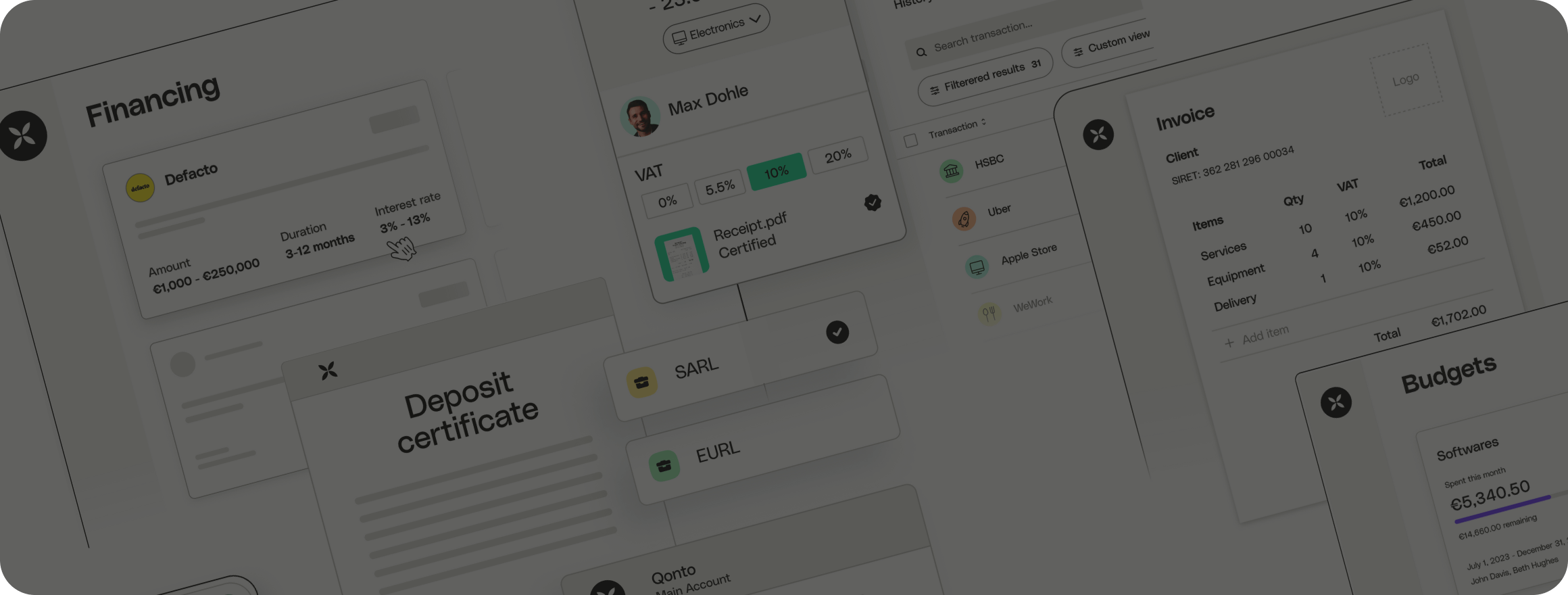

European unicorn, neo-bank that makes business finance easy

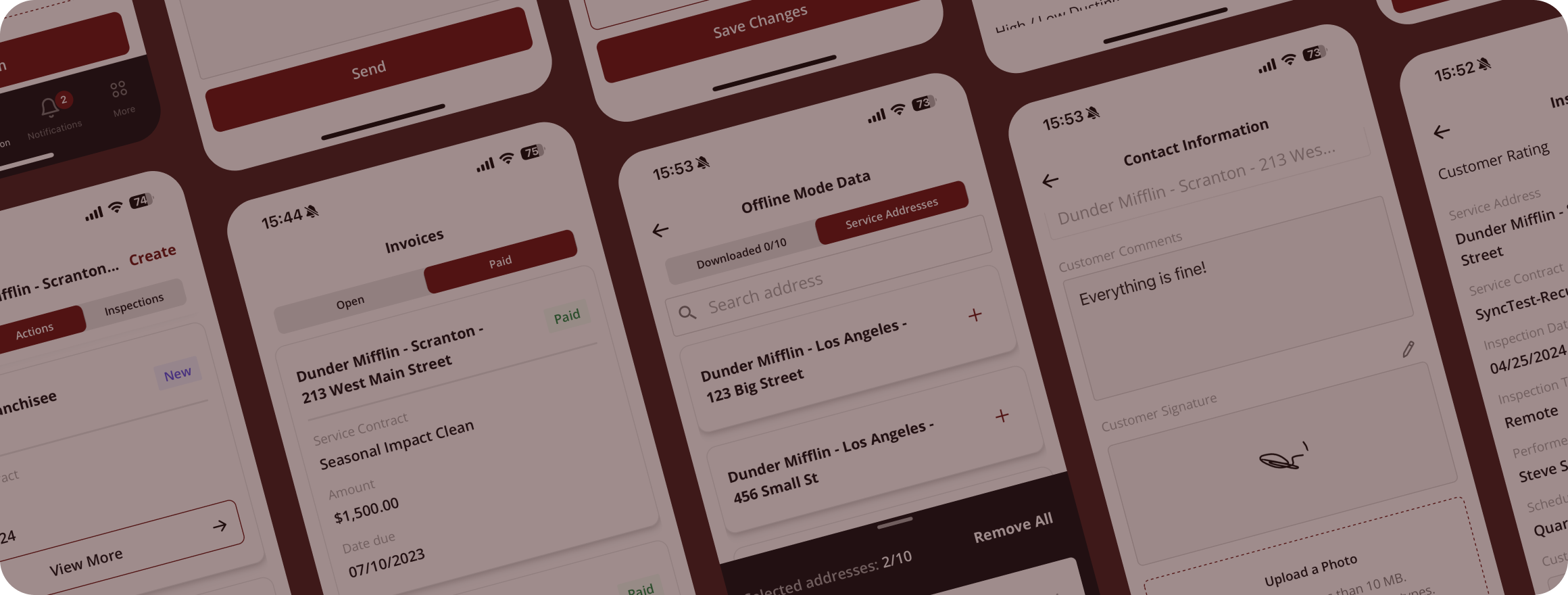

WSU was involved in the development of the banking system, including development of the internal tools, improving onboarding experience and solving risk and compliance issues.

Industry

Fintech

Project duration

February 2022 - Present time

Country state

France (also including German, Italian and Spanish markets)

