time screening

The platform uses advanced algorithms and machine learning to screen customers and their associated risks in real time, providing businesses with up-to-date and accurate risk assessments.

Customizable workflows

The platform provides businesses with customizable workflows that can be tailored to meet their specific needs and risk appetite.

Availability worldwide

ComplyAdvantage covers more than 200 countries and territories worldwide, providing its clients with access to a wide range of information on customers and their associated risks.

Automated monitoring

The platform uses automation to monitor customers and their associated risks on an ongoing basis, helping businesses to identify and respond to any potential issues or threats quickly.

Compliance with regulations

ComplyAdvantage is compliant with a range of global regulations related to financial crime, including AML and CTF regulations.

The ComplyAdvantage KYC platform’s ultimate goal is to offer companies a robust and adaptable solution for controlling the risks associated with financial crime, emphasizing real-time screening, customization, and regulatory compliance.

KYC Software Solution 4: Onfido

Onfido is a KYC solution that uses advanced AI and machine learning technologies to provide businesses with a fast and efficient way to verify the identities of their customers. It builds the customers’ digital identity, killing two birds with one stone: complying with KYC, AML and CTF, as well as enhancing marketing information.

Some of the key features of the Onfido KYC solution include:

Identity verification

The platform uses advanced AI and machine learning algorithms to verify customers’ identities in real time, providing businesses with a fast and efficient way to perform due diligence on their customers.

Document verification

Onfido’s document verification system uses advanced image recognition technology to verify the authenticity of identity documents, such as passports and driver’s licenses.

Global coverage

The platform covers more than 190 countries worldwide, providing businesses access to a wide range of customer information and associated risks.

Customizable workflows

Onfido’s workflows can be customized to meet the specific needs and risk appetite of each business.

Compliance with regulations

Onfido is compliant with a range of global regulations related to financial crime, including AML and CTF regulations.

With a focus on cutting-edge AI and machine learning technologies, document verification, and regulatory compliance, the Onfido KYC solution is made to provide organizations a quick, accurate, and adaptable solution for minimizing financial crime risks.

KYC Software Solution 5: Trulioo

Trulioo is a KYC solution that offers businesses a powerful and flexible way to verify the identities of their customers and comply with rAML and CTF policies.

The Trulioo KYC solution includes a number of essential features, such as:

Global coverage

The platform offers coverage for over 5 billion people and 250 million companies in more than 195 countries worldwide.

Identity verification

Trulioo’s identity verification system uses advanced data sources and technology to verify customers’ identities in real-time, providing businesses with a fast and efficient way to perform due diligence on their customers.

Document verification

Trulioo’s document verification system uses advanced image recognition technology to verify the authenticity of identity documents, such as passports and driver’s licenses.

Customizable workflows

The platform provides businesses with customizable workflows that can be tailored to meet their specific needs and risk appetite.

Compliance with regulations

Trulioo is compliant with a range of global regulations related to financial crime, including AML and CTF regulations.

Enhanced due diligence

Trulioo’s Enhanced Due Diligence (EDD) solution provides businesses with additional insights and risk assessments on high-risk customers, such as politically exposed persons (PEPs).

On the whole, the Trulioo KYC solution is made to give businesses a strong and adaptable way to manage the risks associated with financial crime, with an emphasis on global coverage, cutting-edge identity and document verification technology, customization, regulatory compliance, and improved due diligence.

Build Reliable KYC Solutions with WeSoftYou

Best blockchain KYC solutions are not simply those that make your client drown a dozen of paperwork: the truly greatest platforms provide a set of instruments both for the business and the end client to submit a set of properly filled documents, track progress, provide data analysis and reporting, as well as lend a hand in any crucial or unclear matter.

Having a proper KYC solution matters for a myriad of reasons, but first and foremost, it’s about your business’s legal compliance and even safety: knowing your customer means knowing criminals, terrorists, or illegal bodies do not use your product.

Let WeSoftYou be your trusted professional in the complicated journey of integrating a KYC solution into your business. We can offer full-cycle blockchain development and integration services – all based on the extensive experience we had before: it’s our engineering team who’s responsible for the cryptocurrency exchange platform NDAX and blockchain-powered charity project GoodDollar.

NDAX

NDAX is a Canadian-based cryptocurrency exchange platform. Its main goal is to provide Canadians with a legal, compliant and secure way to trade crypto. In terms of compliance and KYC regulations, our team thought out a compliant solutions architecture. As a result, we completely complied with Canadian banking regulations and adhered to Canada’s highest security standards.

GoodDollar

GoodDollar is a framework powered by individuals that aims to generate, finance, and distribute a basic income globally. By creating a universal basic income (UBI), it establishes a minimum standard of living and mitigates wealth inequality. While developing this solution, we complied with standard SEC regulations.

Let us help you streamline the KYC routine and simplify it for your clients: contact us to discuss the specifics.

FAQ

Blockchain KYC solutions are Know Your Customer (KYC) solutions that use blockchain technology to verify and authenticate customer identities. Such solutions store customer data on a decentralized, immutable blockchain ledger, providing enhanced security and transparency. The solution typically involves using digital identity verification tools, such as biometric authentication, to verify customer identities. The solution may also use smart contracts to automate the KYC process and ensure compliance with regulatory requirements.

By using blockchain technology, blockchain-based KYC solutions can offer several benefits over traditional ones. These benefits include enhanced security, increased efficiency, better transparency, and lower operational costs. Additionally, blockchain technology can help to reduce fraud and improve customer privacy by providing greater control over personal data. For example, customers can decide which data to share with which entities and can revoke access to their data anytime.

Some of the best blockchain kyc solutions in the digital space include:

Onfido, a UK-based company that offers a range of identity verification solutions, including a Blockchain KYC solution. It uses blockchain technology to provide secure, decentralized storage of customer data, while also offering biometric authentication and other identity verification tools.

Civic is a decentralized identity platform using blockchain technology to provide secure, self-sovereign digital identity solutions. The platform allows individuals to control their own identity information and share it with trusted parties as needed while also offering identity verification services for businesses.

uPort, a decentralized identity platform built on the Ethereum blockchain. The platform allows individuals to create and manage their own digital identity, which can be used to access a range of services and applications.

Blockpass, a blockchain-based KYC platform that provides identity verification services for individuals and businesses. Blockpass offers a variety of verification methods, including biometric authentication and government ID checks, and leverages smart contracts to automate the KYC process.

Jumio, a US-based company that offers a range of identity verification solutions, including a blockchain-based KYC solution. In addition to delivering biometric identification and other identity verification capabilities, Jumio leverages blockchain technology to guarantee safe, decentralized storage of customer data.