Team

Backend Developers

Technology

🏃

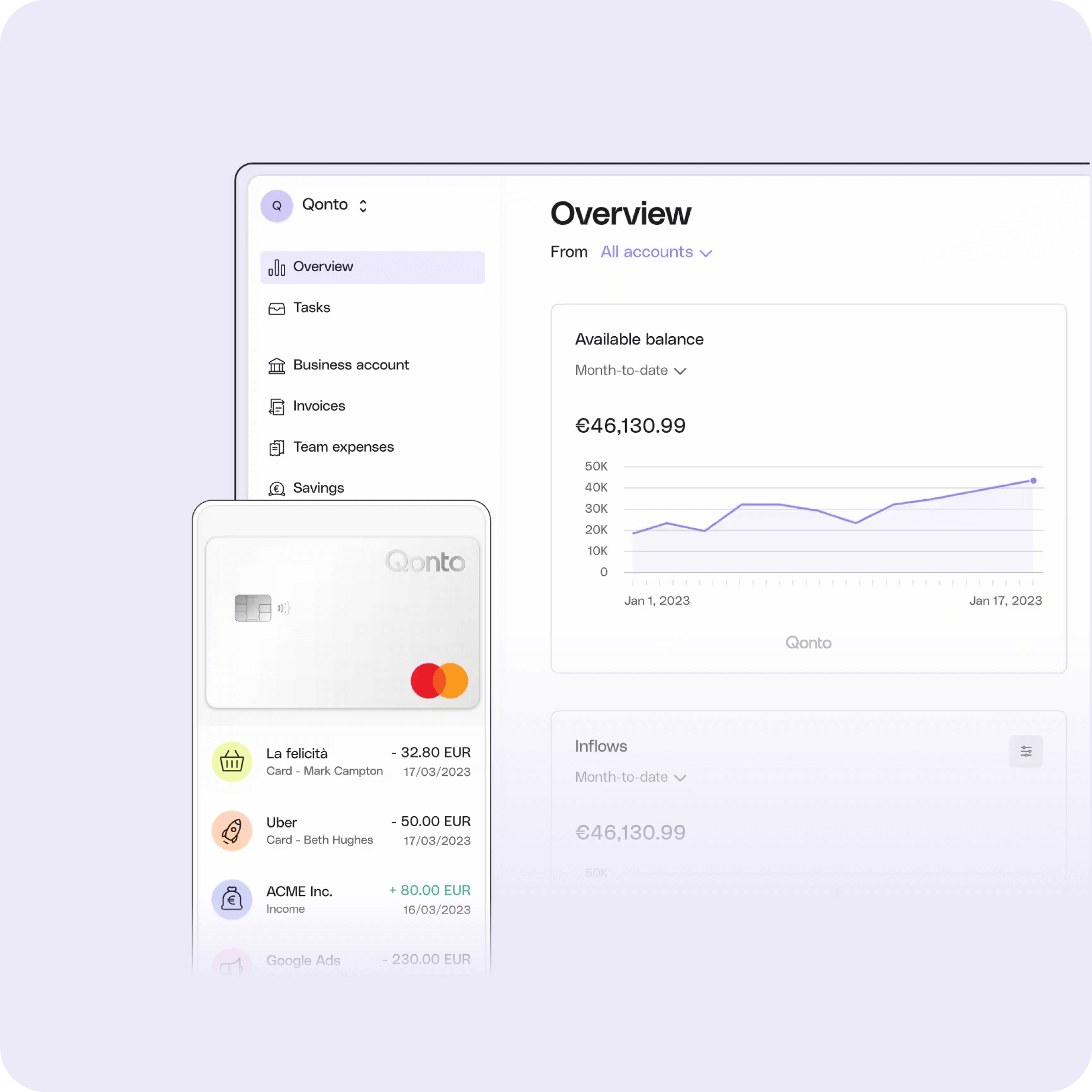

Qonto, the fintech unicorn, neo-bank supported by WeSoftYou, is revolutionizing business finance across Europe.

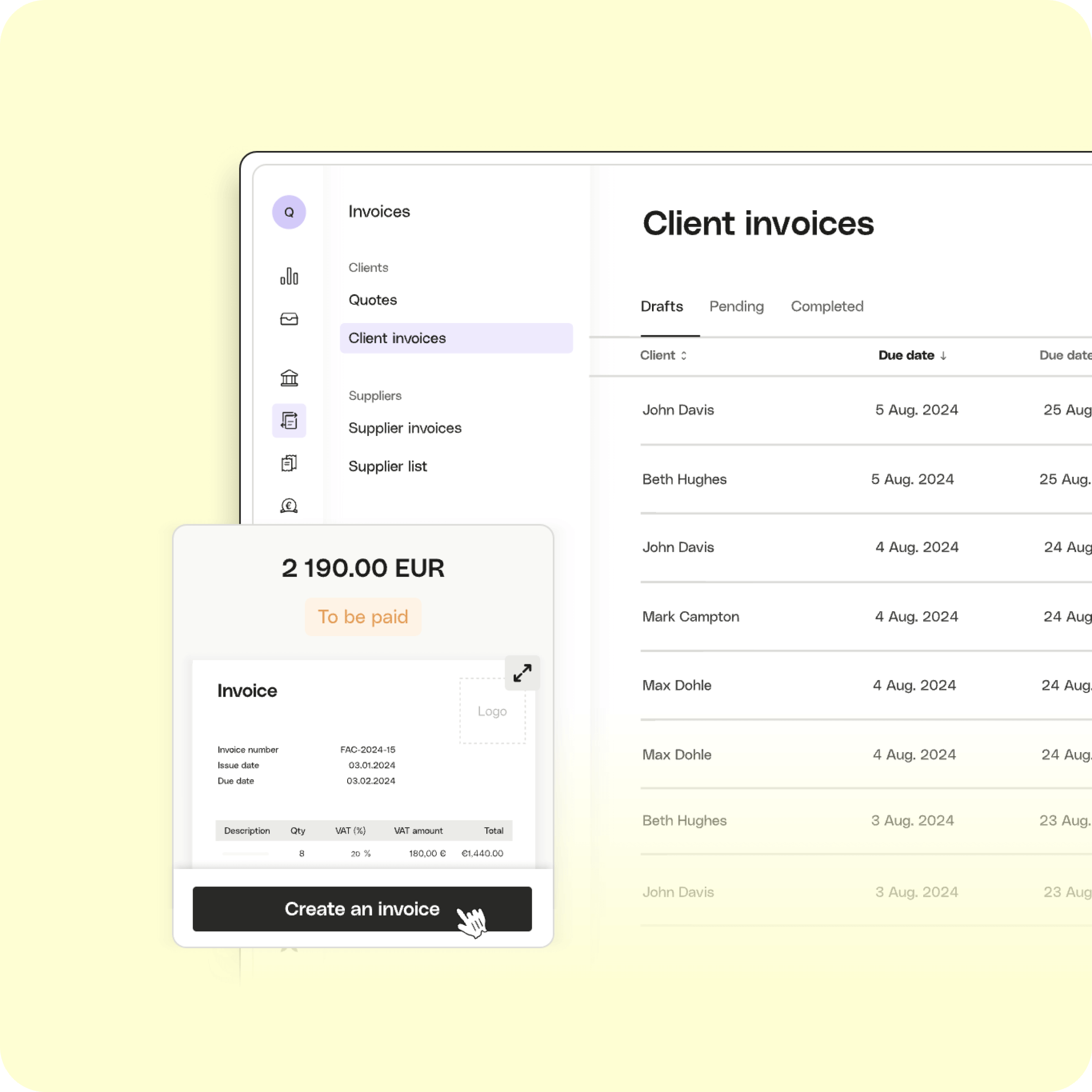

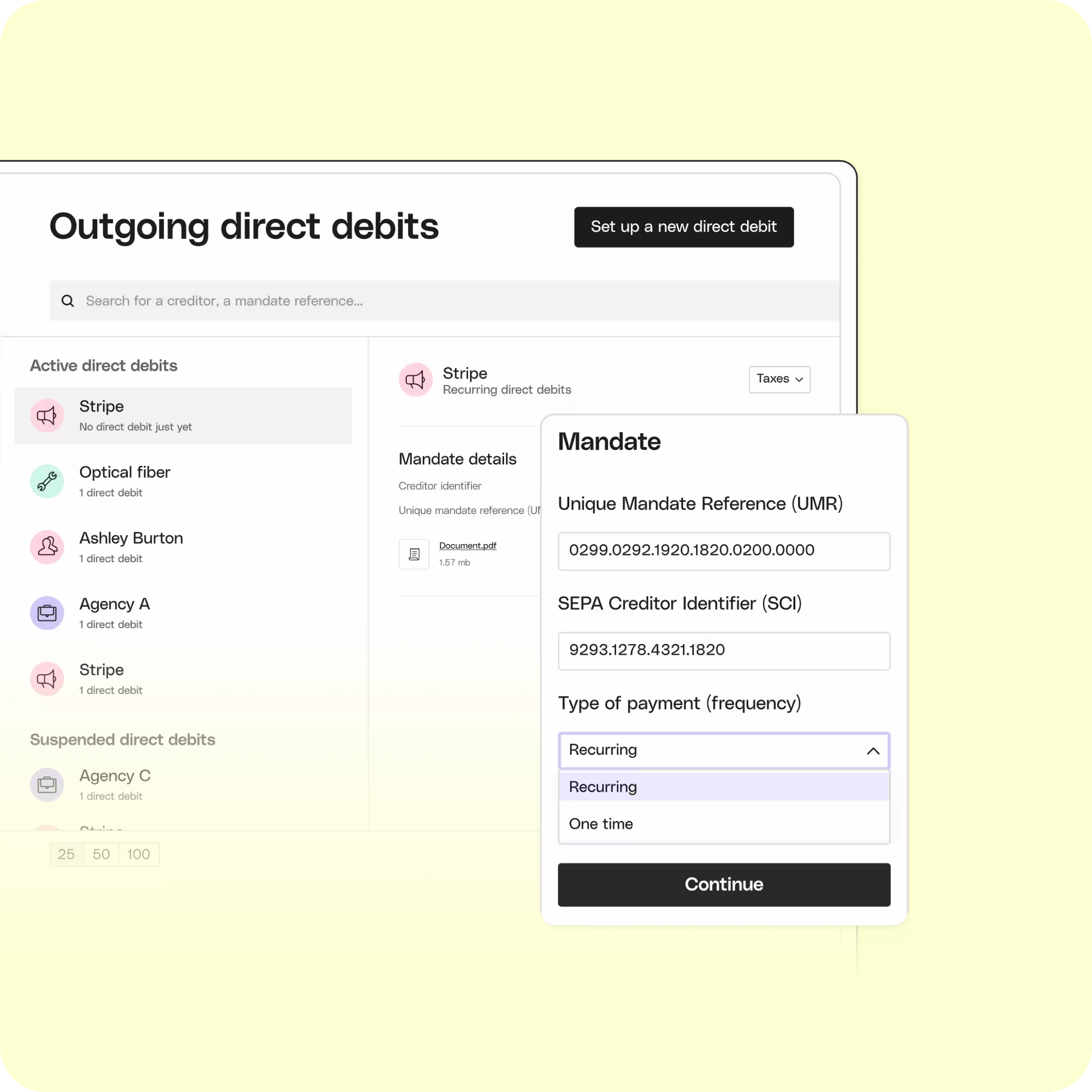

Based in Paris and operating in France, Germany, Italy, and Spain, Qonto prioritizes the best user experience for finance management and accounting. From effortlessly managing business accounts and cards to streamlined invoice, expense, and spend management, Qonto makes business finance easy with automated tools that simplify accounting processes, providing entrepreneurs with more time to focus on what matters.

Qonto has achieved unicorn status, marking its impact and growth in the European fintech industry by offering innovative business finance solutions.

Results ✨

Enhanced Compliance

The collaboration significantly improved Qonto’s ability to meet stringent regulatory requirements, ensuring that all services and features adhere to the latest financial compliance standards.

Streamlined User Experience

By simplifying processes and reducing lead times, WeSoftYou helped Qonto transform the banking experience for its users. Clients now enjoy a more intuitive, hassle-free journey.

Expanded Market Accessibility

The partnership facilitated the expansion of Qonto’s services to cater to a broader spectrum of businesses, including those with unique legal structures and requirements.

Operational Efficiency

Through the introduction of automated systems and streamlined processes, WeSoftYou has enabled Qonto to achieve higher operational efficiency.

Project goals ⚡️

Meet regulatory and compliance requirements.

Improve customer's onboarding experience.

Automate business processes to decrease customers' lead time or decrease workload on customer support teams.

Ensure timely support from WeSoftYou in regard of: fixing QA returns & bugs, mitigating incidents, and unblocking clients.

Participate in the overall improvement of Qonto’s code base quality and development standards.

Challenges ⛰

01.

Continuous adherence to evolving ACPR standards.

02.

Cross-border regulatory alignment.

03.

Optimal balance between user accessibility and regulatory compliance.

The process 🚧

Each feature that was supported by WeSoftYou is underlined by a comprehensive and systematic methodology that Qonto applies to software development, ensuring high-quality outcomes tailored to the business’s specific needs.

Stages 🎢

01.

Nemawashi: Initial consensus-building step to align all stakeholders with the project's goals and methodologies, ensuring a unified direction from the start.

02.

Value Analysis: Focuses on identifying and prioritizing the functionalities that offer the most value to Qonto, ensuring the project targets critical needs effectively.

03.

Value Engineering: Optimizes the use of project resources to deliver the highest value outcomes, designing solutions that are both efficient and scalable without compromising on quality.

04.

Solution Challenge: A phase dedicated to rigorously evaluating and refining proposed solutions, ensuring they are robust, secure, and tailored to meet Qonto's specific business requirements.

05.

Coding: The actual development phase where the planned solutions are turned into working software, integrated seamlessly with Qonto's existing systems and infrastructure.

06.

QA: Ensures the final product meets all predetermined quality, security, and user experience standards through thorough testing and validation before release.

Team composition 👨💻

The WeSoftYou backend team worked in tandem with Qonto, combining their expertise to refine and develop the product. This collaboration played a key role in reaching project objectives, merging the strengths of both teams to offer a streamlined banking experience for European businesses.

Technology stack ⚙️

Back-end: Ruby, Ruby on Rails, Go, Gin, Python, Django, PostgreSQL, Redis, Sidekiq, Kafka

DevOps: Docker

Core features 💻

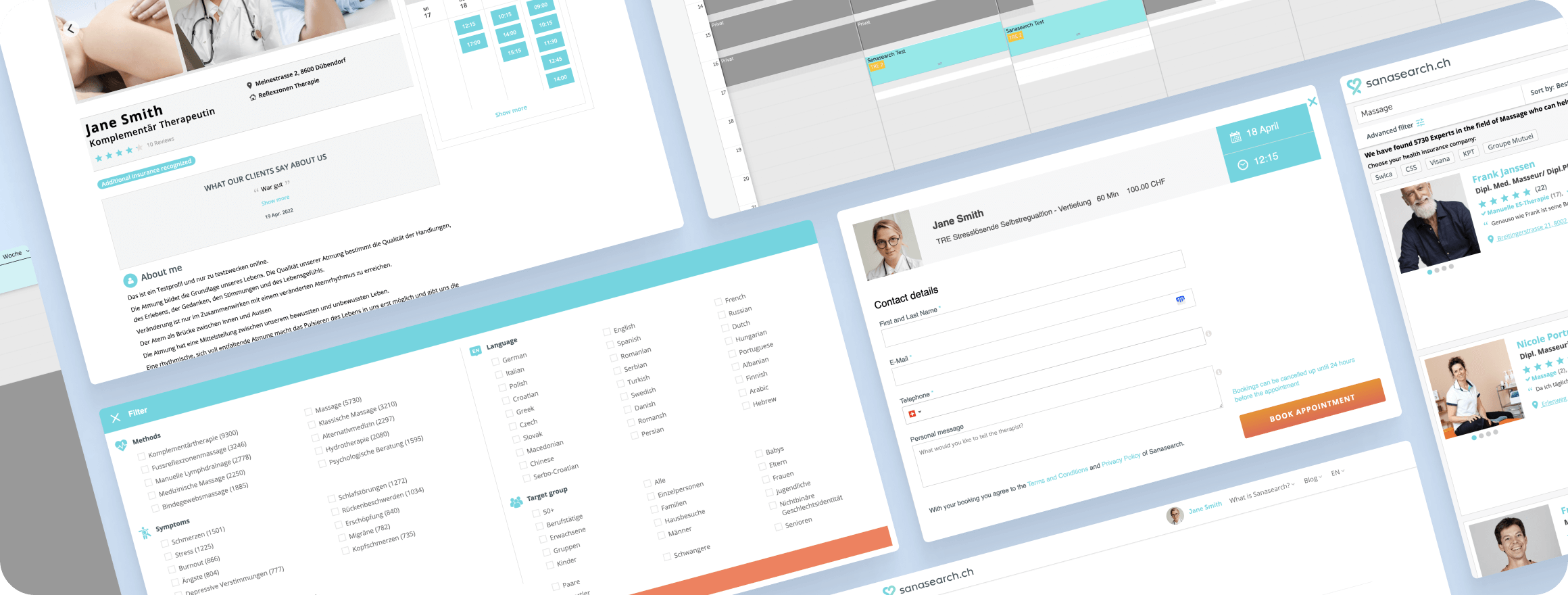

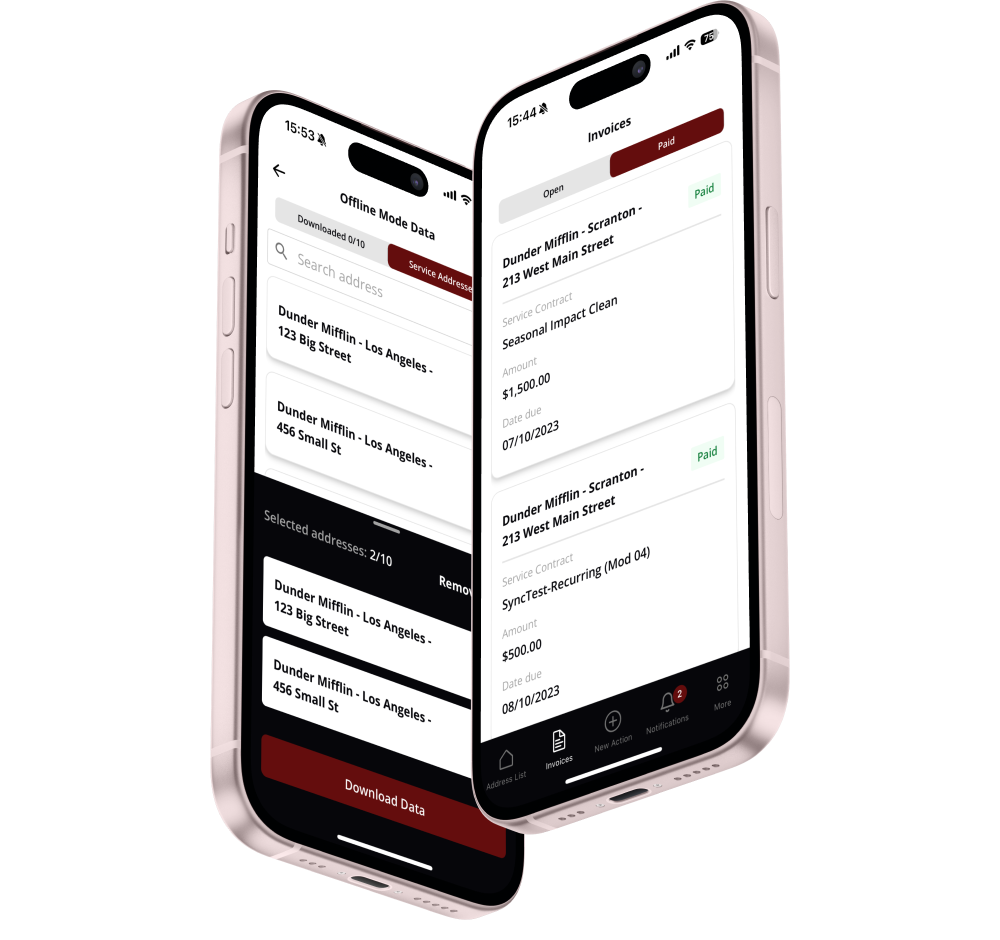

Flex KYB

- WeSoftYou streamlined Qonto's onboarding, introducing Flex KYB to speed up German clients' setup from over 30 days to just one. This feature deferred certain checks while ensuring full regulatory compliance through a follow-up system, balancing convenience with legal requirements.

Shareholders Declaration Optimization

- WeSoftYou helped Qonto launch the Shareholders Declaration feature, streamlining shareholding declarations for German SMEs, particularly during company setup, within the Qonto app. This tool significantly reduced lead times and eased the burden on customer support, making the business setup process smoother.

Shelf Companies Tracking Automation

- WeSoftYou developed this solution to monitor "shelf companies" - pre-registered entities sold to avoid bureaucratic delays. It guarantees compliance with regulations, providing entrepreneurs with a secure, expedited way to establish their businesses.

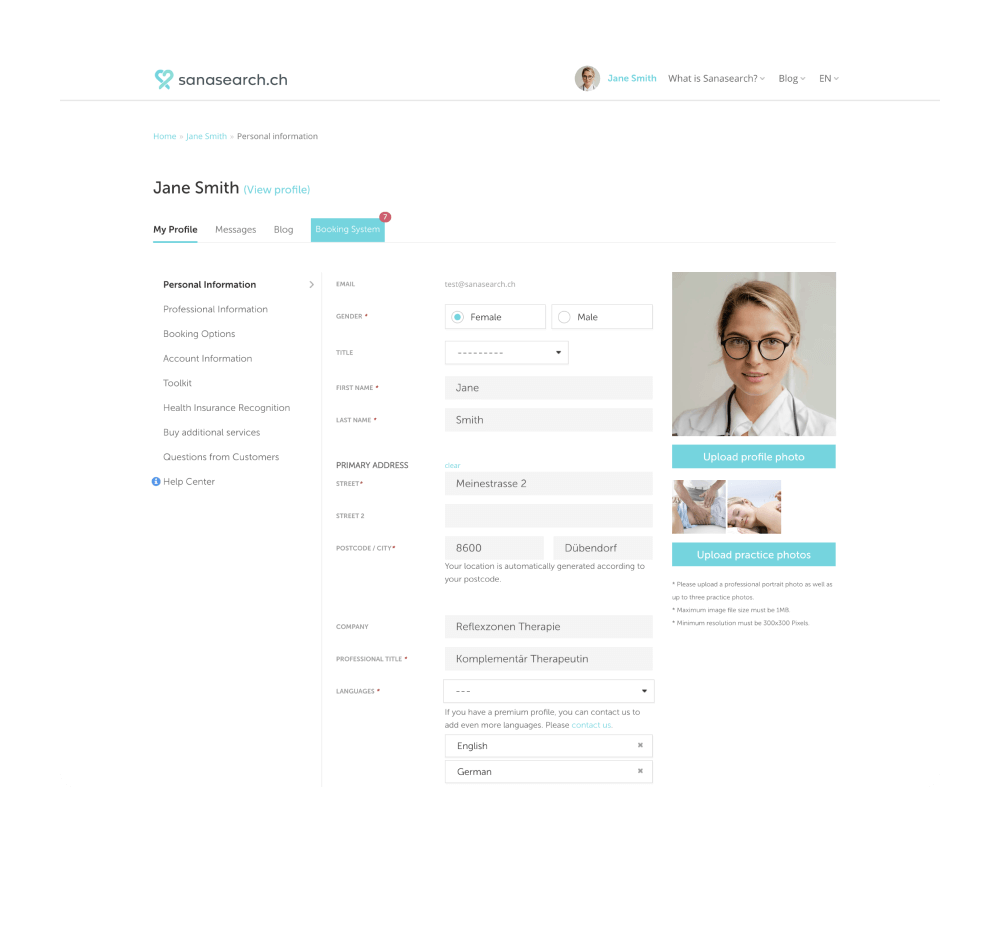

GbR Organizations Integration

- WeSoftYou enhanced Qonto's platform by supporting GbR organizations, allowing clients to detail their management types. This improved inclusivity and user experience for German businesses.

More case studies

Do you want to start a project?

Meet us across the globe

United States

66 W Flagler st Unit 900 Miami, FL, 3313016 E 34th St, New York, NY 10016

Europe

109 Borough High St, London SE1 1NL, UKProsta 20/00-850, 00-850 Warszawa, Poland

Vasyl Tyutyunnik St, 5A, Kyiv, Ukraine

Av. da Liberdade 10, 1250-147 Lisboa, Portugal